Some more thoughts on the economics of delaying #FreedomDay (please read the whole thread before shouting at me!).

Keeping the remaining Covid restrictions for a few weeks longer would be unlikely to derail the recovery, but could still have some significant impacts… (1/6)

Keeping the remaining Covid restrictions for a few weeks longer would be unlikely to derail the recovery, but could still have some significant impacts… (1/6)

The sectors that are still severely restricted account for less than 5% of GDP, and most are already open to some degree.

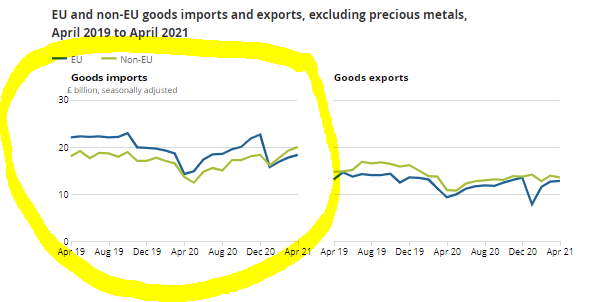

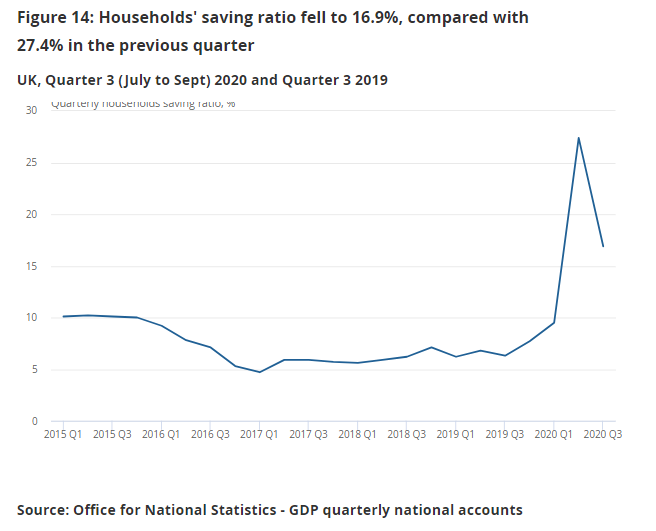

Money not spent in pubs or nightclubs (or holidays abroad) can also still be spent elsewhere in the UK economy... (2/6)

Money not spent in pubs or nightclubs (or holidays abroad) can also still be spent elsewhere in the UK economy... (2/6)

The direct cost of postponing Freedom Day would therefore be relatively small compared to full #lockdowns, probably no more than 2% of GDP, or less than £1 billion for every week of delay.

That’s not peanuts, but nor is it prohibitive. (3/6)

That’s not peanuts, but nor is it prohibitive. (3/6)

There could still be some additional costs.

Even a short delay would be the final straw for many businesses, especially pubs, that have only just survived until now. They may not come back at all.

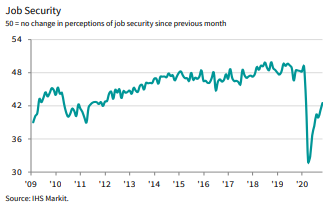

Any bump in the roadmap could also undermine confidence more generally... (4/6)

Even a short delay would be the final straw for many businesses, especially pubs, that have only just survived until now. They may not come back at all.

Any bump in the roadmap could also undermine confidence more generally... (4/6)

More positively, those worried about the recent surge in #Covid cases could be reassured by a brief delay, especially if it is for the specific purpose of accelerating the vaccine rollout.

It might be more damaging to reopen now and then have to shut again soon afterwards. (5/6)

It might be more damaging to reopen now and then have to shut again soon afterwards. (5/6)

The temporary hit from a brief delay could therefore be a price worth paying *both* to protect health *and* to secure a stronger economic recovery in the longer term.

But the most vulnerable sectors would require additional financial support to tide them over. (6/6)

But the most vulnerable sectors would require additional financial support to tide them over. (6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh