Today's #blogpost discusses #Grantham's recent comments on the #SuperBubble's final act. Is that the case, or is this time different?

realinvestmentadvice.com/superbubbles-t…

realinvestmentadvice.com/superbubbles-t…

We find ourselves at the crossroads where #markets and #fundamental realities meet. From this point, the outlook for equities over the next 9-12 months is more #bearish than #bullish.

realinvestmentadvice.com/superbubbles-t…

realinvestmentadvice.com/superbubbles-t…

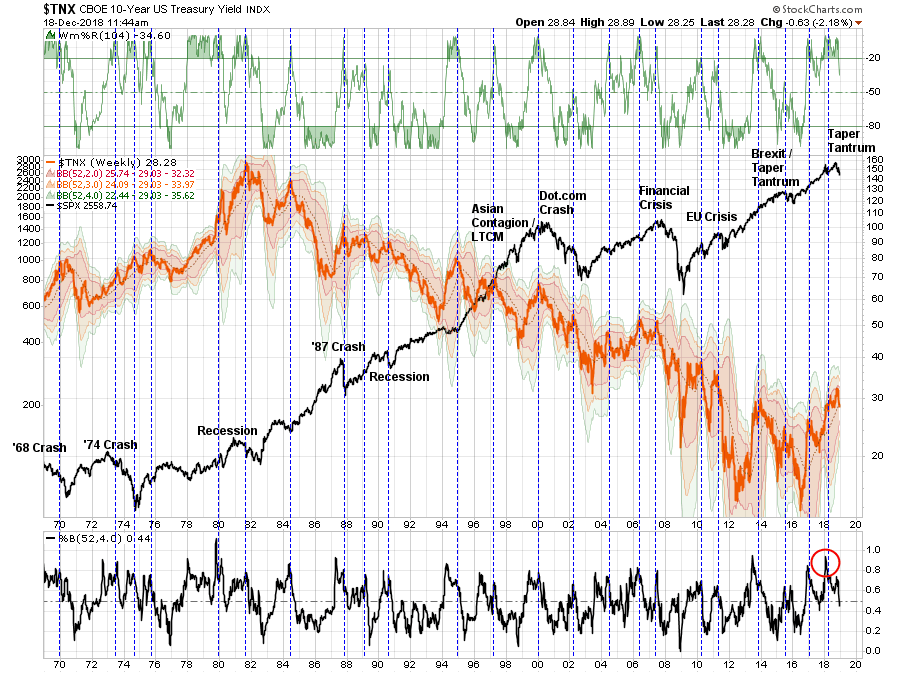

Notably, the “difference this time” is the #Fed is aggressively tightening #monetary #policy to slow economic growth and reduce demand-driven inflation. The consequence is negative concerning both #economic and #earnings growth.

realinvestmentadvice.com/superbubbles-t…

realinvestmentadvice.com/superbubbles-t…

The most obvious indication that a decade of #monetary interventions created a “#superbubble” is in the #deviation of the #markets from corporate #profitability. The eventual reversion in economic growth leaves investors vulnerable.

realinvestmentadvice.com/superbubbles-t…

realinvestmentadvice.com/superbubbles-t…

• • •

Missing some Tweet in this thread? You can try to

force a refresh