Just updated my UK #GDP forecasts with today's data... 🤓🧵

Some key points and international comparisons

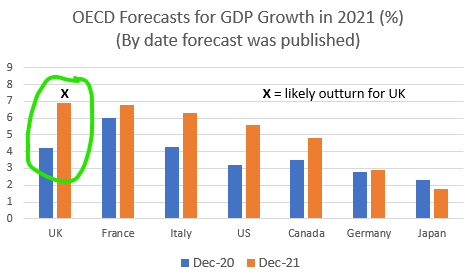

1. UK economic growth in 2021 is likely to be just shy of 7½%, 1% higher than assumed in the October Budget and 3% higher than the consensus at the start of last year... 👍

Some key points and international comparisons

1. UK economic growth in 2021 is likely to be just shy of 7½%, 1% higher than assumed in the October Budget and 3% higher than the consensus at the start of last year... 👍

2. This means that the UK was almost certainly the fastest growing G7 economy in 2021.

Many like to dismiss this as a 'dead cat bounce' after the relatively large fall in 2020. But the UK still did much better than expected, even taking account of this favourable base effect...

Many like to dismiss this as a 'dead cat bounce' after the relatively large fall in 2020. But the UK still did much better than expected, even taking account of this favourable base effect...

3. To illustrate this, this chart compares different vintages of the OECD's forecasts for last year.

In December 2020 the OECD expected the UK to grow by 4.2% in 2021, and to be outpaced by France and Italy. This turned out to be the biggest forecast error for any G7 economy...

In December 2020 the OECD expected the UK to grow by 4.2% in 2021, and to be outpaced by France and Italy. This turned out to be the biggest forecast error for any G7 economy...

4. As a result, UK GDP has returned to its pre-Covid *level* much sooner than most (not all 😉) had anticipated.

For example, most economists surveyed by the FT in December 2020 did not expect this level to be regained until Q3 2022...

ft.com/content/21abda…

For example, most economists surveyed by the FT in December 2020 did not expect this level to be regained until Q3 2022...

ft.com/content/21abda…

5. This is a significant milestone, given the relatively large fall in UK GDP in 2020.

Of course, it would be wrong to say GDP has 'fully recovered'. The economy is still much smaller than if it had continued to grow at its pre-Covid trend, and parts are still on life support...

Of course, it would be wrong to say GDP has 'fully recovered'. The economy is still much smaller than if it had continued to grow at its pre-Covid trend, and parts are still on life support...

6. But the UK recovery also ended 2021 with more positive momentum than many of its peers, with GDP rising about 1% in Q4.

So while UK GDP regained its pre-Covid level a little later than some (notably the US and France), it has a better chance of pushing on from here...

So while UK GDP regained its pre-Covid level a little later than some (notably the US and France), it has a better chance of pushing on from here...

7. Indeed, the first full-year estimates for 2021 (also published today) add to evidence that Germany is now the G7 laggard...

🇩🇪 GDP fell by 0.5%-1.0% q/q in Q4 and is still below its pre-Covid level, due to supply chain problems, soaring #inflation, and Omicron restrictions...

🇩🇪 GDP fell by 0.5%-1.0% q/q in Q4 and is still below its pre-Covid level, due to supply chain problems, soaring #inflation, and Omicron restrictions...

8. Turning to 2022, I expect UK #GDP to rise by 5½-6% (the consensus is 4½-5%).

The recovery probably stalled again in December and January, due to caution over #Omicron, and rising energy bills and tax hikes will add to the headwinds in 2022...

The recovery probably stalled again in December and January, due to caution over #Omicron, and rising energy bills and tax hikes will add to the headwinds in 2022...

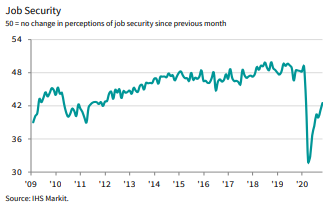

9. But there should be some powerful tailwinds too, including the strong #jobs market, a further easing of #Brexit uncertainty, a rebound in business #investment, and the fading threat from Covid.

The more timely business and consumer surveys are generally reassuring too...

The more timely business and consumer surveys are generally reassuring too...

10. In summary, the UK economy should again beat expectations this year.

Obviously there are big risks (in both directions), and the government may need to do more to help low income households in particular. But the consensus still looks too pessimistic, just as it was in 2021.

Obviously there are big risks (in both directions), and the government may need to do more to help low income households in particular. But the consensus still looks too pessimistic, just as it was in 2021.

• • •

Missing some Tweet in this thread? You can try to

force a refresh