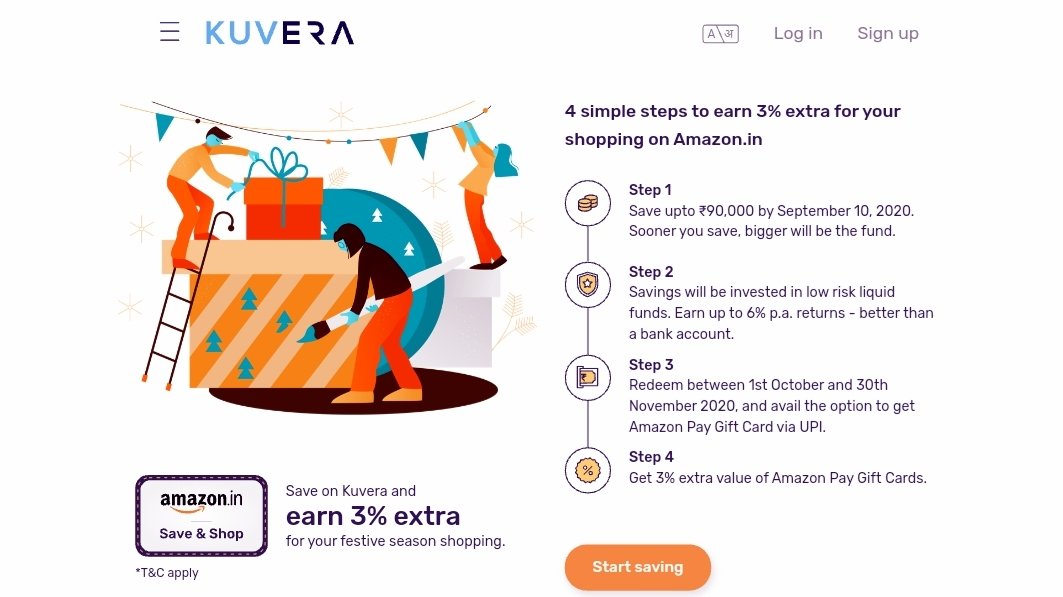

Request @SEBI_India to look into these 2 RIAs both offering as plans. Orowealth is even showing comparison between Savings Account vs Liquid Fund vs Amazon Save & Shop. It seems they are in direct violation of code of conduct of RIAs. @harshroongta @monikahalan @SureshSadagopan

Request @aria_india to also have a look though these 2 are not members of your association but being RIAs are doing unethical practice. It is a matter of great concern for other RIAs as well. @bsindia @livemint @DainikBhaskar @CNBC_Awaaz @networkfp @cafemutual @businessline

After reading the article bit.ly/31i6nnX @livemint by @ActusDei ; we can suggest #investors that: Don’t fall for the promise of indicative or exorbitant or assured returns by RIAs or MFDs. Don’t let greed overcome rational #investment decisions. (1/2)

• Don’t get carried away by luring advertisements or market rumours.

• Don't fall prey to limited period discount or other incentive, gifts, etc. offered by RIAs or MFDs.

The issue is not of Amazon offer. The issue is the lurement being advertised by both RIAs. @bsindia (2/2)

• Don't fall prey to limited period discount or other incentive, gifts, etc. offered by RIAs or MFDs.

The issue is not of Amazon offer. The issue is the lurement being advertised by both RIAs. @bsindia (2/2)

• • •

Missing some Tweet in this thread? You can try to

force a refresh