For a sustainable alt move we need new capital to enter, which generates wealth in the most liquid fiat on ramps and later pushes people out on their risk curve

It almost became a self fulfilling prophecy, but the twitter calls alone weren't enough to do it

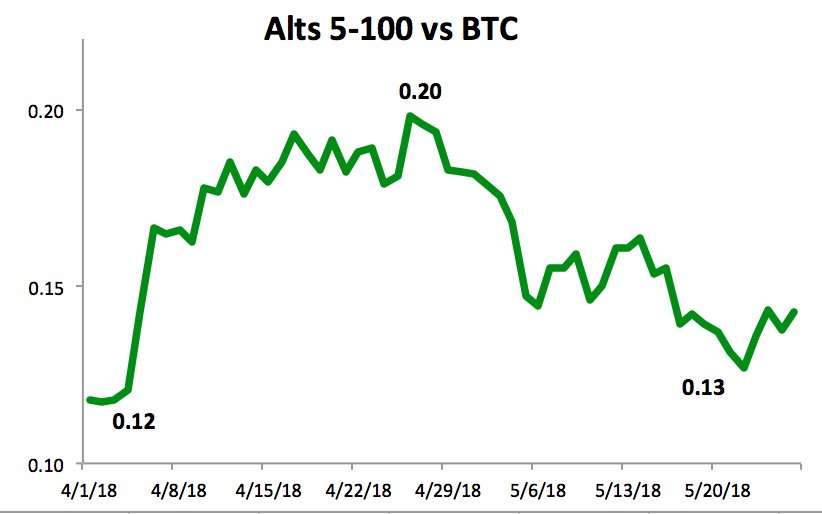

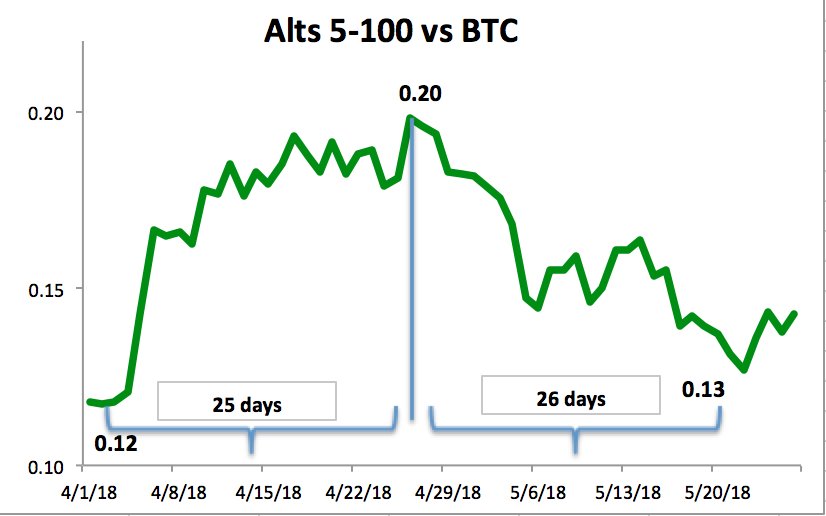

IMO, for there to be a sustainable alt run, we first need a decoupling between BTC and the broader alt market