September witnessed a somewhat disappointing nonfarm #payroll gain of 194,000 jobs, which was weaker than the upwardly revised August gain of 365,000 and was well below #economists’ consensus estimates of nearly 490,000 jobs.

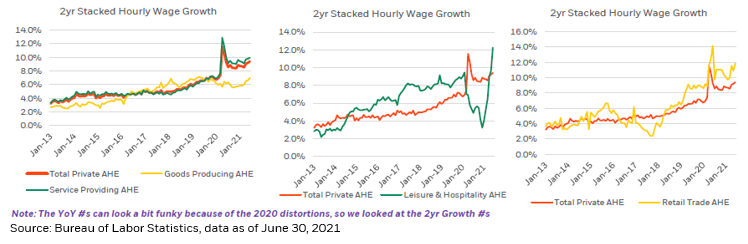

Clearly, there are significant #labor supply issues limiting the pace of recovery. Further, the #unemployment rate declined meaningfully, from 5.2% to 4.8% in Sept, and average hourly #earnings saw gains of 0.62% m-o-m, which brings the measure to 4.58% greater on a y-o-y basis.

The most interesting part of today’s #JobsReport, and much of the other recent #economic/corporate data, is that it’s the supply of resources that’s creating systemic pricing pressure, as well as consequently dulling growth of an #economy not lacking demand in virtually any area.

These #SupplyShocks are clearly accelerating prices higher in the near-term, which is creating #inflation fears (and reality) that has started to tangibly cut into the willingness of #consumers to spend.

This is an unusual situation to be in, since very rarely in our #economic or #market history has the supply side of the equation been the almost exclusive driver of #inflationary conditions and growth slowdown.

And the @federalreserve is largely without utility in influencing supply. Hence, the #Fed probably will (and should) continue its plan to #taper excessive #liquidity accommodation in the very near future.

What will be a true test for the #Fed into 2022 is whether these supply shocks (including #labor) continue well into the year, and how the Fed would deal with #inflation continuing and growth potentially slowing alongside of those rising inflationary conditions.

Why is such easy #monetary policy being maintained at the #CentralBank at this stage in the recovery, when we have long argued that policy befitting “emergency conditions” was simply not necessary in the midst of what has been an impressive #economic recovery?

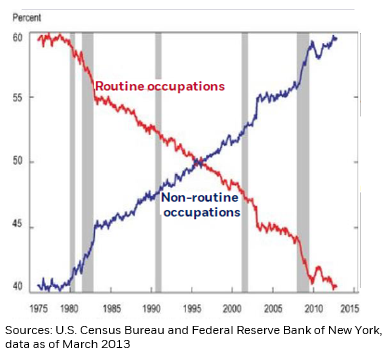

Some believe that #technology will eliminate #jobs that were lost during the pandemic, such that job growth will slow from here, rendering a full recovery in labor force participation impossible.

We think both the historical record and long-run supply/demand dynamics indicate that as implausible: long-term demand should overwhelm supply, particularly in areas like #tech and robust #employment growth will follow that demand, as well as #PopulationGrowth trends.

In fact, while it’s true that #tech renders some jobs irrelevant; in the process of this “creative destruction” more #jobs are created, and this also happens to result in higher #incomes/GDP, suggesting that we’re not witnessing labor #market dynamics warranting emergency policy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh