@VPaldiwal

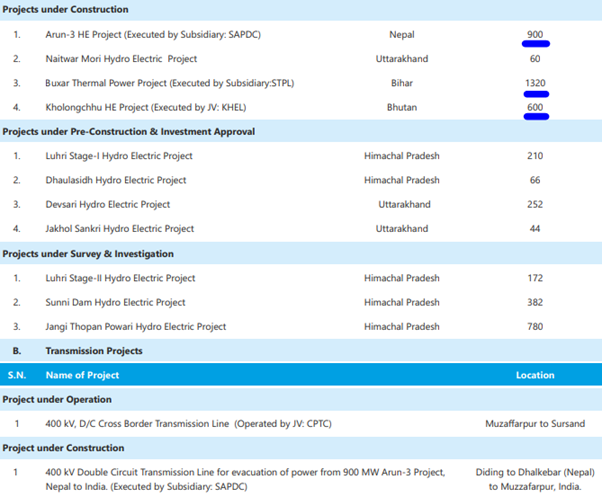

The biggest project by capacity #Buxar Thermal is on track and it has already signed PPA with #Bihar govt. for 86% power so the project is secured from #commercial angles.

timesofindia.indiatimes.com/city/patna/bux…

#ArunachalPradesh government had decided to allot the entire #Lohit Basin to SJVN to study and harness the hydro potential exceeding 7,000 MW.

Please find the link for the same below:

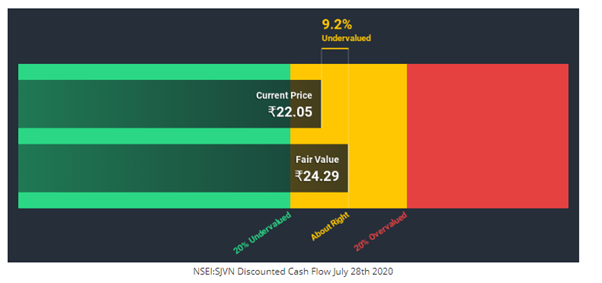

Fair Value Calculation: simplywall.st/stocks/in/util…