20% on tomatoes?

I looked up tomatoes, (cherry tomatoes, harmonised code 0702000007, but the same applies for other tomatoes under code 0702000099).

I see lots of zeros.

This is page 1.

Throughout each page I see lots of zeros

What about where 0% is not explicitly stated? e.g. South Africa?

There's a conditions button/link for these countries and a few others. If you open up Tunisia you get this:

This is the Entry Price System explained in the next tweet.

The exception is "ERGA OMNES".

So for these countries, and these countries only the following tariff applies.

This percentage is seasonal and the trigger price is adjusted weekly according to market conditions.

For part of the year it's 8.8%, for the remainder 14.4%. At no point 20%.

eur-lex.europa.eu/legal-content/…

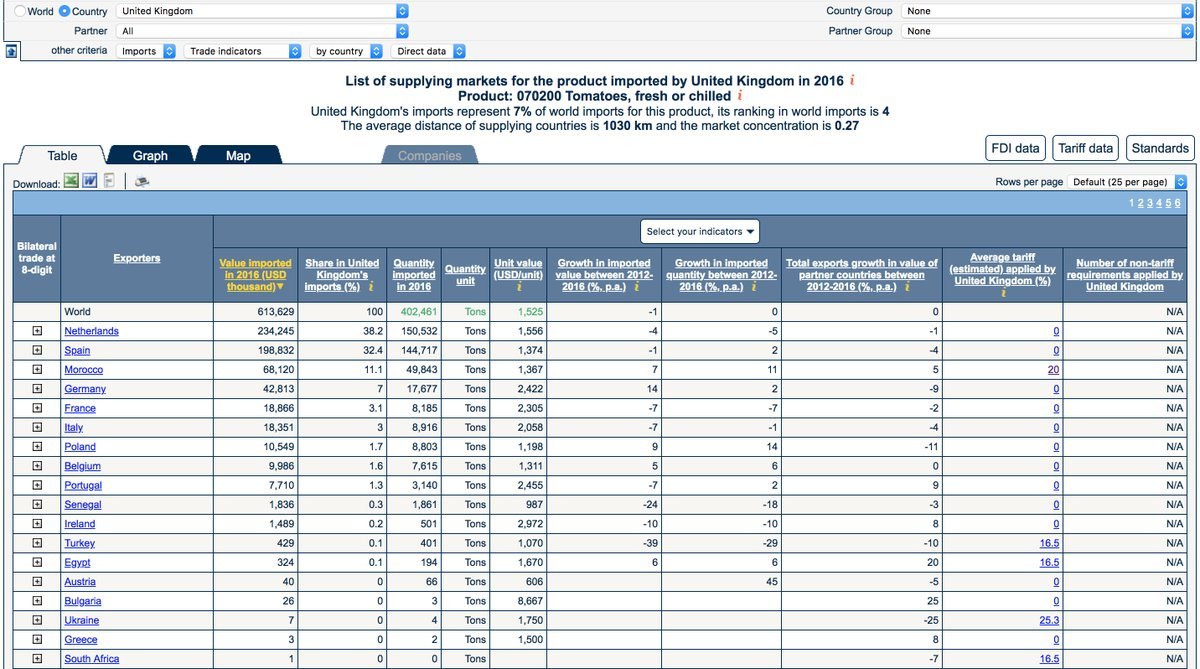

Earlier on he used the TradeMap tool on the ITC website to show tariffs on Nigerian goods exported to France. If you use this tool to look at tomato imports to the UK, trademap.org/Country_SelPro… you get:

If you click the number it takes you to the MacMap tool and the tariff for exports from Morocco or Ukraine to the rest of the world. Here's the one for Ukraine.

So that's the ad valorem tariff right? Wrong!

Click on the info/question mark on the column and you get a pop-up window.

"For HS4 and HS2 products, average tariffs are weighted by reference group imports. For HS6 products, average tariffs are calculated through a simple average."

Ok so it's doing an average. What's the problem?

The problem is what it's actually averaging.

If you recall, there is an Entry Price System for tomatoes, so there is a range of tariffs that could potentially be applied.

To figure this out use the menu to change the MacMap tool to "find tariffs" instead of "compare tariffs".

You'll see that in the drop box it will list the Entry Price criteria similar to that on the UK Tariff webpage.

If you selected the first one the page will look like this.

Now I hadn't mentioned before that some of the exporters have a quota.

The last one will look like this.

It then calculates the average tariff by averaging these.

For the MFN tariff: (8.8+10.21+11.52+12.92+14.23+36.72+36.72+36.72+36.72+36.72+36.72)/11= 25.27

So for the Morocco tariff: (3.5+4.91+6.22+7.62+8.93+31.42+31.42+31.42+31.42+31.42+31.42)/11=19.9727

This is because it is is just averaging all the potential tariffs when the SIV drops below the trigger price for MFN.

And for Morocco it's also ignoring the quota!

I'm not sure what to say about that!

I've just found some research that suggests that TradeMAP tariff is even more inaccurate.

Although this research is on oranges it shows that the Entry Price is hardly ever breaches. So only the top-line EPS tariff almost always applies.

uni-hohenheim.de/qisserver/rds?…

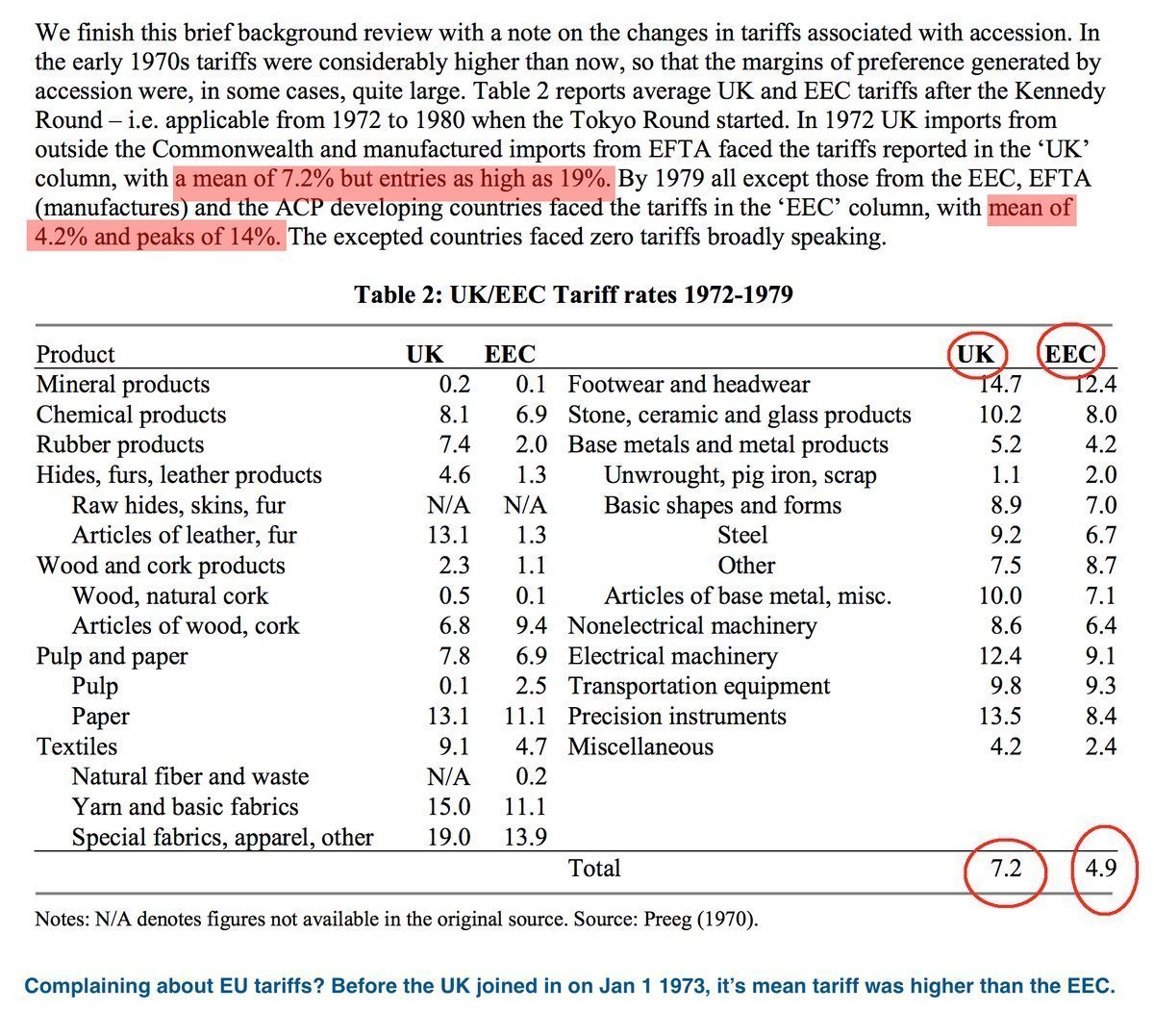

Just adding this explanation of the history of preferences for LDC and ACP countries, to put the current situation in context.