Making Future Safe, Secure & Bright @ Master Mind FinnAsset

How to get URL link on X (Twitter) App

Extent of notional losses that may have occurred to the #investors in these schemes can only be estimated after the probe. Investors may have to wait for further action, disclosures & announcements from the fund house & the regulator around this matter.(2/n) #axismutualfund

Extent of notional losses that may have occurred to the #investors in these schemes can only be estimated after the probe. Investors may have to wait for further action, disclosures & announcements from the fund house & the regulator around this matter.(2/n) #axismutualfund

Request @aria_india to also have a look though these 2 are not members of your association but being RIAs are doing unethical practice. It is a matter of great concern for other RIAs as well. @bsindia @livemint @DainikBhaskar @CNBC_Awaaz @networkfp @cafemutual @businessline

Request @aria_india to also have a look though these 2 are not members of your association but being RIAs are doing unethical practice. It is a matter of great concern for other RIAs as well. @bsindia @livemint @DainikBhaskar @CNBC_Awaaz @networkfp @cafemutual @businessline

https://twitter.com/vaid_varun/status/1141008525344169985?s=20

https://twitter.com/bsindia/status/1233095955341287424#Indian citizens should understand who is polarizing by playing communal agendas, talking trash in debates, favoring agenda of a particular political party - instead of asking tough questions to the governing party, they only focus on opposition. Think Unbiasedly & Ethically !!

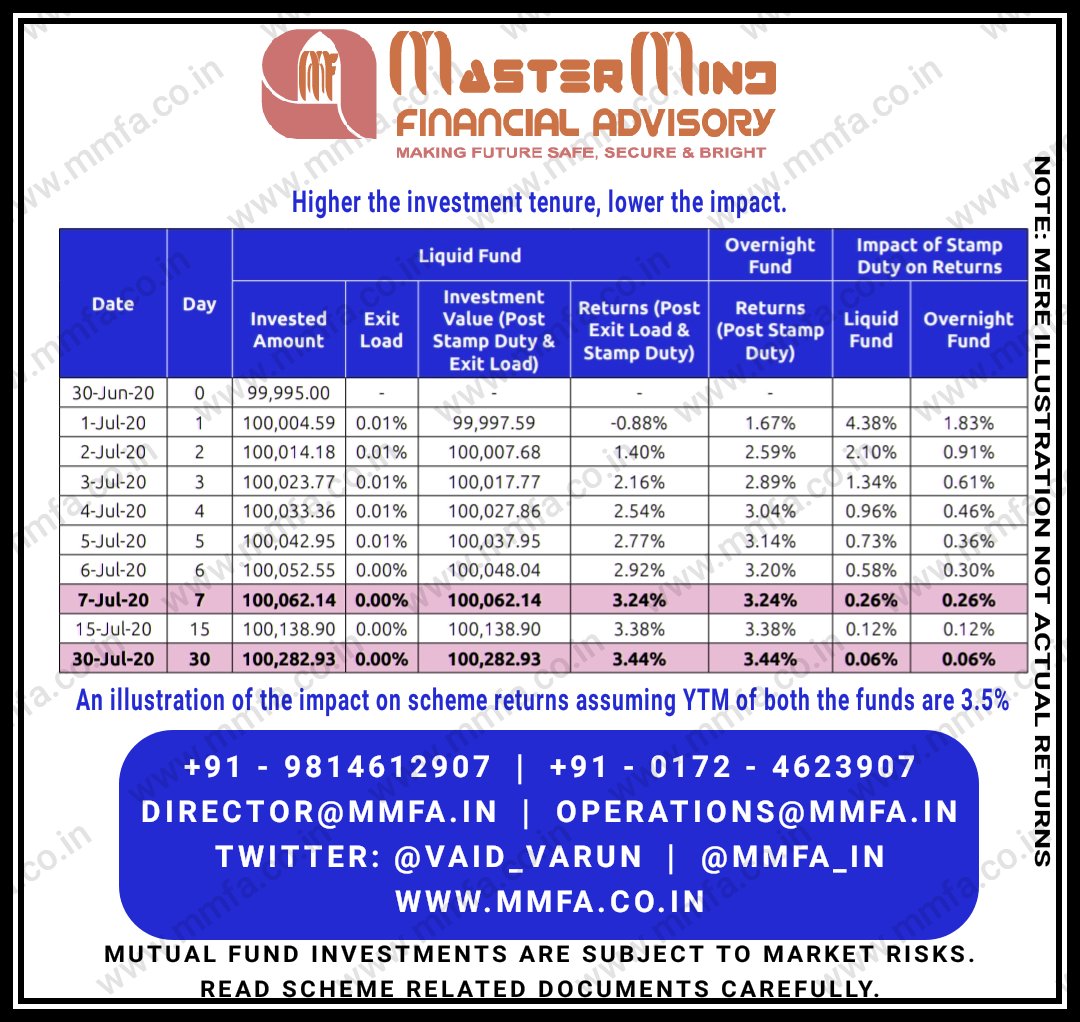

To reiterate, liquid funds are not risk free. Keep in mind that when you approach for #mutualfunds, returns should be secondary. Therefore, do not go after #LiquidFund that has a high credit risk exposure. Do not #invest solely based on past returns.

To reiterate, liquid funds are not risk free. Keep in mind that when you approach for #mutualfunds, returns should be secondary. Therefore, do not go after #LiquidFund that has a high credit risk exposure. Do not #invest solely based on past returns.