Set a reminder for my upcoming Space! twitter.com/i/spaces/1kvJp…

We are going live in 5!

Follow the thread below for slides!

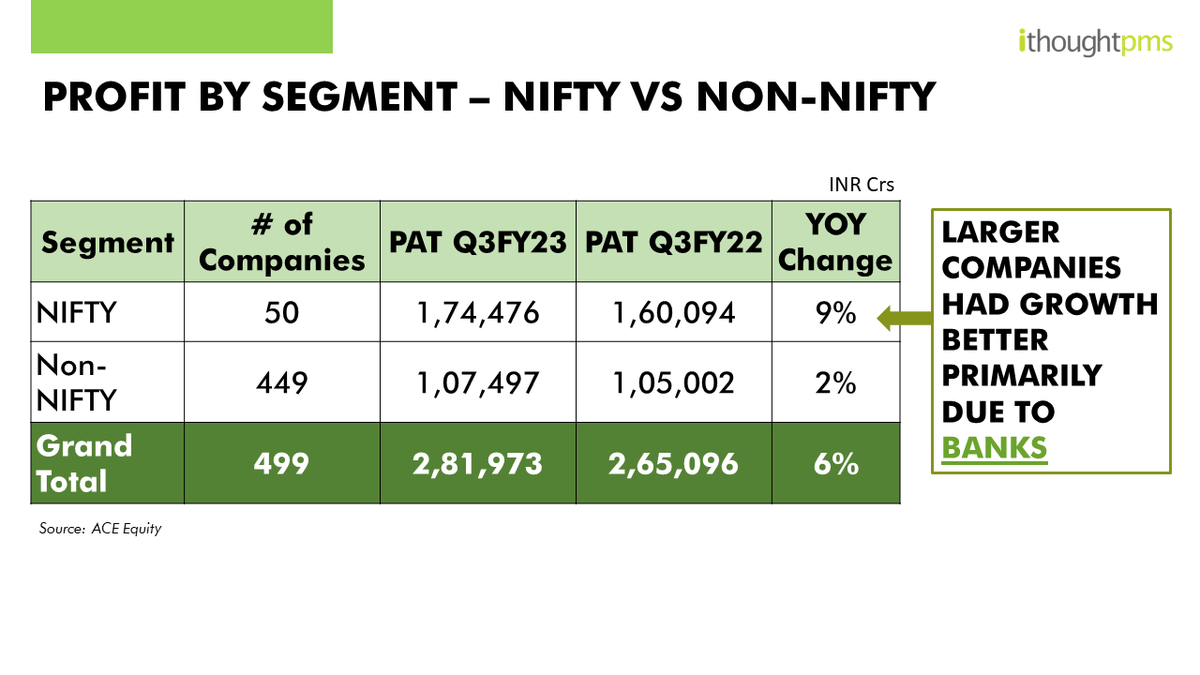

#nifty50 #NiftyBank #corporateindia

We are going live in 5!

Follow the thread below for slides!

#nifty50 #NiftyBank #corporateindia

Top 25 Stocks by Mcap - Historical Profit Trend

#StocksToBuy #longterminvesting #historical #marketcap

#StocksToBuy #longterminvesting #historical #marketcap

Strategic Construct - 5 Blocks of Strategy - An interesting view!

#Bajajfinance #indiagrowthstory #megatrends

#Bajajfinance #indiagrowthstory #megatrends

New Product Development - Interesting Launches - New Category Creation

#newproductdevelopment #corporateindia

#newproductdevelopment #corporateindia

Sector: #IT

Sector: #FMCG

• • •

Missing some Tweet in this thread? You can try to

force a refresh