Quick thread on @CryptoEQ Fundamental Ratings as we get TONS of questions around them.... especially in a bull market when XYZ coin is pumping and outpacing #BTC and #ETH

We list ~50 crypto assets but only have a Fundamental rating on ~30. Why so few?

Because that's all that ACTUALLY matters in the #crypto ecosystem.

And, if we're being honest, probably just 15 but we feel a bit obligated to cover the crap/scam coins in the top 30 as warnings

Because that's all that ACTUALLY matters in the #crypto ecosystem.

And, if we're being honest, probably just 15 but we feel a bit obligated to cover the crap/scam coins in the top 30 as warnings

The top ~15 assets make up ~90% of the market cap.

With ~5 of those being #stablecoins and 2 are wrapped assets (#stETH and #WBTC)

So, by and large, we may seem selective but we cover 90%+ of the MC and 99%+ of what is actually legitimate, innovative, or intriguing.

With ~5 of those being #stablecoins and 2 are wrapped assets (#stETH and #WBTC)

So, by and large, we may seem selective but we cover 90%+ of the MC and 99%+ of what is actually legitimate, innovative, or intriguing.

Nearly EVERY. SINGLE. OTHER. SITE. will try and sell you that "#alpha" is in the newest undiscovered #altcoin on the horizon

And, because stuff like #SOL and #LUNA pump in a bull market, they seem right and vindicated.

WE. AREN'T. CHASING. PAPER. GAINS.

@litocoen

And, because stuff like #SOL and #LUNA pump in a bull market, they seem right and vindicated.

WE. AREN'T. CHASING. PAPER. GAINS.

@litocoen

Plus, the vast majority that get into those "gems" lose money on days and weeks like we've had recently (especially vs BTC and ETH).

They're not successfully timing the market. They all think 10,000x is their future bc that's what the VCs got or stories from #ETH's crowd sale.

They're not successfully timing the market. They all think 10,000x is their future bc that's what the VCs got or stories from #ETH's crowd sale.

TRUE alpha is not stock picking in an #uponly environment.

It's understanding the space and the protocol so intimately that you have all the necessary information to make an informed decision

And, just as importantly, sticking to it when #shitcoins pump & when everything dumps

It's understanding the space and the protocol so intimately that you have all the necessary information to make an informed decision

And, just as importantly, sticking to it when #shitcoins pump & when everything dumps

Just because we are selective with what's on the site doesn't mean we haven't evaluated hundreds of assets and keep tabs on what's around the corner.

We have and we do.

But it's part of our goal to do the hard work and abstract away the complexities.

We have and we do.

But it's part of our goal to do the hard work and abstract away the complexities.

And after evaluating all those hundreds of projects, what do we have to show for it?

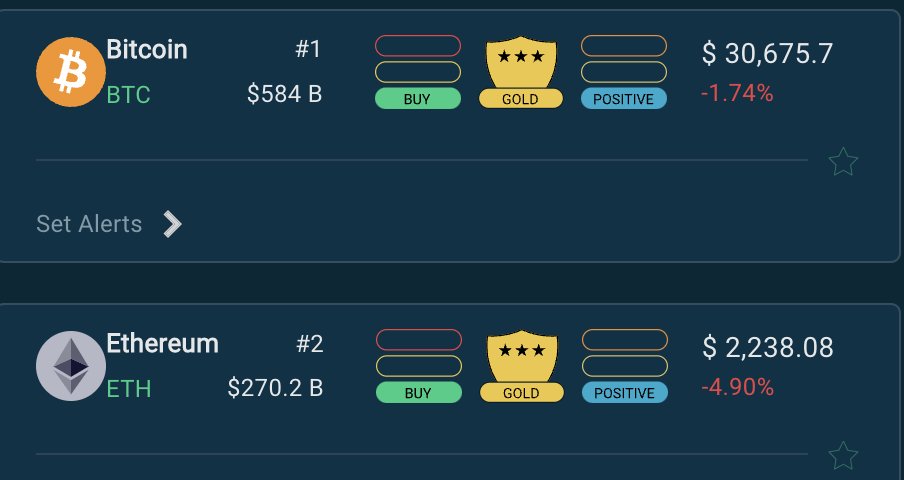

Only two Gold ratings: #BTC and #ETH.

Not very sexy right? Most know this intuitively and think "OK thanks but I could have figured that out myself" and leave it at that

Only two Gold ratings: #BTC and #ETH.

Not very sexy right? Most know this intuitively and think "OK thanks but I could have figured that out myself" and leave it at that

HOWEVER...

To truly understand just how YUUUGE the gap between #Ethereum and, say, #Solana truly is you need ALL the details behind the rating

You gotta know what makes #ETH (and #BTC) special to build conviction

@RyanSAdams

To truly understand just how YUUUGE the gap between #Ethereum and, say, #Solana truly is you need ALL the details behind the rating

You gotta know what makes #ETH (and #BTC) special to build conviction

@RyanSAdams

It's in times like 2021 when you see #SOLUNAVAX crushing it that people get lured away.

And times like this week when even Gold assets' USD value is going down and think you're a sucker

Short-term price does not reflect long-term reality

And times like this week when even Gold assets' USD value is going down and think you're a sucker

Short-term price does not reflect long-term reality

To the surprise of no one...

Understanding what you own, warts and all, IS the "secret sauce" here

But that's unbelievably hard to do in #crypto! Most won't do it!

And by simple math, THAT'S your edge....

Understanding what you own, warts and all, IS the "secret sauce" here

But that's unbelievably hard to do in #crypto! Most won't do it!

And by simple math, THAT'S your edge....

Spending your precious free time rigorously challenging your already-held assumptions and diligently vetting crypto from many, many angles is a FAR better use of time than tracking whale #NFT wallets so you can front-run the other suckers or scrolling CMC for penny caps

Here's most of #crypto top-30 vs Gold Assets ( $BTC and $ETH) over the last ~3 months (roughly when the market really started to turn down)

And then go back 3 years. Then 6....

Having trouble aren't ya?

And then go back 3 years. Then 6....

Having trouble aren't ya?

Everyone knows crypto is a 10+ year game but their portfolios don't reflect that. Euphoria or #GoblinTown fears take over.

Another boom-bust cycle is upon us. Tide rolls in, tide rolls out.

What hasn't changed is the significance of #BTC and #ETH.

Another boom-bust cycle is upon us. Tide rolls in, tide rolls out.

What hasn't changed is the significance of #BTC and #ETH.

Anyways, that was a lot to basically say @CryptoEQ is here to help! And to do yourself (and your sanity) a favor by poking around our reports now that the bull market isn't masking most protocol's inherent issues.

Plus you can learn more about our approach and methodology.

Plus you can learn more about our approach and methodology.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh