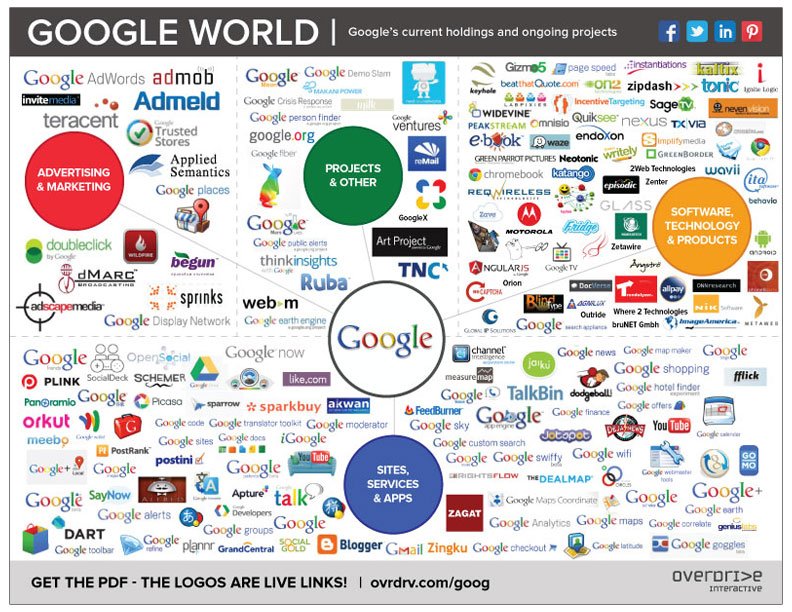

2001-2018: Google has been buying 1 firm per month, every month, for the past 17 years. 1/

en.wikipedia.org/wiki/List_of_m…

Proposals (non exclusive):

-Thresholds based on turnover work ok for mature industries, not for digital and pharma for instance. 2/

-“Potential competition” is super important: current “more likely than not” standard is not right.3/

-Use “expected consumer surplus”. Probability of future competition (with large future gains) can be sufficient to optimally block mergers.4/

-Think of forward-looking counterfactuals that differ from the pre-merger equilibrium. 5/

-For superdominant companies: strengthening of dominant position is enough? Can also shift the burden of proof: parties must show efficiencies, else adopt anti-competitive presumption. 6/

-Look at G, but also FB, and MS...

-Super valuable to learn from these studies. 7/