A bit more on today's UK trade data and the impact of #Brexit...

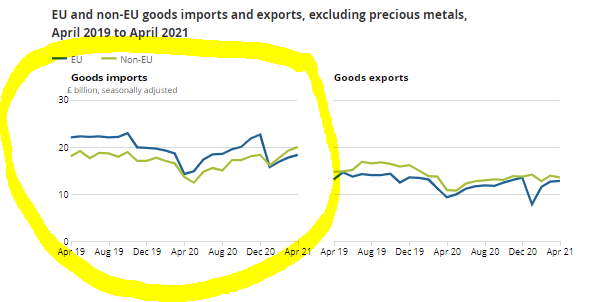

It helps to look at #imports and #exports *separately* - the stories are quite different.

The relative weakness of UK trade with the EU is mainly on the *import* side, which is only partly Brexit related... (1/6)

It helps to look at #imports and #exports *separately* - the stories are quite different.

The relative weakness of UK trade with the EU is mainly on the *import* side, which is only partly Brexit related... (1/6)

A lot is also due to problems in the car sector (e.g. global shortages of parts) and the relative weakness of demand for cars, which we mainly import from the EU, compared to goods we import from the rest of the world (e.g. clothing & PPE from Asia)... (2/6)

There may also be some cases where UK imports from the EU are being replaced by imports from the rest of the world, or local production.

But if consumers were happy buying from the EU before #Brexit, new trade frictions that hinder this are not obviously a 'good thing'... (3/6)

But if consumers were happy buying from the EU before #Brexit, new trade frictions that hinder this are not obviously a 'good thing'... (3/6)

On the other side, UK #exports to the EU are back above pre-Brexit levels (e.g. the average in 2020 H2).

To be clear, exports are probably still lower than they would otherwise have been. But here is more evidence that the initial disruption in January was only temporary. (4/6)

To be clear, exports are probably still lower than they would otherwise have been. But here is more evidence that the initial disruption in January was only temporary. (4/6)

Also worth stressing these are *April* data, when the German economy in particular was hit by new #Covid restrictions.

More timely surveys are more encouraging; e.g. the new #export orders component of the UK manufacturing #PMI rose to a survey record high in May... (5/6)

More timely surveys are more encouraging; e.g. the new #export orders component of the UK manufacturing #PMI rose to a survey record high in May... (5/6)

In summary, there's something here for both pessimists and optimists. But stripping out the Brexit impact is not quite as simple as comparing trade with the EU with that with the rest of the world, given everything else that's going on. (6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh