Thread Starts here

You can also slide into our DM if you have further insights on some of the stories we will share today.

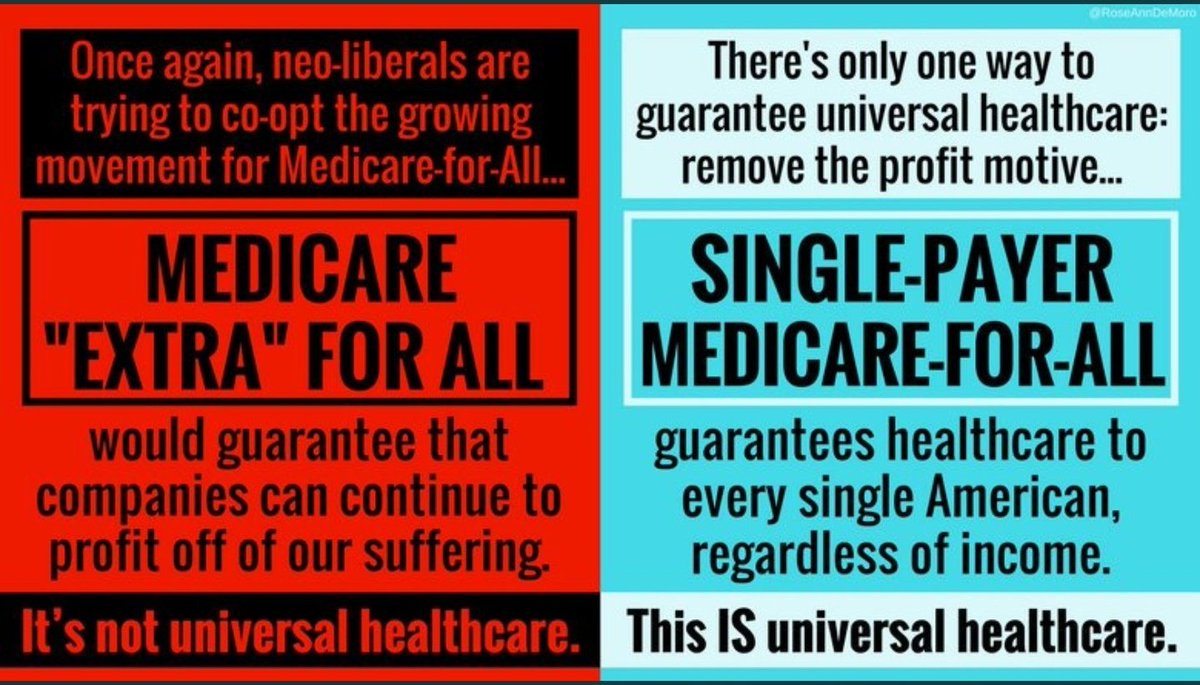

I am just wondering how many Nigerians can actually afford this?

And for our corporate story fans, we should be releasing the next installment in February, so stay locked.

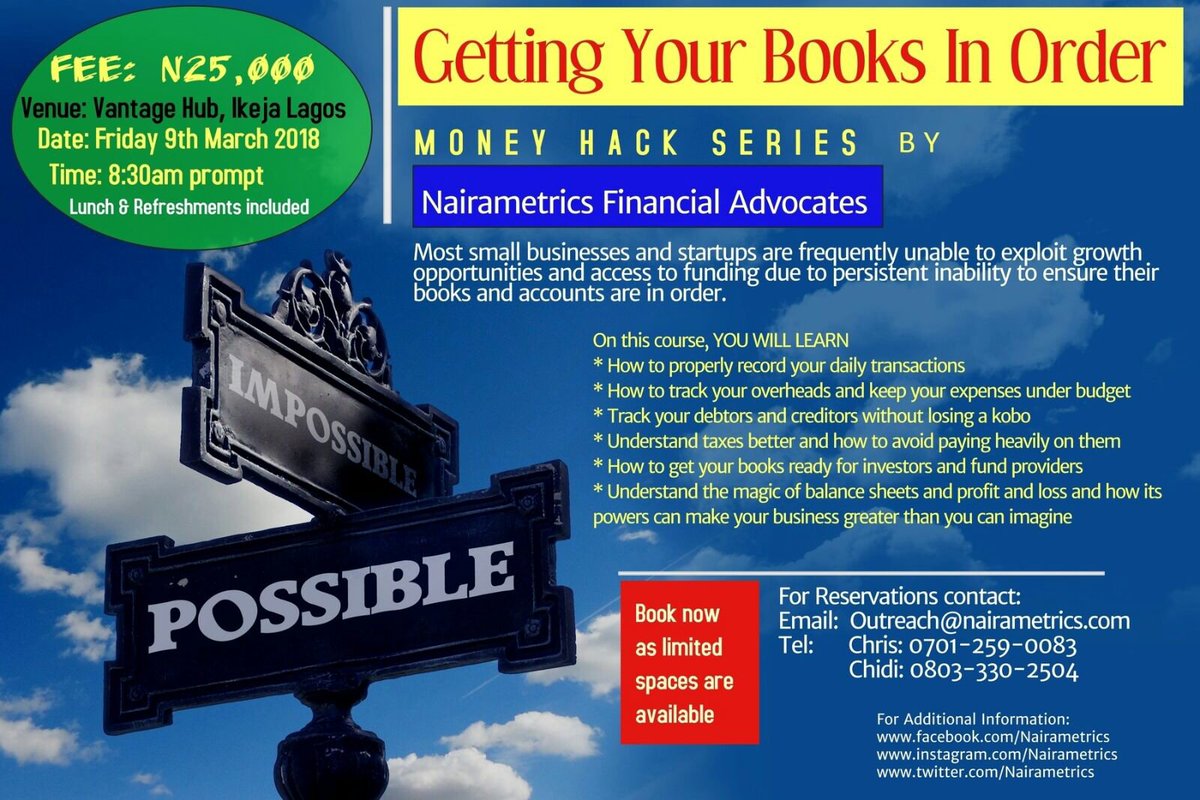

We will start with a seminar for Startups and Side Hustlers looking to keep their boom straight ahead of raising capital and boosting profits.

If you are that Small business owner then this is for you.

We will be providing more details in the coming days. Further inquiries can be directed to the @Nairametrics handle.

Do have a profitable week ahead!!!

*END*