1) I see @BambroughKevin is saying we could see #Uranium prices skyrocket "2x-3x in just a couple of weeks as #USA is poised to ban Russian uranium".🤯 While impossible to accurately predict "how high"🌜🪐 here's a thread on why U prices would spike on a US/EU or Russian ban.👇2

2) Both #USA & #EU rely on importing #Russia's #Uranium to provide about 20% of annual #Nuclear fuel requirements for their fleets of reactors, the 2 largest fleets in the world.⚛️ A ban would force operators to find alternate sources ASAP to fill the resulting supply gap.🛒 👇3

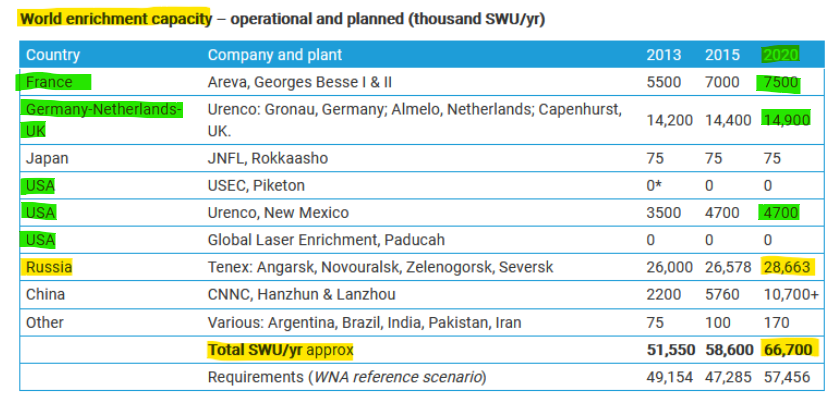

3) Majority of US/EU imports of #Russia's #uranium is in Enriched Uranium(EUP) with Russia having 43% of global enrichment capacity.🇷🇺 If US/EU (or Russia) were to ban imports then first impact, I think, would be steep price rise for EUP, enrichment SWU & UF6 enricher feed.⬆️👇4

4) A US/EU ban on #Russia's #uranium would require other enrichment plants in #USA & #EU to increase output ASAP.🏭 They've been in low demand, running with excess SWU capacity that's led to underfeeding = large secondary U supply⛏️ that's reduced huge #Nuclear fuel deficit.⚛️👇5

5) New skyrocketed demand for #SWU enrichment & #UF6 feed to those enrichment facilities would, imho, drive Up #SWU & #UF6 prices.💲⬆️ Enrichers can't quickly add more enrichment capacity so instead would flip from underfeeding to overfeeding of #UF6 to get more EUP per SWU.🏭👇6

6) Overfeeding involves feeding more #UF6 #uranium into centrifuges than supplied by #Nuclear fuel buyer, so enricher will need to go to Spot market & elsewhere to buy extra UF6 needed, if available, spiking higher prices for UF6 & for conversion of #U3O8 to produce UF6.💲⬆️ 👇7

7) Rising demand for #Uranium conversion services to produce more #UF6 would likely hasten restart of the ConverDyn Metropolis conversion plant in #USA🏭 & ramping up of other #U3O8 conversion facilities in #France & #Canada that have been operating well below capacity.⬆️⛏️ 👇8

8) Finally, at front-end of #Nuclear fuel cycle, spike in immediate demand for #UF6 & #U3O8 conversion would force buyers into the Spot #Uranium market to acquire as much #U3O8 feed as possible🛒🚛 as there's little time for writing term contracts.⌛️ U Price & U #stocks soar🚀👇9

9) End result: with ~200M lbs of #Uranium demand & only 135M lbs of mined supply, #Nuclear utilities were relying on 25M lbs secondary supply including ~20M lbs underfeeding. But overfeeding flips that to >20M lbs of new demand!🔀 U supply deficit grows to over 80M lbs.🤯=💲U🚀🌜

• • •

Missing some Tweet in this thread? You can try to

force a refresh