1/14)#Uranium #mining #stocks have been thrashed by global market meltdown⏬ but U #investing thesis👨🏫 is most bullish in 4 decades!🤠🐂 This🧵will bring U up to speed🏇 on how a record U supply deficit⤵️⛏️ is colliding💥 with a global #Nuclear #Energy Renaissance⤴️🌞🏗️⚛️ 🌊🏄♀️👇2

2)Entering 2022, #Nuclear fuel consultants UxC & TradeTech estimated 200M lbs of #Uranium demand versus just 135M lbs of mined supply🔀 for a ~65M lbs primary deficit.↕️ #Nuclear utilities are drawing down inventory & relying on ~20M lbs of Secondary Supply to fill the gap.⛏️👇3

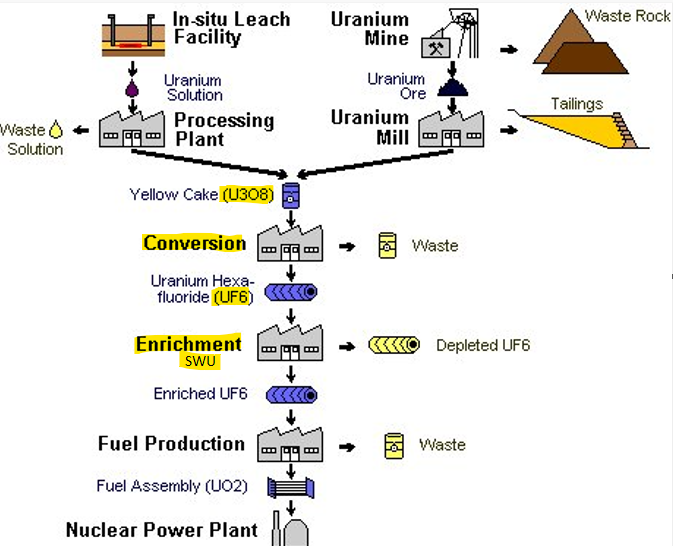

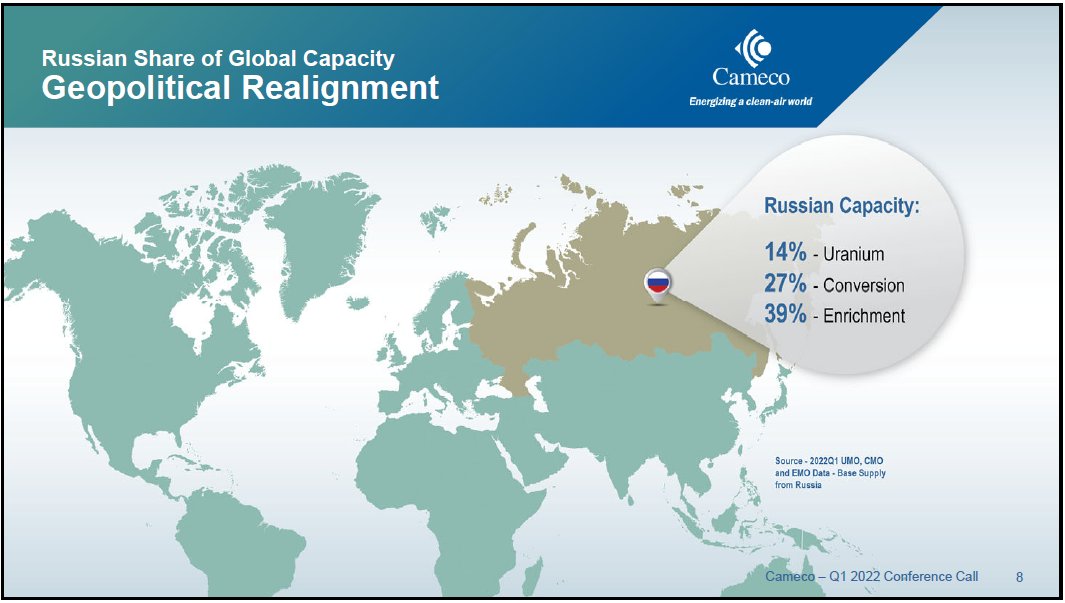

3)But then #Russia invaded #Ukraine🪖 turning global #Nuclear fuel market on its head.🙃 Russia's 39% of global enriched #Uranium, 27% conversion & 14% of mined U supply have been disrupted by US & EU sanctions, shipping bans & self-sanctioning by western utilities🇷🇺⚛️⛏️⛔️🇺🇸🇪🇺👇4

4)Western pivot away from #Russia's #Uranium has triggered record-breaking spikes in prices of UF6, Conversion & enrichment SWU⏫ as #Nuclear utilities scramble to find alternative supplies in the west.🛒 Anti-Russia pivot also cuts expected U Secondary Supply in half.✂️⚛️⛏️😟👇5

5)Interruptions to EU flow of Russian gas have led to a pivot to #Nuclear⤴️ as key 24/7 #CarbonFree #energy able to mitigate a new #EnergyCrisis.🌞⚛️⚡️ UK & France now put #Nuclear at heart of their #EnergySecurity & #NetZero plans, while Belgium delays reactor closures.🤠🐂👇6

6)Suddenly a wave of new unanticipated #Uranium demand🌊🏄♀️ has been added to a global #Nuclear build-out already underway to achieve #NetZero.🌞🏗️⚛️ On top of that, #SouthKorea reverses its planned nuclear phase-out while #Japan moves to accelerate restarts of its reactors.🏇👇7

7)China has already announced plans to build 150 new #Nuclear reactors by 2035, approving 6 new reactor builds in April.🌞 India has announced plans to triple its nuclear capacity, confirming 10 more builds plus 6 giant EPR reactors it plans to build with France.⚛️🏗️⤴️👇8

8)Even #USA is reversing its decades of #Nuclear decline by launching a $6 Billion program to halt premature reactor retirements😯 & spend $4.3B to boost US enriched #Uranium supply.⛏️🇺🇸 Anti-nuclear #California is now working to halt 2025 closure of its Diablo Canyon NPP.🚨🚑👇9

9)Worldwide, plans to build mass-produced advanced Small Modular #Nuclear reactors (#SMR's) are moving into high gear.🏎️🧑🔬⚛️ Their #Uranium demand hasn't yet been added to demand models.😲 China, Canada, UK, US, Korea, France... over 70 designs in 18 countries today.🌞🏗️🌎⚡️👇10

10)Global #Uranium demand is surging⤴️ but supply is in a deep structural deficit from years of under-investment.⤵️⛏️ No major new mines are coming online.🤯 Kazatomprom has capped its production at -20% thru 2023, while Cameco will only ramp up production to -41% by 2024.🐌👇11

11)Many forget too that #Uranium mines operating today are being depleted & must be replaced.😲 But with inflation driving up costs, #Uranium prices must nearly double to $80+/lb⏫ for lenders & miners to give green lights for new mines that will take many years to build.🏭🦥👇12

12)#Uranium demand is now rising at an unprecedented rate⚛️📈 and pivot away from Russia adds new "secondary demand" thru a transition by western enrichers from underfeeding to overfeeding in order to replace lost Russian enrichment, driving need for even more mined U3O8.⛏️⤴️👇13

13) Mined #Uranium production data for 2021 just published by World #Nuclear Association came in at just 48,303tU (125.6M lbs #U308)⛏️ but with global supply chain disruptions from COVID-19 & Russia's war on Ukraine,🪖 achieving 2022 forecast of 135M lbs seems unlikely.⚠️😯👇14

14)#Nuclear demand⚛️⤴️ vs #Uranium supply⤵️⛏️ fundamentals are extremely bullish🤠🐂 but global market meltdown⏬ has driven prices of high quality U #mining #stocks to be deeply oversold🤿 in complete opposition to "Best Ever" fundamentals🔀 & primed for a strong rebound📈😃☘️💰

• • •

Missing some Tweet in this thread? You can try to

force a refresh