Roku has a unique position in the Streaming or Connected TV (CTV) market. Roku at its core is an operating system for TVs or “platform” that allows average people an easily usable TV interface to access all of their streaming content.

You can’t (very easily). If you have Roku enabled TV, your OS is Roku, to turn it off you either loss functionally or with some TVs it’s just impossible.

Focus: Singular focused companies always have an advantage over multi focus companies

Cost: Roku can be run on cheap hardware

Ease of Use: Roku is super easy to use

Embedded Roku Tv advantage

Ad Revenue/ Data

Subscriptions: Roku gets a perpetual cut from subscriptions purchased on their platform. % of people that buy directly through their platform only growing over time.

On demand Movies/TV

They are a true TV OS platform for CTV. Subscription revenue will scale at high margins. It’s basically perpetual referral fee paid from Direct TV Now or Hulu or other streaming service. Margins should be high.

It really still depends highly on how CTV evolves. Adoption so far has been solid, in part due to ease of use and low cost, but that could change.

•Competition is fierce, but not as Focused.

•Reveneue scale still early, margins and pace may be lower especially with Ads/Data

•Consumer preferences may change

•They may try to build too much content themselves eroding margins

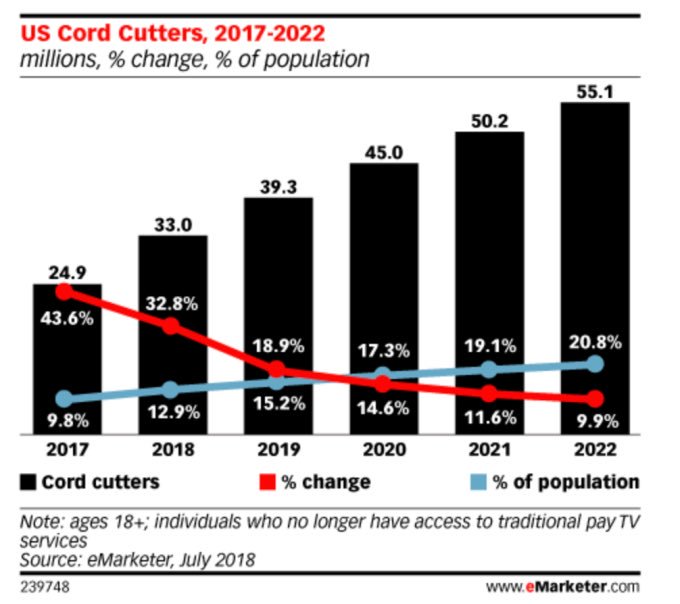

•Adoption continues to grow.

•Platform revenues really starts to scale, specially ad revenue and subscriptions

•Mgmt is long term focused and will make good long term decisions

•Additional TV manufacturer partnerships

•M&A target