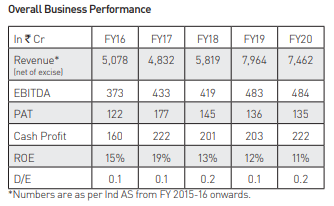

#Apar Industries is one among the best established companies in India, operating in the diverse fields of #electrical and #metallurgical #engineering.

@Raunak_Bits @Sachsharma12 @srslysaurabh @Agarwal_Ishu @Random_Gyan @drprashantmish6

Crude #oil & #Steel

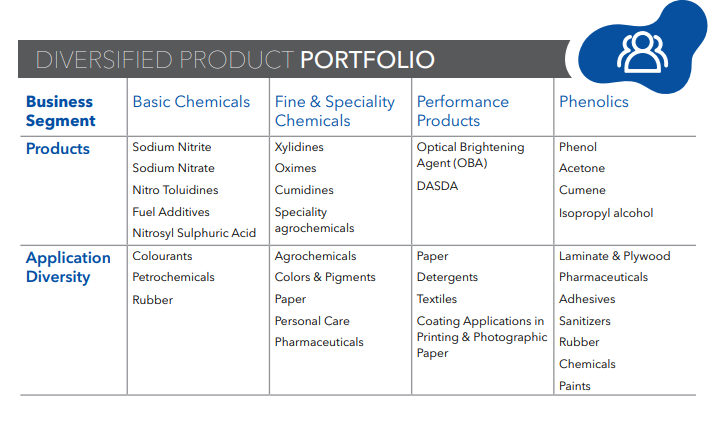

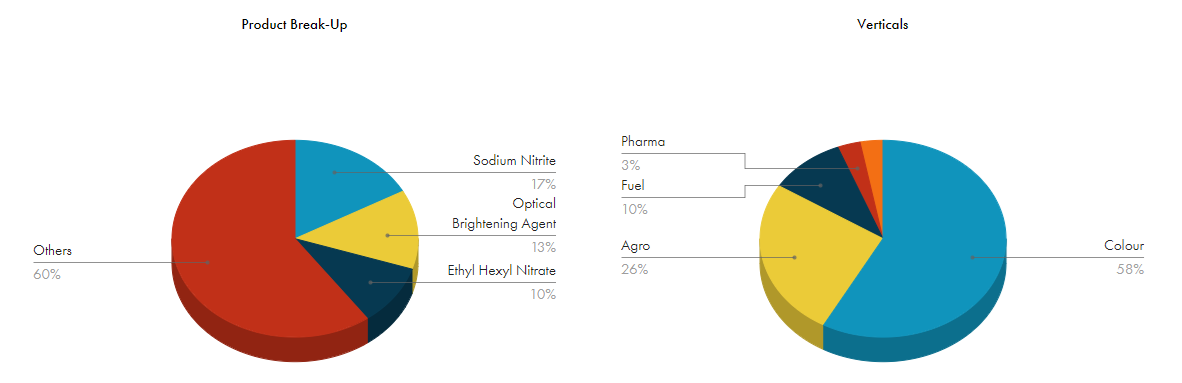

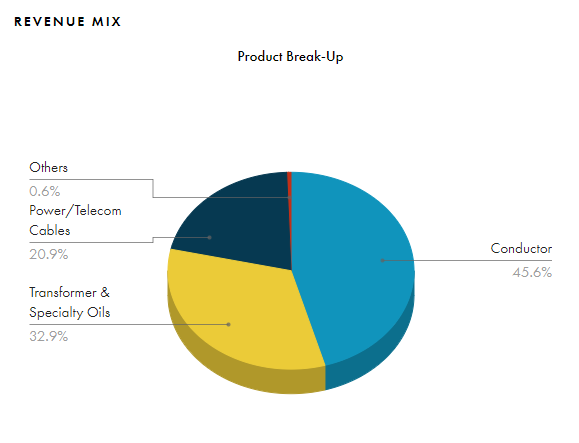

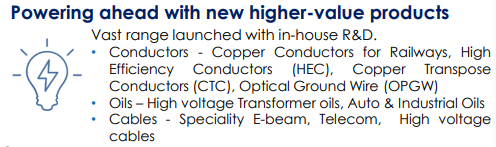

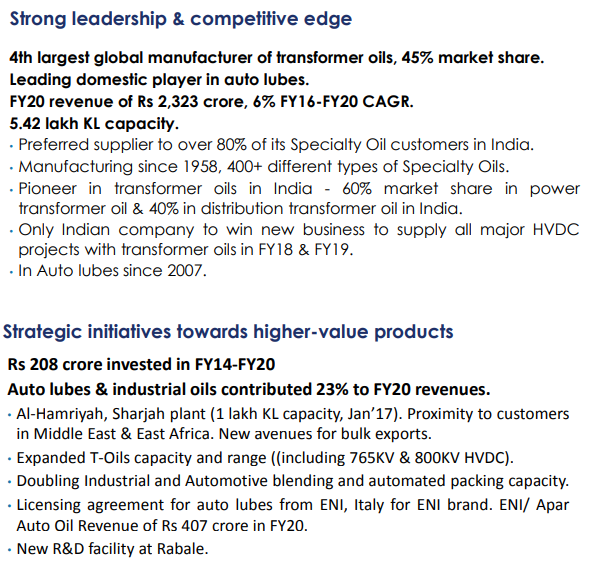

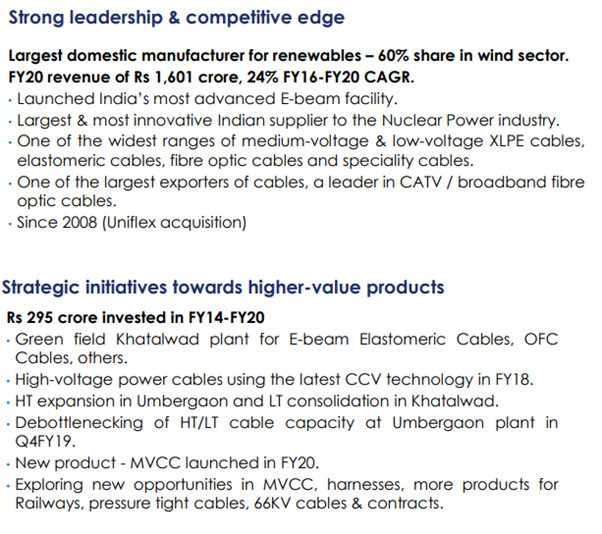

There are 3 segments: #Conductors, Transformer and speciality #oils & Power/Telecom #Cable. The revenue breakup is in the screenshot attached

Customers: #Auto (including tractors), Industrial & #agriculture.

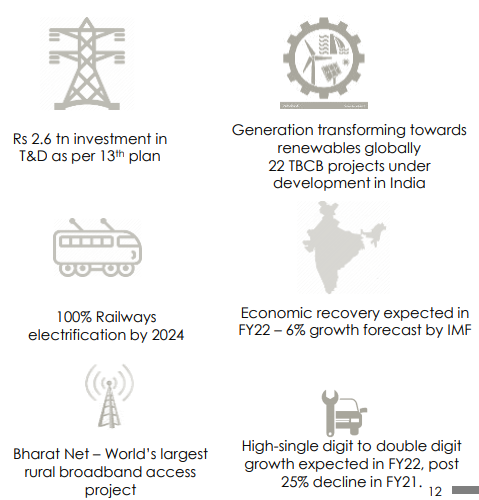

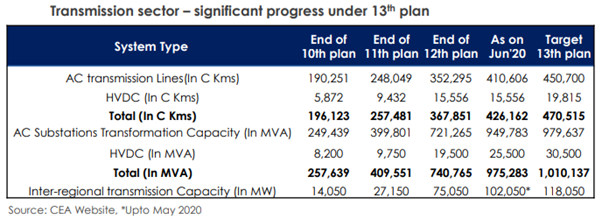

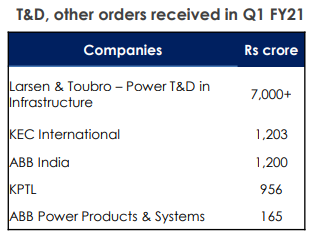

Rs. 90,000 crore #bailout package for the stressed DISCOMs as a part of the #Atmanirbhar #Bharat Abhiyan is to tide the COVID19 pandemic

#Renewable #power sector projects are another positive for the company

Promoters increased stake, MF have reduced stake & retail shareholders have increased stake. FII & DII also have presence in the company.

Hope this helps @sucrel @sureshg321 @aammiitt2