The majority of charts shared on twitter are setups, entries, or patterns. Exits and selling after original update are rarely discussed outside of "boom this moved 'x' %"

Should you take profit, or hodl for 2x?

This is one part of the trade - the entry, buying, taking the risk

With a blend of basic TA and common sense, you too can find an alt entry

The second part, determining an exit, is the bigger (and less discussed) question.

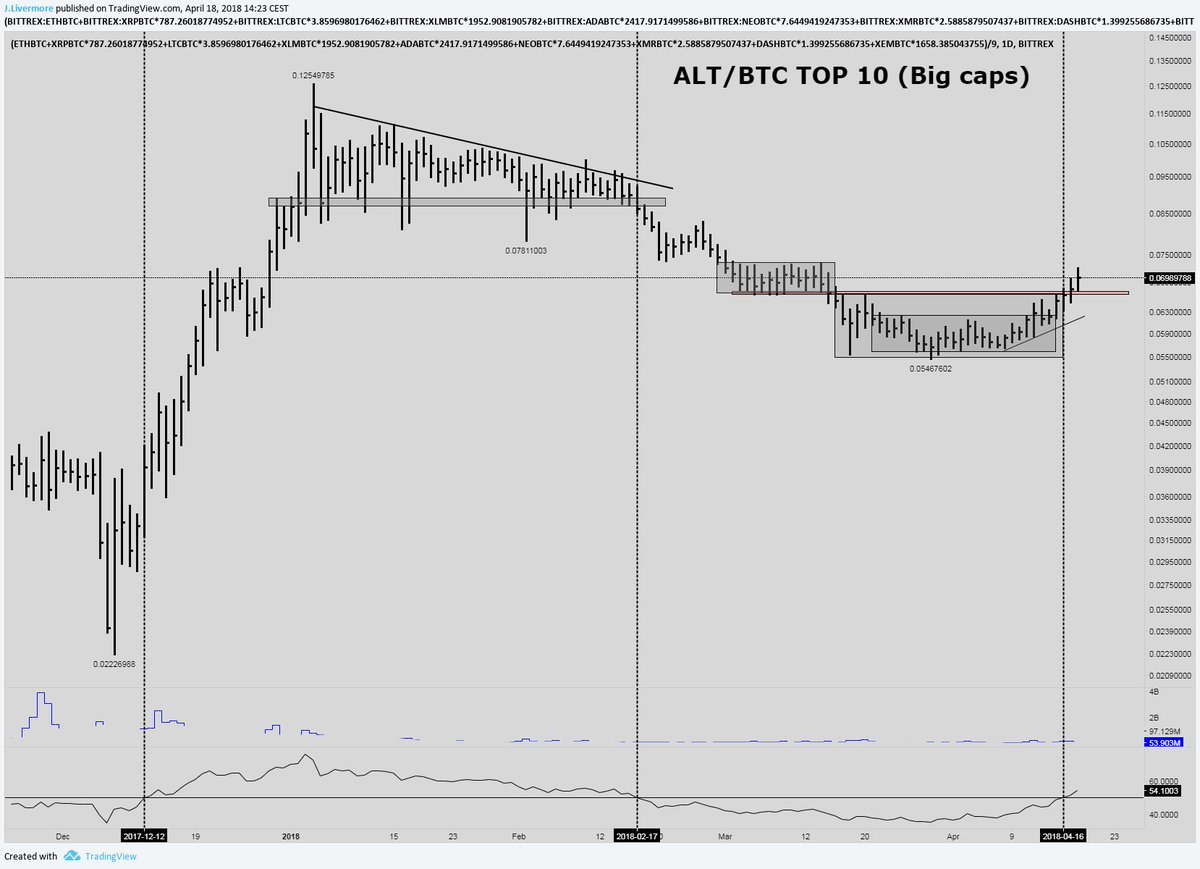

> Majority of top 200 mkt cap coins (most traded/liquid) are up 20-50% in last 30 days. *obviously some outliers down slightly or up more than 50%*

> Biggest 1 day movers are typically 30-40%, and then retrace

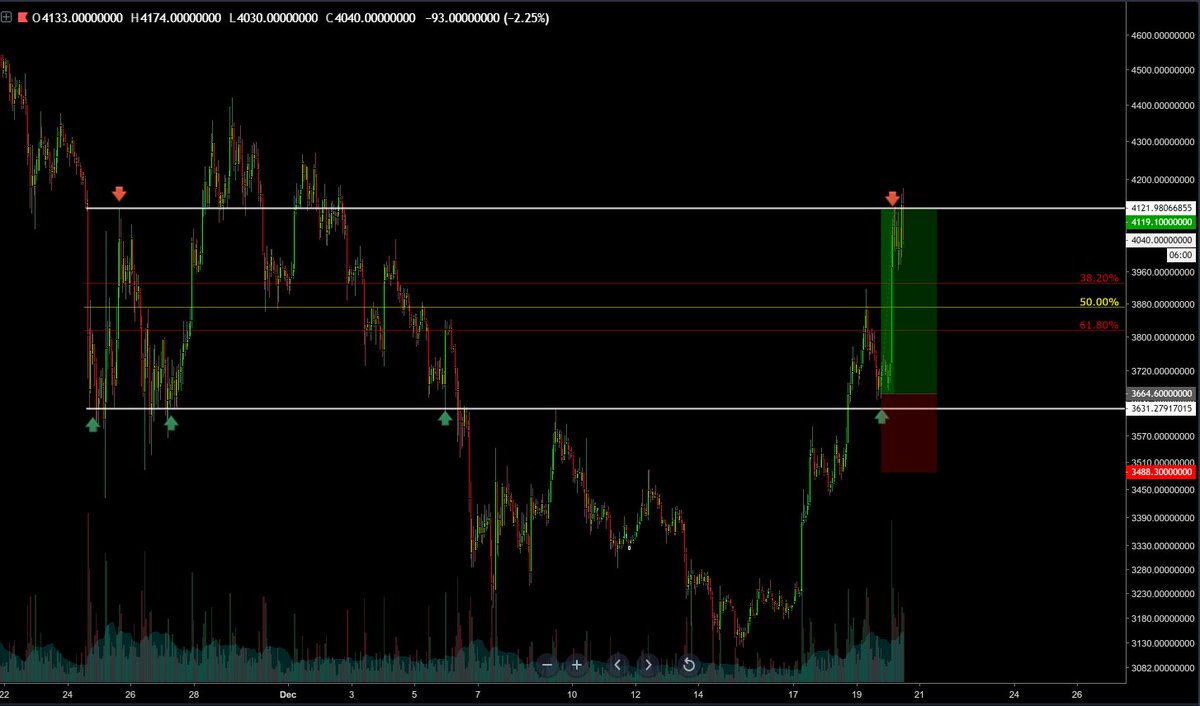

-> examples and charts below so you can decide for yourself...

This means hodling alt trades longer, looking for 2x gains, laughing at 20% plebs, and not getting in way of uptrend.

Why?

- Reducing risk if positive momentum stops

- If alts prove me wrong and keep running, almost always chance to get back in at same rate or lower

-Could miss slight upside for a few/handful of first alt trades of a cycle

If alts start to prove it wrong, adjustment is very easy. Can simply hold remaining/new alt plays longer. Other than

Based on my poll most havn't taken 1 profit. Comment any thoughts below!