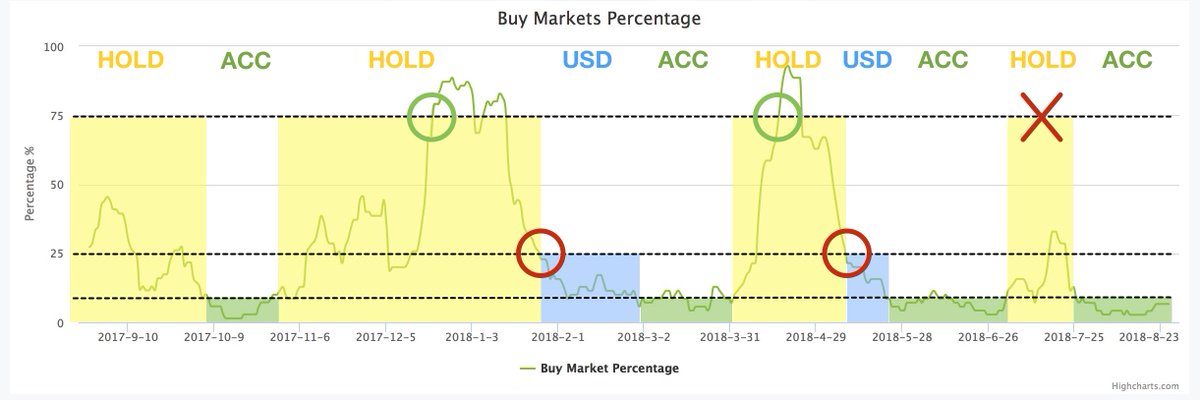

Use turtlebc buy market percentage signal: turtlebc.com/tools/buy_perc…

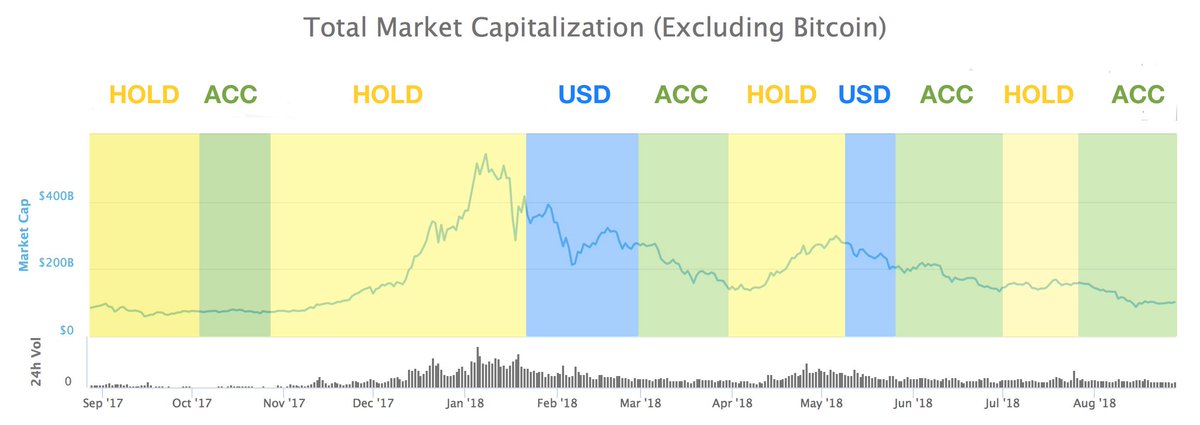

Three phases:

1. ACC: if <10% then alts accumulation

2. HOLD: if >10% hold alts.

3. USD: if <25% sell alts directly to fiat.

USD phase only if >75% during HOLD!

Using a 1h rebalancing on alts should give you better performance than just hodling. An analysis here: hackernoon.com/rebalance-vs-h…

It’s a free tool that can also support this kind of strategy.

⁃during USD phase sell also the passive income alts (clean slate) with goal to rebuy them lower in the next ACC phase

⁃when rewards + cycle profit > initial investment, the MN is allocated to long term freeroll portfolio

⁃sell rewards to fiat

⁃1/4 monthly rewards are invested to non crypto: stocks, silver/gold

⁃if monthly rewards > real life income then reinvest the rest in MNs and other passive income plays

ACC and HOLD phase:

⁃min 10% fiat

⁃min 20% BTC

⁃max 50% alts

⁃max 20% long term passive income

USD phase:

⁃80% FIAT

⁃20% long term passive income

During HOLD phase some swing trading plays are possible with the BTC portfolio allocation with the following rules:

- max 2% portfolio risk

- stop loss mandatory

- R:R >1.5

- max 5 plays at the time

- no margin trading!

1. NVT Signal (by @woonomic and @Kalichkin)

NVT > 150 -> overbought

NVT < 45 -> oversold

charts.woobull.com/bitcoin-nvt-si…

woobull.com/nvt-signal-a-n…

2. BTC retail volume vs overall (by @cryptorae)

tradingview.com/script/zSkZhP1…

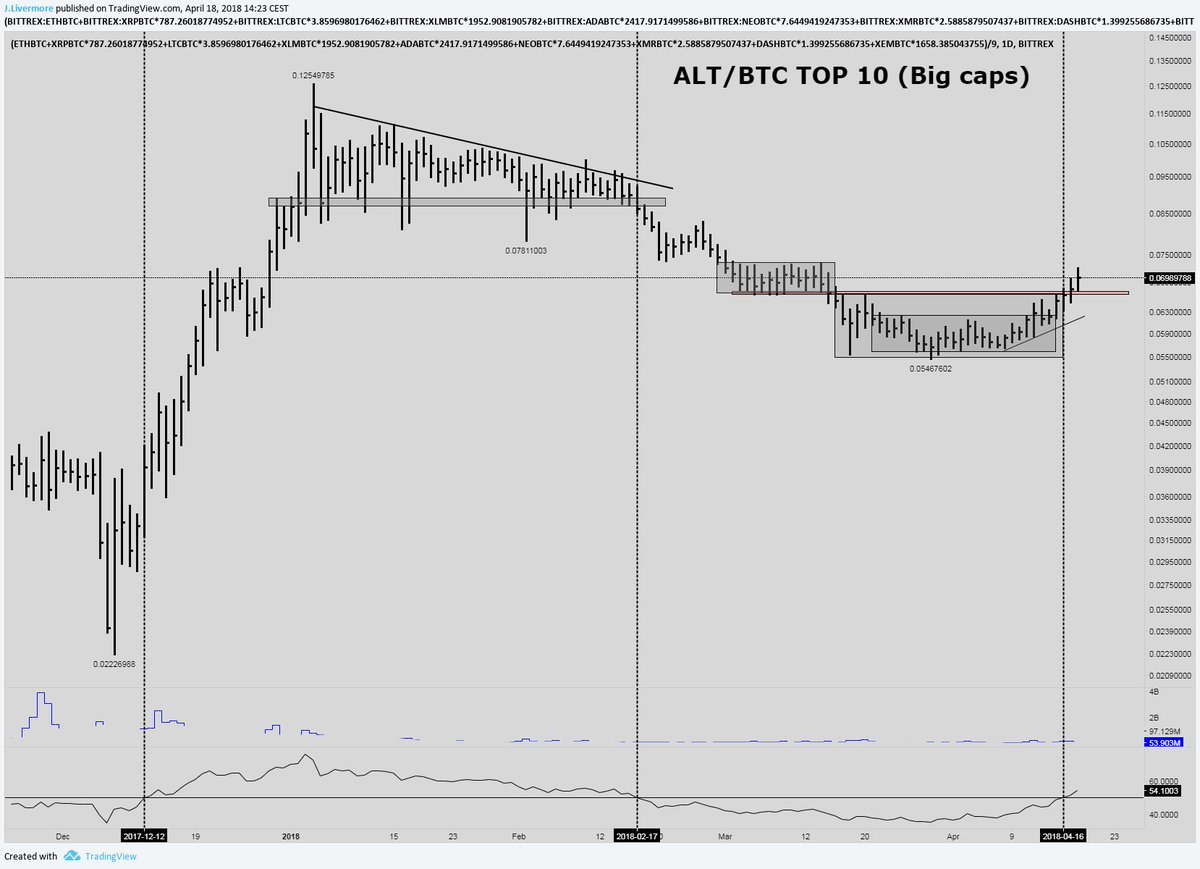

Detecting general macro trend of alts by using HMA50 & HMA80 crosses on 1D

medium.com/@ismailtarim97…

BTC macro view:

- BTC 1D HMA 55/80

- NVT signal

Alts macro view:

- Turtlebc BMP

- Global alts 1D HMA 55/80

Actions:

- ACC: look for alts: charts + CT

- HOLD: alt swings (CT/discord) + 4h EMA 30/60

- USD: switch between USD/BTC: HMA 55/80 + CT

I will soon aggregate the results in a strategy workflow.

Adding alts to the mix can further improve the strategy by 50%

The graph is generated using only Poloniex pairs, so it could be now a bit more conservative/lagging because the real action is on Binance.

But alts are highly correlated so I don’t think it’s a bit issue.