1) While market meltdowns🫠 & #Ukraine war FUD😱 may be raining on #Uranium for now⛈️ a huge Shockwave💥 dubbed 'overfeeding'🍼 is already crashing thru the seemingly calm #Nuclear fuel market.🌀⚛️⛏️ I've created a Tutorial👨🏫🧵 to help prepare U to ride the coming wave.🌊🏄💰👇2

2) #Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇3

3) Mined #Uranium⛏️ is processed into drums of Yellow Cake #U3O8🛢️ that in the west are shipped🚢🚛 to plants in Canada, US & France for "Conversion" into a gas form called #UF6 which is then shipped in cylinders🚛 to plants in US & Europe for "Enrichment" into reactor fuel.⚛️👇4

4) Enriched #Uranium (EUP) is then shipped🚛 to a fuel fabrication plant🏭 where it is processed into solid "Pellets" that are loaded into reactor fuel rods that are bundled into "fuel assemblies" ready to be shipped🚛 to #Nuclear power plants for loading into reactors⚛️⚡️🌞🧵👇5

5) These stages of #Uranium processing are together called the "#Nuclear Fuel Cycle".⚛️ Operators of reactors have to sign contracts🧾 with companies providing Mining, Conversion, Enrichment, Fuel Fabrication, and as well must arrange shipments between each facility. 🌎🚢🚛🚂👇6

6) With #Uranium having to be shipped to plants in various locations worldwide for each of the #Nuclear fuel cycle stages, as fuel buyers compete for contracts to get their reactor fuel processed, it can take 2+ years to go from mined #U3O8⛏️ to delivered fuel assemblies.⚛️🦥👇7

7) #Nuclear reactor fuel must be ordered/contracted at least 2 years before it's scheduled for loading into reactors⏳😯 but that lead time can be cut in half✂️ if reactor operators buy already converted UF6 held by a supplier, bypassing #Uranium #mining & conversion stages.🐎👇8

8) Which brings us to "underfeeding."🍼 Without getting too technical👶 after Fukushima in 2011, demand for enriched #Uranium fell⤵️ but for technical reasons enrichment devices have to be kept spinning at full throttle.🌀 Enrichers switched gears⚙️ to operate differently🏎️👇9

9) Enrichers can spin the #UF6 feed for longer periods to achieve the desired #Uranium enrichment % while using less UF6.😯 A contract might call for 6 x UF6 cylinders, but enricher would only use 5 then sell the extra UF6 back into the market.💰 That is "underfeeding"🍼🧵👇10

10) Underfeeding led to an excess of #UF6 in the market, known as "secondary supply", that #Nuclear utilities could buy instead of signing contracts for Conversion.🧾✖️ Demand & prices for Conversion & mined #U3O8 plummeted.⤵️ Honeywell shut down only US Conversion plant!🇺🇸😯👇11

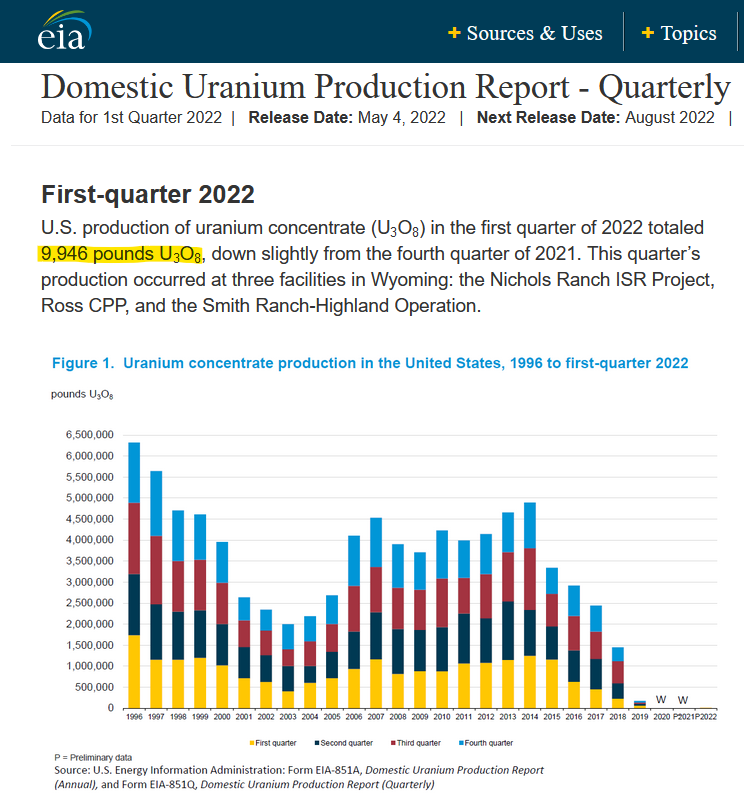

11) Demand for mined #U3O8 plummeted⬇️⛏️ due to oversupply.♒️ New mine projects were cancelled✖️ many mines closed🏭⛔️ investment in exploration fell off a cliff 💰⤵️ as did #Uranium supply & prices😟even tho #Nuclear fuel demand has been rising year after year🌞⚛️🏗️⤴️👇12

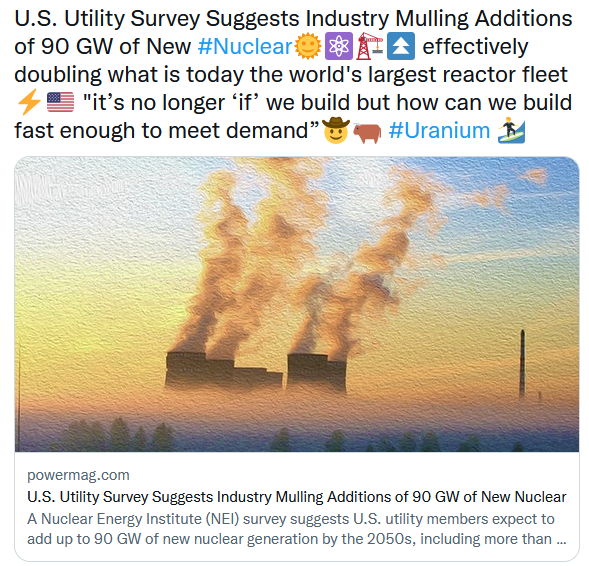

12) Today #Nuclear power capacity & #Uranium demand is greater than it was before Fukushima.⚛️🏗️⤴️🤠🐂 Demand is surging in a global decarbonization drive to fight #ClimateChange & achieve #NetZero🌞in midst of an #EnergyCrisis.⚡️ A 'Nuclear Renaissance' is now underway.🌞⏫👇13

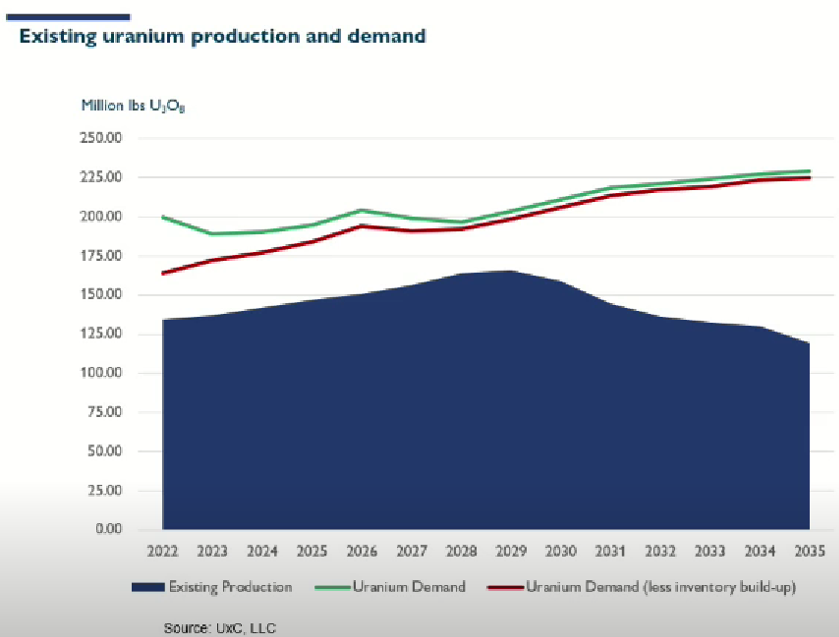

13) Even before #Russia invaded #Ukraine to upend fuel markets🪖💣 #Nuclear demand was circa 200 Million lbs of #Uranium this year, but mined supply at only 135 Million lbs.🤯 'Underfeeding' was providing about 20M lbs/year of Secondary Supply for net -45M lbs deficit.⚛️⛏️⏬👇14

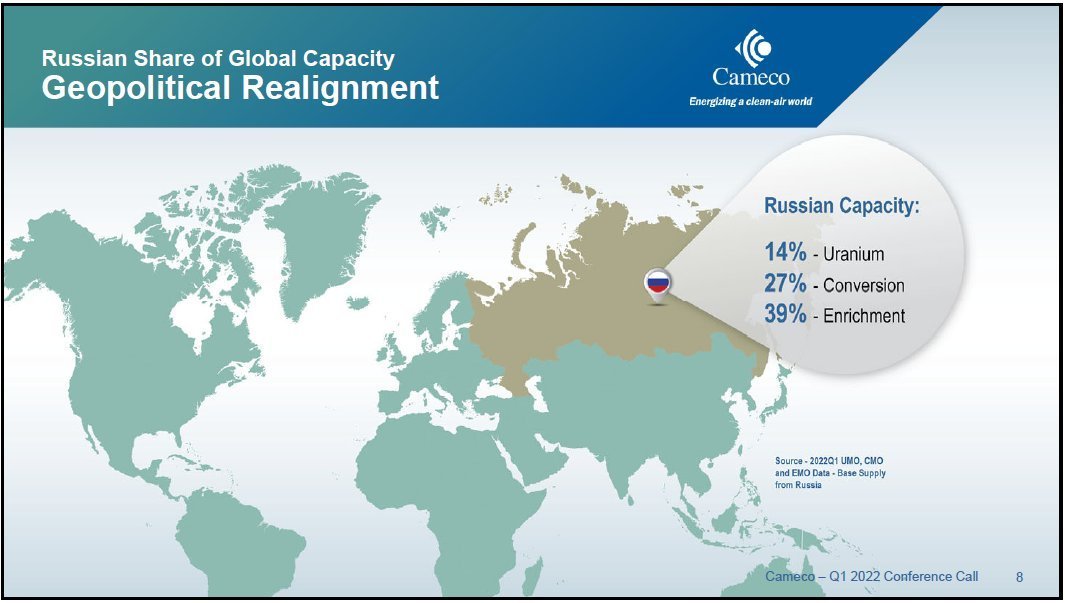

14) #Russia has been supplying 39% of global enriched #Uranium, 27% of Conversion & 14% of mined U supply.⚛️⛏️ #Nuclear utilities in US & Europe are now pivoting away from Russian supply🇷🇺⛏️⛔️ with shipping also disrupted🚢🚛🚂 impacting ~20% of US & #EU Nuclear fuel supply✂️👇15

15) Demand for Western enriched #Uranium & Conversion has surged⤴️⚛️ spiking the prices for enrichment SWU & Conversion like never before⏫as #Nuclear utilities scramble to secure alternative supply.🛒 Conversion price has spiked to an all-time industry high!🌋👇16

16) But with the west pivoting away from dependence on #Russia's enriched #Uranium🇷🇺⚛️⛏️⛔️ there's not enough enrichment capacity in US & Europe to meet demand so enrichers that had been 'underfeeding' their plants are performing a magic trick🎩🐇 by switching gears again⚙️🏎️👇17

17) Western enrichers are switching from 'underfeeding' to 'overfeeding'🍼🍼 so they can enrich a lot more #Uranium at a faster pace.🏇 By feeding extra UF6 they can shorten enrichment time⌛️ to try to keep up with demand, but must buy the extra #UF6 feed in the market!🛒🤠🐂👇18

18) But #Nuclear fuel consultants are saying that supply of #UF6 is running out.🏜️ More Conversion of mined #U3O8 is needed ASAP in order to produce more #UF6.⏫ Cost of Conversion has risen to an all-time high.🌋 Luckily, Honeywell is restarting their US conversion plant🏭🇺🇸👇19

19) As Conversion ramps back up⤴️ #Nuclear utilities must purchase more mined #U3O8🛒⛏️ to be converted to #UF6🏭 so enrichers can "overfeed"🍼🍼 to produce more enriched #Uranium to replace lost Russian supply.🇷🇺⛔️ This is the Shockwave💥 that has yet to hit #U3O8 price!🌊⛏️👇20

20) Overfeeding🍼🍼will result in most of that 20M lbs of 'Secondary Supply' disappearing💥 to be replaced by 20-30M lbs of new 'Secondary Demand' which #Nuclear fuel consultants estimate could push today's -45M lbs #Uranium supply deficit to -90M lbs over next few years.🤯⏬👇21

21) But there aren't enough idled & new #Uranium mines able to meet that massive demand🤷♂️ & it can take many years to develop #Uranium deposits into mines🐌 so #U3O8 prices will spike very high due to under-supplied market🚀🌜while operating mines are already in decline.⛏️↘️👇22

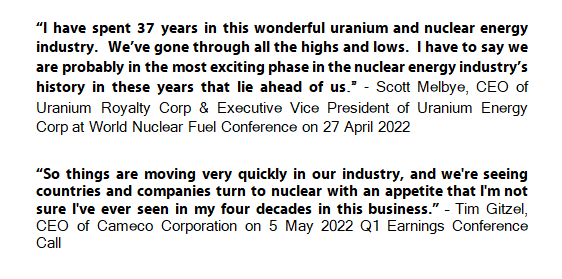

22) This is why many #Uranium market veterans say that fundamentals today are best they have ever seen in the industry's history.🏆 A record #U3O8 supply deficit⤵️⛏️ is colliding💥 with a global #Nuclear Renaissance⤴️🌞🏗️⚛️ creating a massive investment opportunity 4U 🌊🏄♀️💰👇23

23) #Nuclear as become a key #CarbonFree 24/7 #CleanEnergy source to mitigate a new #EnergyCrisis.🌞⚛️⚡️ UK & France now put #Nuclear at heart of their #EnergySecurity & #NetZero plans, while Belgium & even anti-Nuclear Germany are rethinking planned reactor closures.🤯🤠🐂👇24

24) #SouthKorea has reversed its planned nuclear phase-out while #Japan accelerates restarts of its reactors.🏇⚡️ #USA is investing $36 Billion to keep its #Nuclear fleet running. 🇺🇸 Anti-nuclear #California is now working to halt 2025 closure of its Diablo Canyon NPP.🚨🚑🤯👇25

25) #Uranium investment opportunity has never been more bullish🤠🐂 but shares of high quality U #mining #stocks remain deeply oversold🤿 in spite of "Best Ever" fundamentals🔀 & primed for a strong rebound.🚀🌜I hope this🧵 has helped U get ready to ride the coming wave.🌊🏄💰☘️

26) For more details on the #Uranium #investing thesis & #Nuclear #energy, as well as info & ideas on U #mining #stocks & ETF's for your own portfolio📂💡 please browse thru this library of tweets I have compiled into a Guide📖 to aid your research.🧐👇🤠 twitter.com/i/events/11378…

• • •

Missing some Tweet in this thread? You can try to

force a refresh