In August we saw #inflation growth moderate further, for the second consecutive month, at least relative to the impressive rate of growth in #prices witnessed around mid-year.

Core #CPI (excluding volatile food and energy components) came in at 0.10% month-over-month and 3.98% year-over-year, which was considerably less than the consensus forecast and was driven higher by #shelter components.

Meanwhile, headline #CPI data printed at a solid 0.27% month-over-month and came in at 5.20% year-over-year.

We continued to see a rebound in #rent and owners-equivalent-rent components, however the dramatic gains seen in used car prices slowed and lodging, #airfares and car rental costs fell month-over-month, reflecting some travel drag from #Covid concerns.

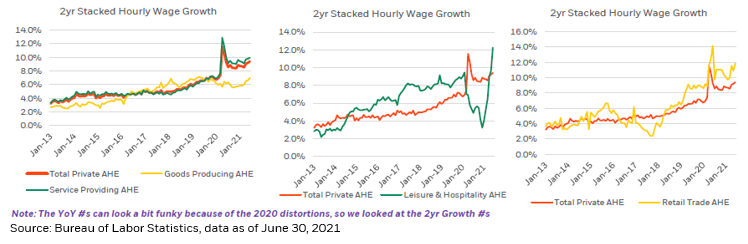

In the context of a solidly expanding #economy, higher #wages and supply-chain shocks for an extended period of time may allow companies to achieve higher levels of #PricingPower for a while.

So, despite the unlikely return of runaway #inflation that does not imply that there aren’t risks to inflation running a bit too hot for a bit too long.

In fact, #SupplyShocks and rapid price increases in #housing, automobiles and in some regions of the household goods sector have contributed to a drop in consumer #sentiment to 11-year lows.

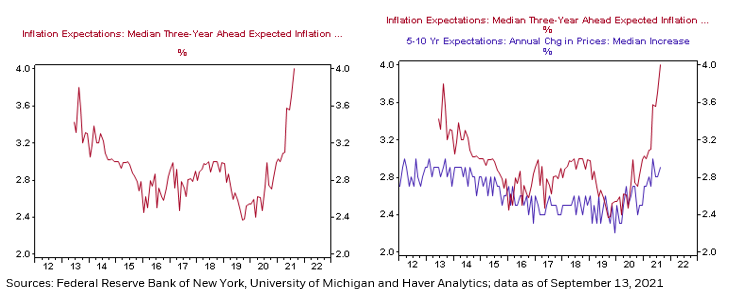

Further, some measures of forward #inflation expectations are vaulting to their highest levels in a decade.

We’re particularly concerned about the possibility of more #housing/shelter #inflation that could come at a time when many lower-to-middle-#income households are still struggling with employment challenges and rising #prices in other areas as well.

Specifically, when we look at the flow through from home #price appreciation to the #CPI shelter component, we can see that the latter tends to lag the former by roughly 12 to 15 months.

We think the @federalreserve should adjust #MonetaryPolicy that is distorting the #economy and in particular the purchasing of $40 billion a month of Agency #mortgages, which continues to overheat a housing #market beset by low inventory, surging prices and reduced affordability.

• • •

Missing some Tweet in this thread? You can try to

force a refresh