#MacroView

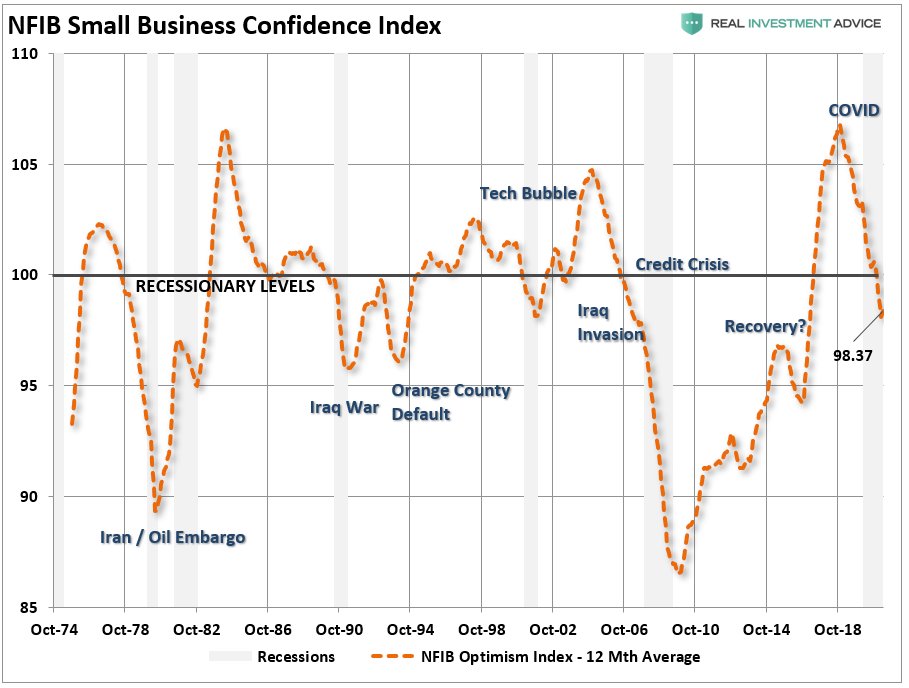

#NFIB data says we are only in a #recovery, not an #economic expansion.

While the NFIB data doesn't get much #media attention, it should as it tells you much about what is really happening in the #economy.

realinvestmentadvice.com/macroview-nfib…

#NFIB data says we are only in a #recovery, not an #economic expansion.

While the NFIB data doesn't get much #media attention, it should as it tells you much about what is really happening in the #economy.

realinvestmentadvice.com/macroview-nfib…

Reason I pay attention to #NFIB

Sept 2019 - Data rings alarm bells on #recession.

April 2020 - Data says recession arrived.

May 2020 - Data says #economic recovery not as strong as media suggests.

realinvestmentadvice.com/macroview-nfib…

Sept 2019 - Data rings alarm bells on #recession.

April 2020 - Data says recession arrived.

May 2020 - Data says #economic recovery not as strong as media suggests.

realinvestmentadvice.com/macroview-nfib…

If businesses were expecting a massive surge in “#pentup” #demand, they would prepare for it. Such includes #planning to increase #capex to meet expected demand. Unfortunately, those expectations peaked in 2018 and are dropping back to the March 2020 lows.

realinvestmentadvice.com/macroview-nfib…

realinvestmentadvice.com/macroview-nfib…

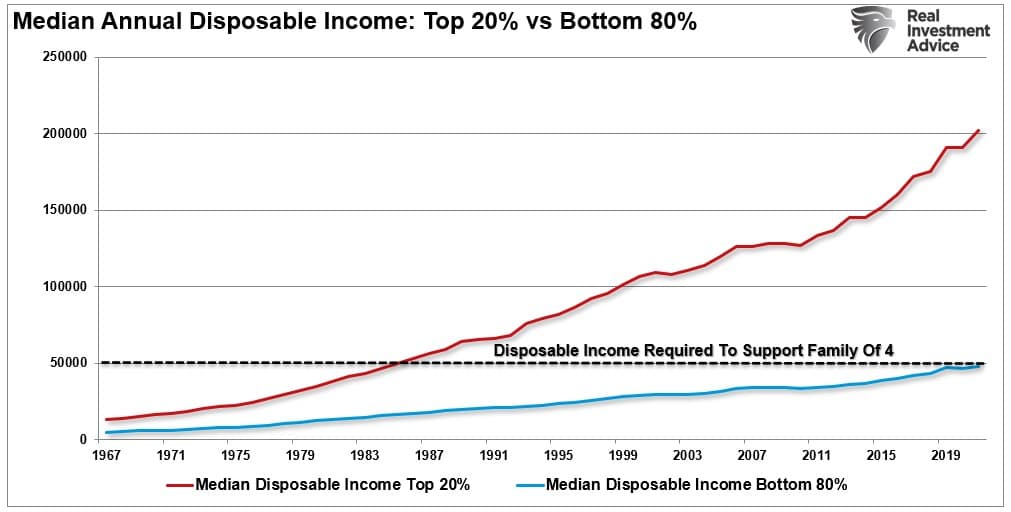

When it comes to #headlines versus #reality there is a major difference between:

- Yes, I am thinking about hiring in the future, and

- Actually committing the #capital and #resources to do it if you aren't sure about future #demand.

#ProblemWithStimulus

realinvestmentadvice.com/macroview-nfib…

- Yes, I am thinking about hiring in the future, and

- Actually committing the #capital and #resources to do it if you aren't sure about future #demand.

#ProblemWithStimulus

realinvestmentadvice.com/macroview-nfib…

Small businesses are not concerned about #LaborCosts as much as #Biden hiking #taxes.

Higher taxes = less #profit = less #employment and #wage suppression.

realinvestmentadvice.com/macroview-nfib…

Higher taxes = less #profit = less #employment and #wage suppression.

realinvestmentadvice.com/macroview-nfib…

Despite the surge in #headlines #retailsales numbers, #smallbusiness aren't seeing it, nor are they expecting to as #stimulus evaporates.

realinvestmentadvice.com/macroview-nfib…

realinvestmentadvice.com/macroview-nfib…

If you are betting on the #smallcap trade to continue on expectations of an #economicboom, you may want to reconsider.

realinvestmentadvice.com/macroview-nfib…

realinvestmentadvice.com/macroview-nfib…

• • •

Missing some Tweet in this thread? You can try to

force a refresh