1) investing for the long-run (time & compounding are your best friends).

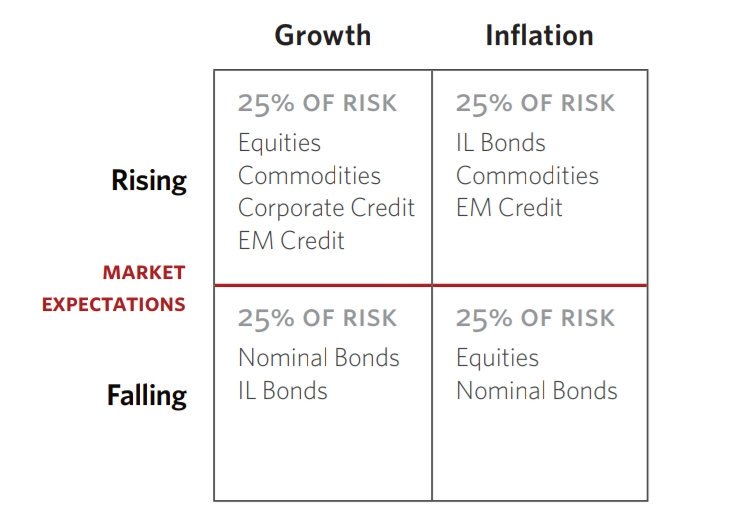

2) asset allocation (diversification > all your eggs in one basket).

3) simplicity trumps complexity.

4) why index funds beat most active strategies (fees/taxes, etc.)...

6) staying the course during market declines, while not easy, is a long-term investor’s best friend (“don’t do something, just stand there”)...

1) Common Sense on Mutual Funds, amazon.com/gp/product/047…

2)The Little Book of Common Sense Investing,

amazon.com/gp/product/111…

3) @ritholtz 2016 Interview (Masters in Business)

ritholtz.com/2016/03/mib-ja…