* Simplicity

* Cycles

* Expertise

* Time

* Diversification

* Judgement

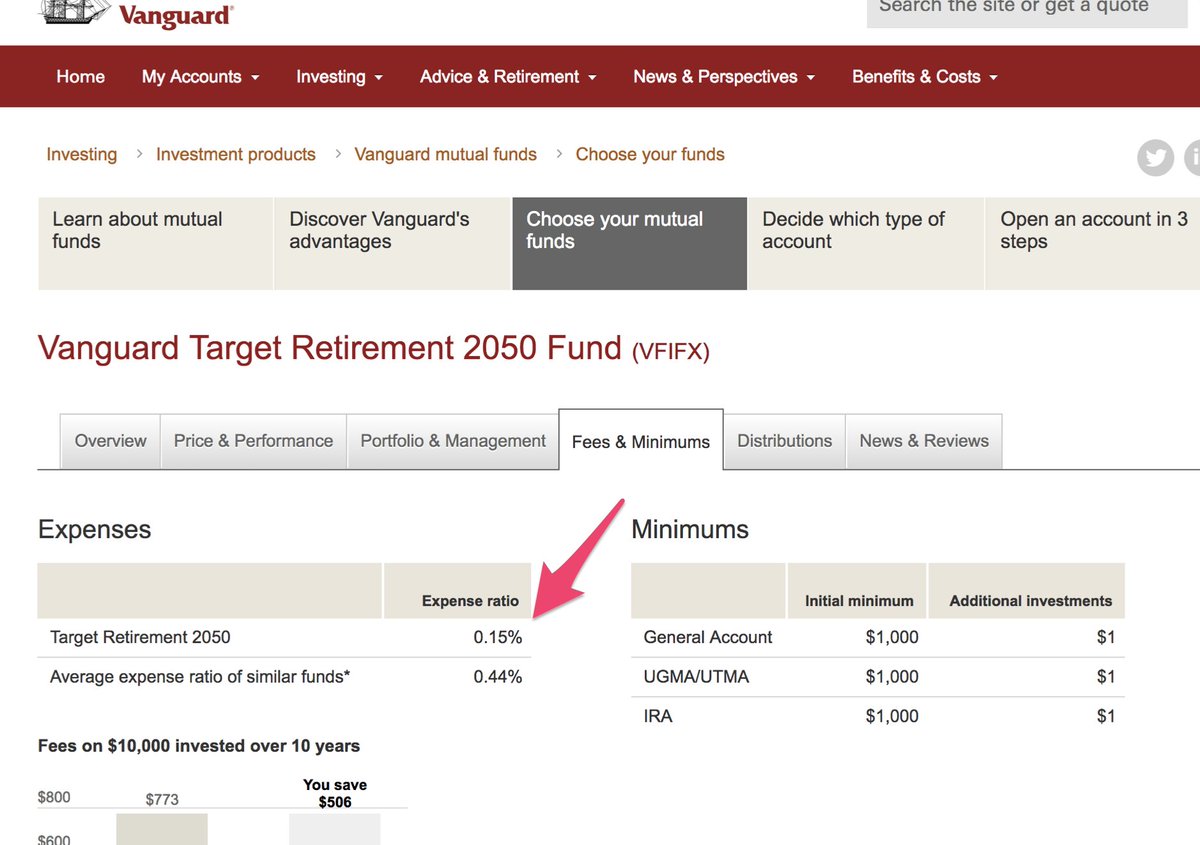

* [Low] Fee’s

* Risk Management

* Unfairness

1. Plan to own it for 10+yrs

2. Strongly desire the lifestyle (especially understandable if u have a family)

3. Acknowledgement that u may not make money off it

Its hard for me to be concise when it comes to homeownership 😥

Have u thought about the opportunity cost of the down payment?

Moving on!

For investing, this means to buy & hold low cost broad market index funds primarily.

amazon.com/Elements-Inves…

Simple, cheap, and clear!

Now seems like the right time to intro crypto. Yes, Ive been stuck in the rabbit hole.

Buy some $BTC or at least learn about it: amazon.com/Bitcoin-Standa…

Remember, cycles.. Things will take a turn down, but when? Im more on the sidelines now than the past 3yrs, which may be a bad decision. We’ll see.

Timely thread:

Long time horizon w/ a windfall? May be better off not DCA if u can stomach it:

awealthofcommonsense.com/2015/08/invest…

The earlier you discover @WCInvestor, the better.

Buy this 📕: amazon.com/White-Coat-Inv…

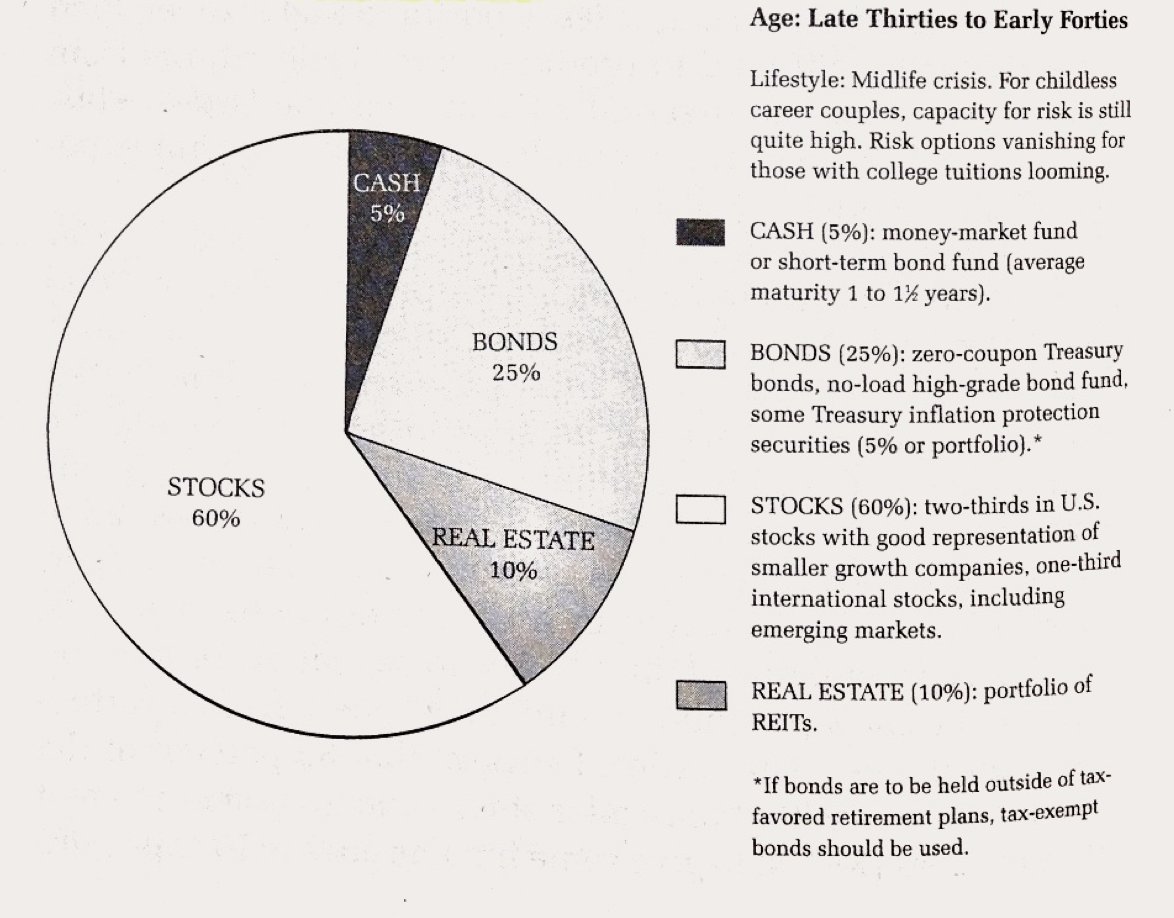

E.g.

He hosts a dope podcast focused on current financial events w @michaelbatnick called Animal Spirits. Shoutout to @ritholtz while we’re at.

Buy the 📖: amazon.com/Wealth-Common-…

Diversification is key. Diversify investments across industries, geographies, etc. Diversify income streams. Diversify hobbies.

Diversity lowers risk.

From @awealthofcs:

The chart on this @Wealthfront blog post shows why you diversify & why u shouldn’t chase returns.

blog.wealthfront.com/the-benefits-o…

“'The Get Rich Slowly but Surely' strategy. “

Buy the 📖: amazon.com/Random-Walk-do…

We have accounts w both @Wealthfront & @Betterment. As previously stated, time in the market is hugely important. If you’re young & on the sidelines due to decision paralysis w how/where to invest, just choose 1 of them. You’ll be fine.

Since we just touched on Diversification... he puts out 🔥 posts like: betterment.com/resources/dive…

Listen to her on @patrick_oshag podcast: investorfieldguide.com/cathie/

U may be interested in following some members of @CathieDWood’s team at @ARKInvest.

@yassineARK, @wintonARK and @jwangARK

ark-invest.com/innovation-whi…

Bad shit happen to good ppl. Lifes unfair. Fuck cancer.

I have a 10 yr term policy w option to extend later thru @NewYorkLife.

Fortunate to be healthy enough to qualify? Married or have kids & make 🍞? Stop delaying; its simple.

newyorklife.com

Complex, hard to understand products are not better. Similarly, more expensive doesn't always mean better either.

@AriDavidPaul of BlockTower Capital is 1 of the good guys.

Get to know him & the current state of the universe regarding token projects on @WhatBitcoinDid:

whatbitcoindid.com/podcast/2018/0…

VPN, PW Manager, @protonmail > Gmail..

Great guide by @tayvano_ for businesses & most lessons can be applied to personal life: medium.com/mycrypto/mycry…

‘Marry 1 frugal spouse who shares ur dream of becoming financially independent. Weddings are about love & divorces are about money. Make sure that u & ur beloved r on the same page financially before signing up 4 life.’

bogleheads.org/forum/viewtopi…

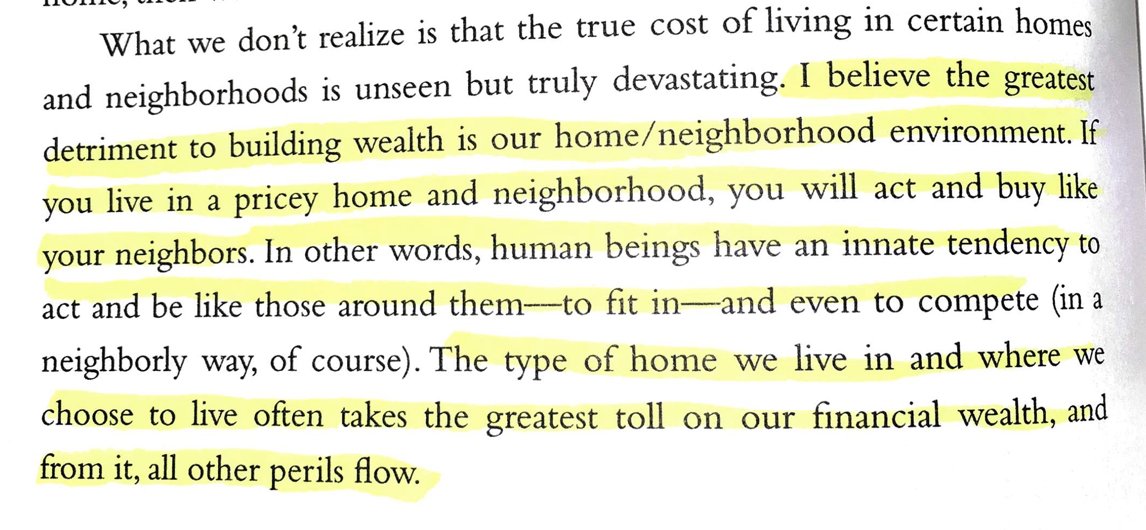

Keeping up with the Joneses will destroy u. Screw the Joneses.

“Whatever your income, always live below your means.”

Buy the 📖: amazon.com/Millionaire-Ne…

It’s the big things. Cars 🚗, houses 🏡 (size, location), college 👩🏽🎓, expensive brands...

* Tax-free, Tax-deferred, Taxable

* Roth, Traditional

* Contribution limits, Eligibility

* 401k, IRA, 403b, 529, HSA, ....

* Employer matches

* Fees

theastuteadvisor.com/tax-deferred-v…

h/t @DavidNWaldrop

* Tax-Free: Pay taxes on the income now, withdrawal investment tax free later.

* Tax-Deferred: Defer taxes until withdrawal, ideally when ur in a lower tax bracket.

* Taxable: Withdrawal at any age without penalty. Pay taxes on the income in the year received.

Roth: Taxed now; not at withdraw.

Traditional: Decrease taxable income now; pay taxes at withdrawal.

There r Traditional IRAs & 401ks.

There r Roth IRAs & 401ks.

Its likely wise to contribute to a Roth 401k if avail & to a Roth IRA if eligible (under the income limit).

* 401k/403b: Employer sponsored retirement plan.

* IRA: Individual retirement account.

* HSA: Health Savings Account.

* 529: College savings plan.

All of these tax advantages account types have unique eligibility requirements, limits, and benefits.

Consider contributing if u know you’ll have a kid(s), believe in the future of college, and are maxing out elsewhere.

Be advised: Food, vet visits (always $200+), boarding for vacations, early mornings, random vomitting, mucho 💩...

FWIW we have @NationwidePet

Writer of ‘The Devil's Financial Dictionary' & editor of the 📘 'The Intelligent Investor' by Benjamin Graham.

@WarrenBuffett said it ‘is by far the best book on investing ever written.’

jasonzweig.com

His philosophy stressed investor psychology, debt minimization, buy-and-hold investing, FA...

Buy the 📙: amazon.com/Intelligent-In…

* Know they can get ripped off easier by a dude with a pen than a gun

* Think IPO stands for ‘It’s Probably Overpriced’

* Understand margin of safety

* Refuse to spend too much for an investment

* ....

& so much more. Such a great book.

@StatusMoneyUSA enables you to anonymously compare net worth, spend, and income by age range, income range, geo, etc...

* Cant borrow💲as easily for retirement as 4 education

* Can borrow against 401k if really needed

* IRA earnings can be withdrawn penalty free 4 education

* Roth IRA contributions can be withdrawn penalty free + tax free

1. Serial impulse @amazon 📚 buyer? Start utilizing the ‘Wish List’ feature. Saves💰

2. Review @AppStore subscriptions:

imore.com/how-to-cancel-…

My budgeting & investing decision making process revolves around positioning myself to

*comfortably withstand extended bear markets (or job loss)*

It’ll get you thinking about soc security, healthcare, & withdrawal strategies; a topic I still need to learn a lot more about.

Buy the 📖: amazon.com/gp/product/B01…

Buy the 📖: amazon.com/Bogleheads-Gui…

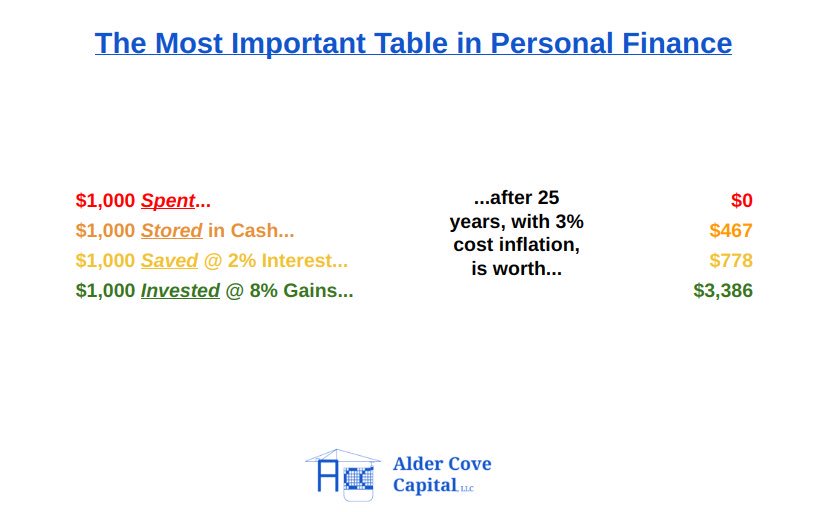

Takes a long time to feel like ur making investing progress. Takes time to earn interest & then for ur interest to earn interest.

Ur 1st $100k is a b*tch - Charlie Munger

fourpillarfreedom.com/charlie-munger… h/t @4PillarFreedom

- ‘Millennial Money’ by @patrick_oshag

Buy the 📖: amazon.com/Millennial-Mon…

Make sure to review/update it every few years. Tragedy strikes unexpectedly & it’s unfair for younger 1s left behind to have to fight for what you’d want.

Buy the 📖: amazon.com/Cryptoasset-In…

If u decide to speculate or trade (public stocks, crypto) then the rule of thumb is to limit the amount to < 5% of your portfolio.

I think of it as much as a mindset. It takes patience, humility, and strength 💪🏽.

* Card utilization

* Payment history

* Account count

* Inquiries

* History age

Services like @creditkarma & @creditsesame are great.

Credit cards 💳 are great:

* Builds credit

* Sign up bonuses = very valuable

* Buyer protections

* Dont need to carry cash (phsyical security)

* Waterproof

* Easy

* Rewards

* @Blispay 4 everyday purchases (2% cash back) & big spend like vet bills, my 🚲, taxes, etc. (for longer term financing).

* @Chase, @AmericanExpress, @Citi travel cards just for sign up bonuses, redeemed later for travel 🌎.

*just use responsibly*

flyertalk.com/forum/miles-po…

"It’s an intimidating topic because we have no idea where to start, and it’s hard to talk about money 💵 because it’s such a taboo topic." - @thewildwong

h/t @timherrera @nytimes

* The Capital to Income Ratio

* Savings Ratio

* Debt Ratios

* Investment Ratio

* Life Insurance Ratio

* ...

Buy the 📘: amazon.com/Your-Money-Rat…

* A little friendly competition can be healthy

* Consolidation requires high [enough] switching costs with little upside

* Treat as 1portfolio

More details: quora.com/How-do-married…

1. Theory

2. History

3. Psychology

4. The Business

Buy the 📙: amazon.com/Four-Pillars-I…

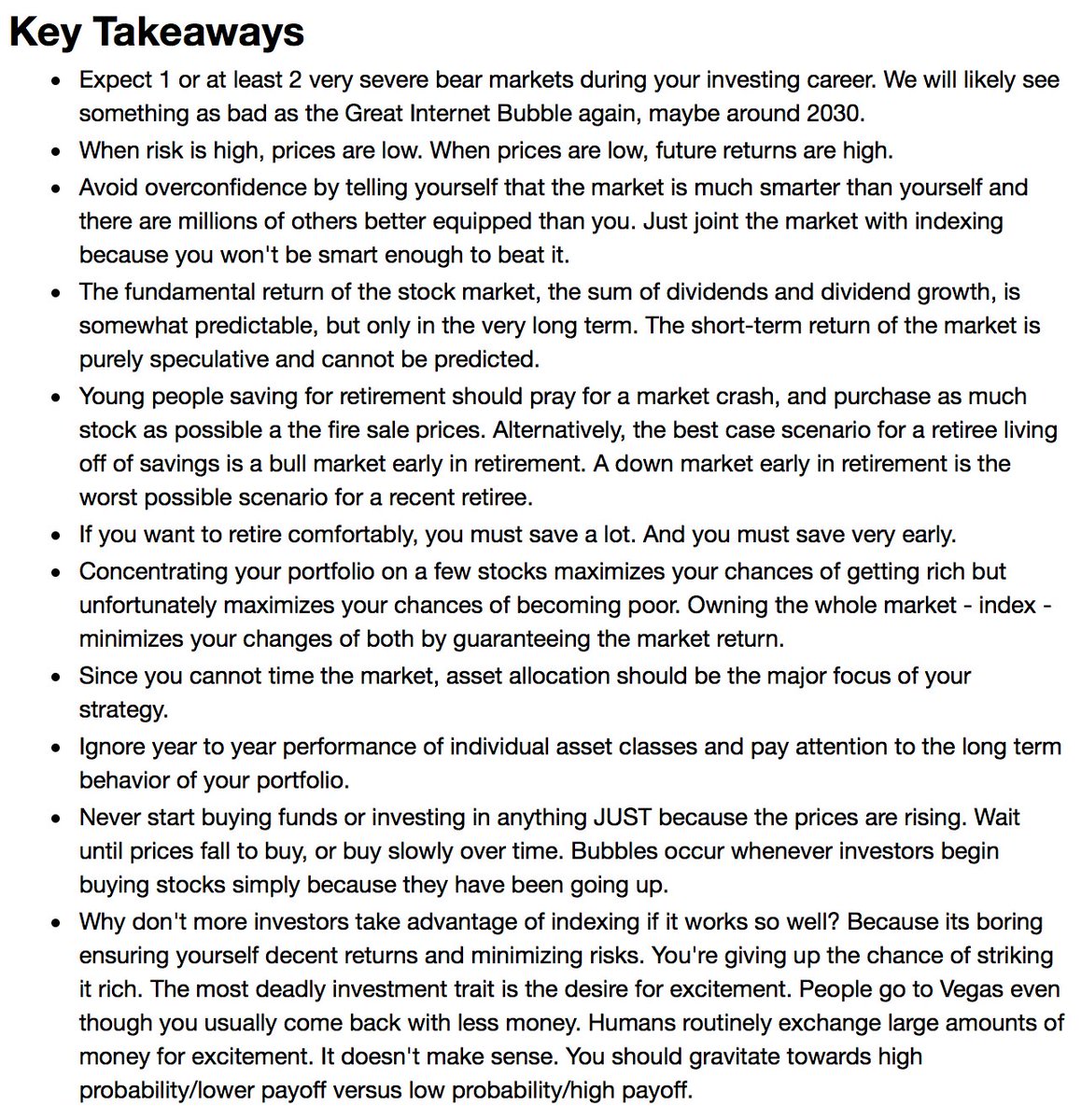

Read it a while ago, but I attached a screenshot of my notes.

It covers a wide range of topics from how Reserve Currencies work, why the US gov cant go bust, market myths, and more.

Buy the 📘: amazon.com/Pragmatic-Capi…

Supposedly @GarrettPlanning can be useful for finding 👍 hourly-fee based CFP's.

garrettplanningnetwork.com

Accredited Investor rules r BS 🖕. Conceptually 👍 but implemented 👎. Im educated enough for riskier opportunities.

(h/t/ @financialsamura)

financialsamurai.com/what-is-an-acc…

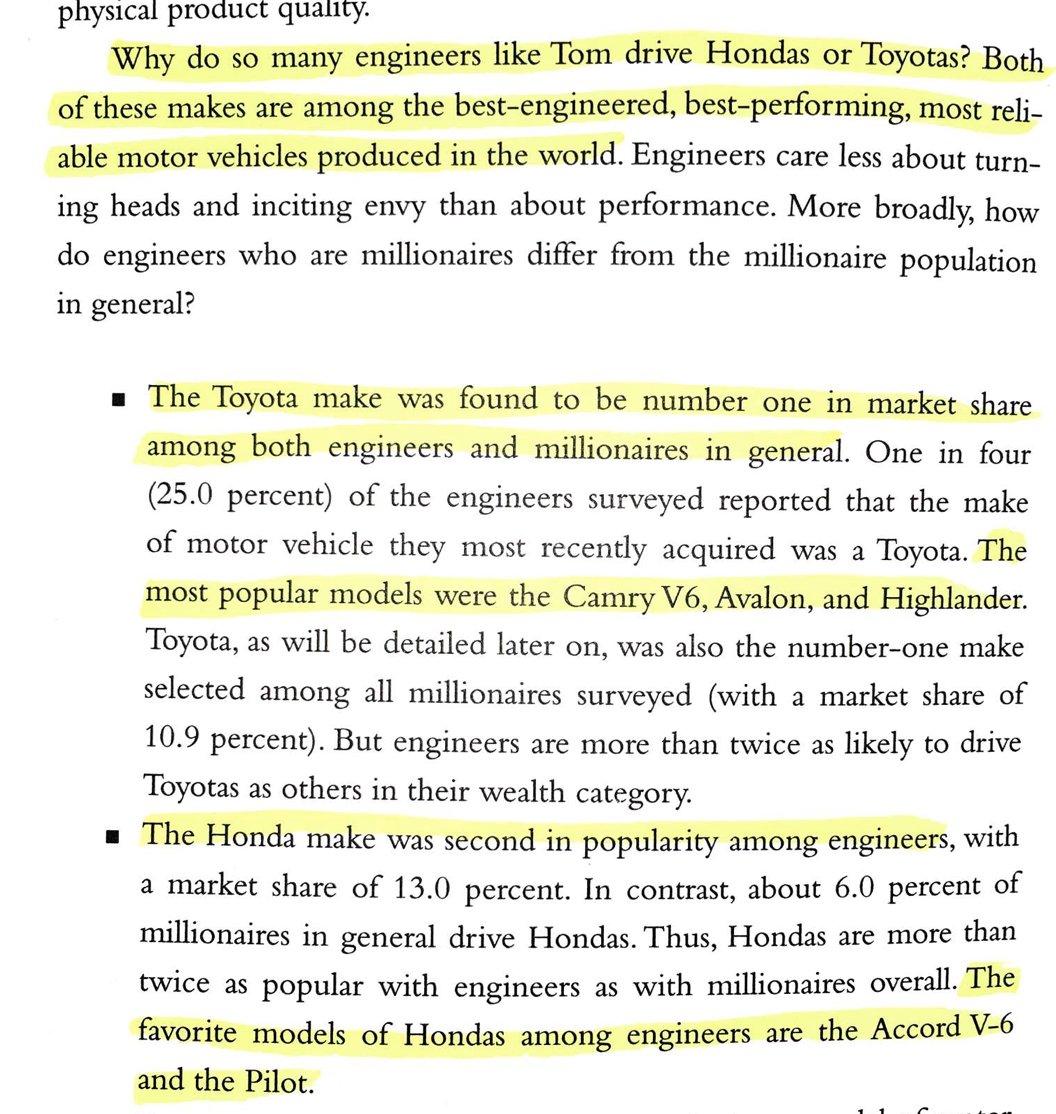

- 1 of my fav takeaways from the book 'Stop Acting Rich' by @thomasjstanley

Buy the 📘: amazon.com/Stop-Acting-Ri…

The decision far from just money driven, but 💲 is certainly a factor.

(h/t/ @awealthofcs)

* [Try] Choose a fulfilling career path

* Negotiate

* Understand at-will employment

Feeling fulfilled is very valuable💲. Obviously most people dont really 'choose their path' (myself included). But its a luxury to not hate work.

Seek 😃

U won’t get what u don’t ask for. Ask for what u want. Ask until its beyond uncomfortable. Be told no and ask again.

Basically, u can leave & they can let you go. Don't be scared by it; embrace it.

en.wikipedia.org/wiki/At-will_e…

Equity is an incredible motivator but assume your startup will not become the next $FB or $GOOG.

This guide by @HollowayGuides is the best I've come across: holloway.com/g/equity-compe…

I view huge companies as risky, ready to do layoffs at any moment.

I break startups into 2 camps: pre & post product/market fit. Post is really just a small company to me.

I'm not educated enough yet to 'take a side', but I have to say that fractional reserve banking seems & feels... icky.

investopedia.com/terms/f/fracti…

Follow @real_vijay and @saifedean if you're interested in questioning if this is how it should be.

Good primer podcast (h/t @villageglobal):

spreaker.com/user/10197011/…

The only none finance book I'll mention in this thread is called "Grinding it Out - the Making of McDonald's" by Ray Kroc himself.

amazon.com/Grinding-Out-M…

As inflation increases, each $ buys less. If its 2% in a year, u should demand a raise of at least 2% to keep up.

investopedia.com/university/inf…

aldercovecapital.com/personal-finan…

Bit dated now but buy the 📘 for a younger loved 1: amazon.com/Will-Teach-You…

Savings accounts r a good place to stash it. @GoldmanSachs $GS Bank, @AmericanExpress Personal Savings, @capitalone 360, @allyfinancial

@PeterAttiaMD teaches lifespan (length) & healthspan (quality). @classpass played a role in my journey to discover a routine 🚵🏼♀️.

h/t @patrick_oshag

investorfieldguide.com/attia/

www2.jdrf.org/site/Donation2…

The book highlights a lot of survey results re: millionaires such as GPA (2.9/4.0), SAT scores (1190/1600), and the ability to always show up.

Such a great book.

amazon.com/Millionaire-Mi…

FYI u can usually trust that @Vanguard_Group will be 👍.

Concisely explains a driving force behind everyones actions; especially sales forces. Be wary of what anyone is selling u, or advising you of. Try to understand what their incentives are 🔎.

* Systematic: aka Market Risk. Reaction of individual stocks to market swings.

* Unsystematic: Variability independent from the market movements. Result of factors peculiar to an individual company like accounting fraud, labor trouble, etc.

I've done them myself using @turbotax in the past but I prefer to pay a trusted friend now (easier + accounting fees are deductible).

Follow @CryptoTaxGirl (congrats on @ycombinator).

For me at least. It’s so much simpler and safer that way.

Just remember to temporarily lift them prior to applying for any sort of loan.

Heres how data breaches made a big business out of buying & selling personal information online:

aarp.org/money/scams-fr…

Calculated by averaging your top 35 earning years (adjusted for inflation).

But dont count on receiving it if you’re young. Even if u end up getting some of it, its better to plan for not getting any. Which sucks... because u contribute a lot to it..

The 2018 course material is available here: cs007.blog/2018/09/28/cs-…

'I'm not anti-homeownership... I'm anti believing the propaganda that it's always a great financial decision...'

Here's a thread on his last book/memoir before he died in January 2019:

evernote.com/shard/s106/sh/…

bogleheads.org/forum/viewtopi…

This epic post by @DanielleMorrill embodies the importance of owing a piece of a business (in her case, being an early @twilio employee), as well as to own your life instead of letting outside forces own it.

daniellemorrill.com/2019/08/reflec…

* @onepeloton: 3TWTMH

* @Wealthfront: wlth.fr/17Hvrzr

* @Betterment: betterment.com/?referral_key=…

* @fundrise: fundrise.com/r/z8rgr

* @CashApp: cash.me/app/BSPKGTC

* @get_pei: 9jy4mv

@mflaxman has you covered. His epic post covers many of the same topics + more (investing, taxes, asset classes, robos, psychology, timing, credit cards, life insurance...)

This 1 from Semper Augustus is 🔥

“Mistakes in life and in investing make you better, particularly if you force yourself to learn from them... Hard work makes you better, but it only allows you to keep up.”

static.fmgsuite.com/media/document…

We did a destination & it was significantly cheaper 👰🌴

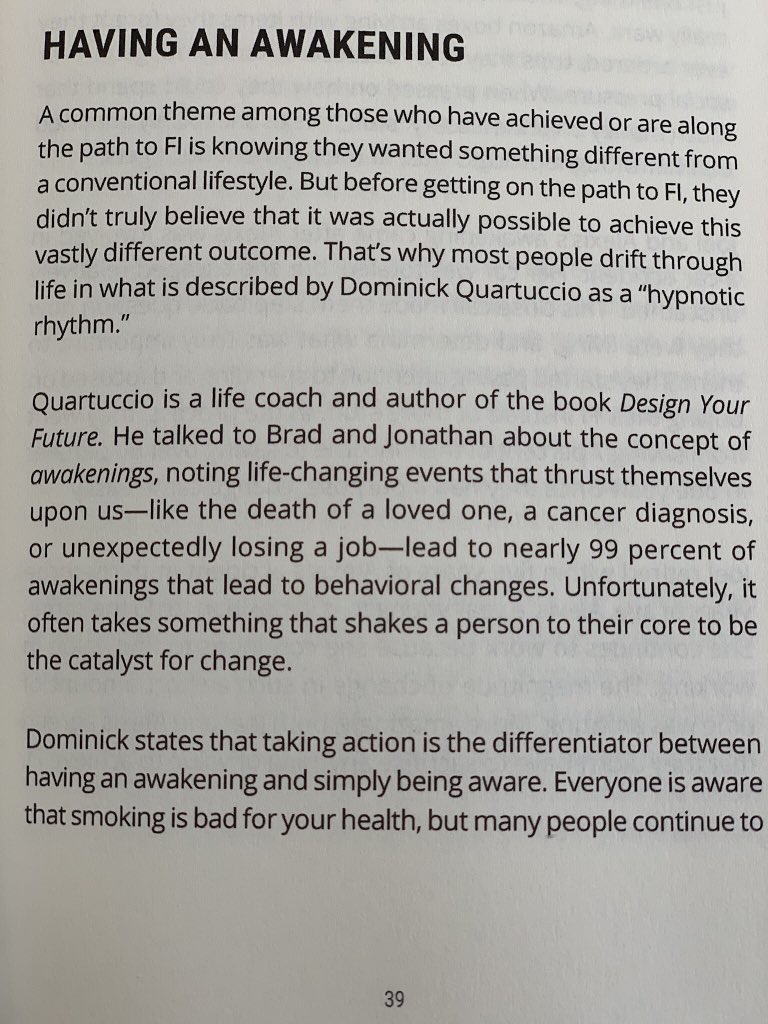

A recent episode recommended a new book called @ChooseFi by @caniretire_yet. Typical ultra-frugal FIRE’rs arent for me but it was actually really enjoyable.

Have u had an awakening yet?

amazon.com/Choose-FI-Blue…

@MyKindur at a glance seems like a great resource if it actually works as advertised.