Anyone perusing the top articles of major media outlets last weekend would have read several pieces on the extraordinary #shortages being witnessed in the U.S. #economy today, and particularly those in the #labor market.

The tone of many articles was pessimistic, suggesting that the #supply-side #shortages and dislocations may be systemic, or long-term, but we think there’s evidence that the U.S. #economy will display considerably greater dynamism and resilience than the pessimists believe.

First, it’s vital to recognize that this is a #supply constraint problem, not one of #demand. Indeed, strong demand is being driven by a host of powerful influences: 1) household balance sheets never been cleaner and HH #wealth is $25 trillion greater now than pre-Covid level.

Further, 2) personal #savings has never been greater, with excess savings now more than 12% of GDP, and 3) household #incomes are also at record highs (and climbing fast), even over and above the recently outsized federal transfer payments.

And while #CorporateProfitMargins may well experience some near-term degradation, broadly speaking, 4) the #corporate sector is in solid shape, with strong #cash flows and having termed-out #debt at historically low rate levels.

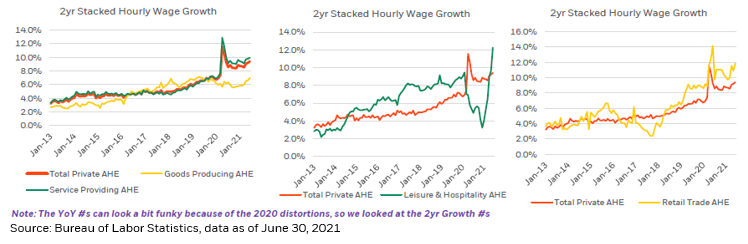

Thus, with these kinds of tailwinds, it’s not surprising to see demand for #labor so high! Existing #workers are putting in more hours, employers are raising #wages and still job openings remain at series highs.

Remarkably, all that is in the context of a labor #market in which total nonfarm employment is nearly 5 mil. lower than the pre-pandemic Feb 2020 level, and household #employment is down roughly 3 mil., with the labor force participation rate more than 2 pct. pts. lower.

The fact is that the Q3 surge in the Covid delta variant caused a mini #LaborMarket shock, arresting what had been solid #job growth in Q2, but now as case counts plummet and vaccines/boosters expand that is likely to reverse.

Moreover, we think it’s likely that transfer #payments and UI #benefits have heretofore enabled workers to refrain/delay reentry to the #labor force, but now that these top-ups have ended, return to work should become more pronounced.

Astoundingly, in August 2021 alone, aggregate #UI benefits were 15% greater than the full 12-month period that led up to the pandemic, and transfer #payments were 67% greater that month than they were in Feb. 2020! That is dramatically changing…

…which should redound to the benefit of #LaborMarket supply, helping to alleviate the #CapacityConstrains we face as we enter Q4 and into 2022. Obviously, it won’t happen overnight, but in time the Beveridge Curve should normalize toward prior levels.

An admittedly untested, but nonetheless interesting, indicator that this process could already be taking place is the fact that search #trends on #Google finally show that more people are looking for “job” than “unemployment” for the first time since the start of the pandemic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh