Instead, we explore the dynamics of the 17-18 boom, fitting ICOs into the broader picture of $BTC & altcoin market cycles.

ICO data courtesy of the @coindesk ICO Tracker.

coindesk.com/ico-tracker

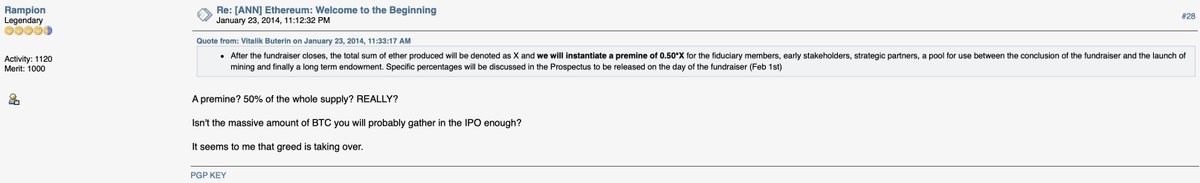

This was a time of extreme skepticism to anything that wasn't Bitcoin.

$BTC "Old Money" branded pre-mines as scams-by-default & any successful launch was typically a fair launch PoW or low valuation ICO.

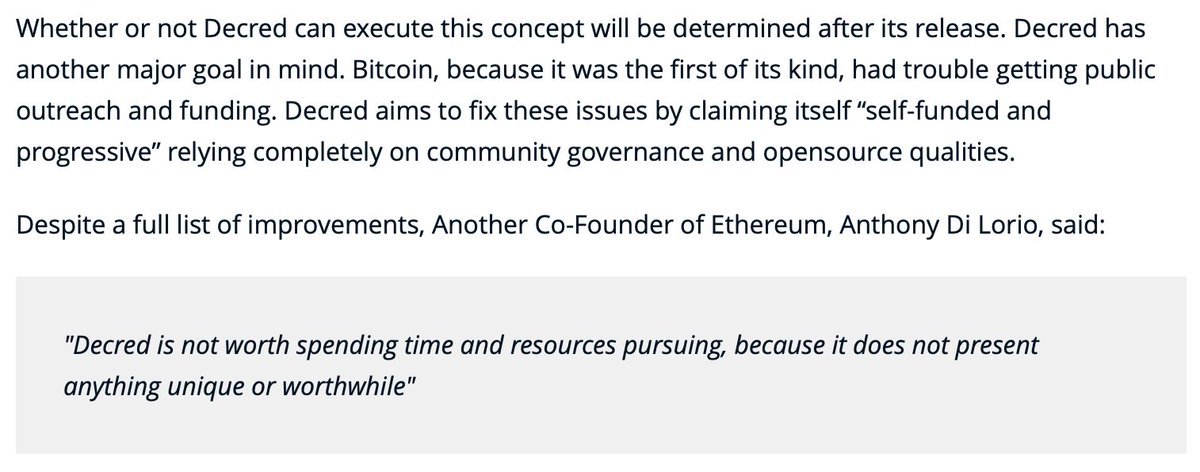

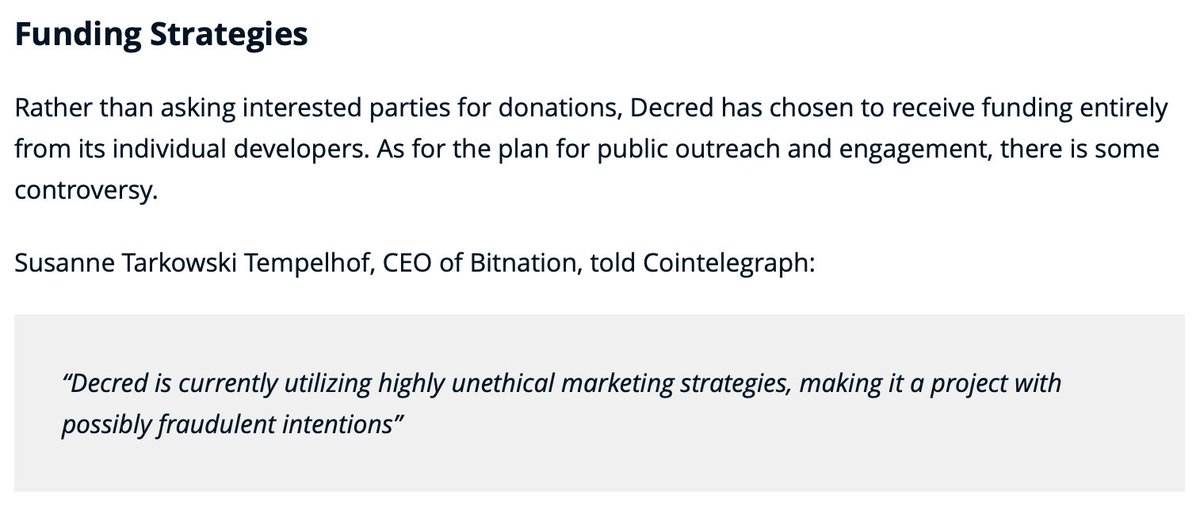

The "legitimate" coins of today - from @VitalikButerin's Ethereum to @cburniske-backed Decred - were viewed as "unethical" & greedy cash grabs.

bitcointalk.org/index.php?topi…

cointelegraph.com/news/decred-an…

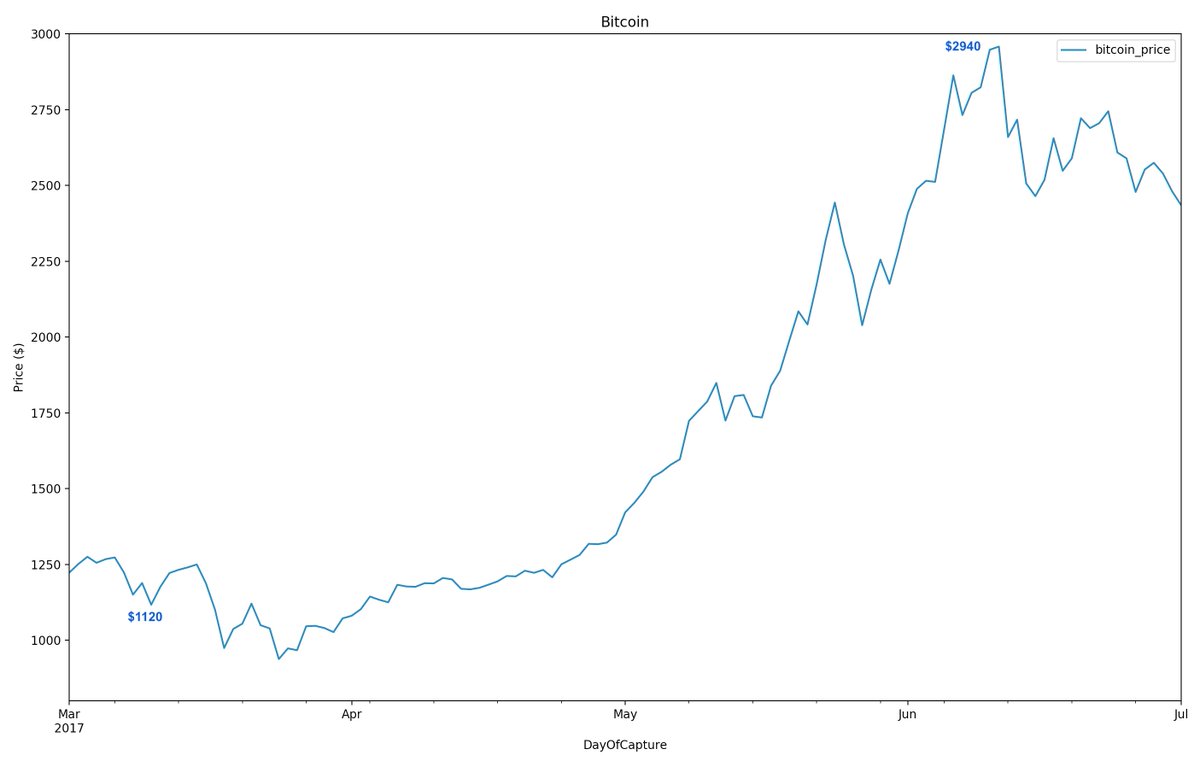

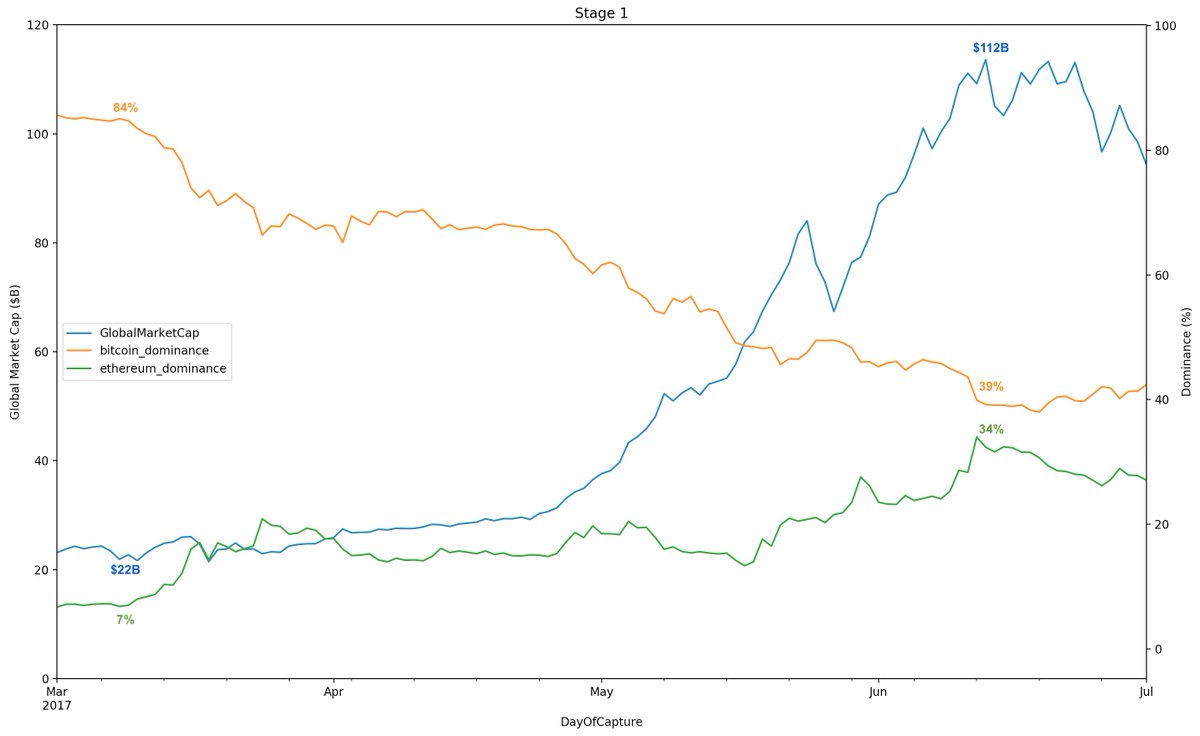

Lead by a resurgence in $BTC, the market slowly began to transition to Stage 1: Exchange-Listed Alt Season.

It was here that retail exuberance began, as traders cleared the orderbooks of promising altcoins.

1) Bitcoin ~2.5x'd

2) Global market capitalization ~5x'd

3) $BTC dominance fell from 84% to 39%

4) $ETH dominance rose from 7% to 34%.

Retail investors posted immense liquid profits - profits that would soon fuel a mania in ICOs.

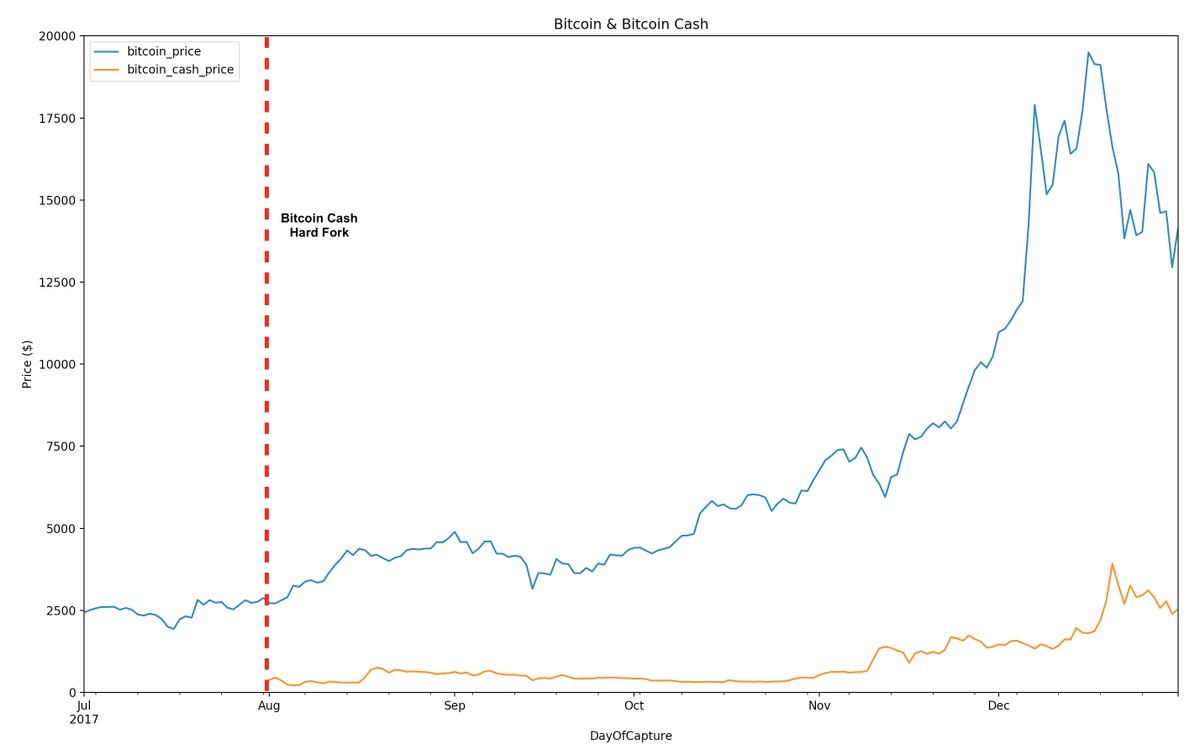

A successful split gave $BTC investors a sigh of relief, with fresh media buzz painting a bright picture for Bitcoin.

Problem: the altcoin market was topping out, as Bitcoin began its 2017 run.

Solution: enter ICO madness.

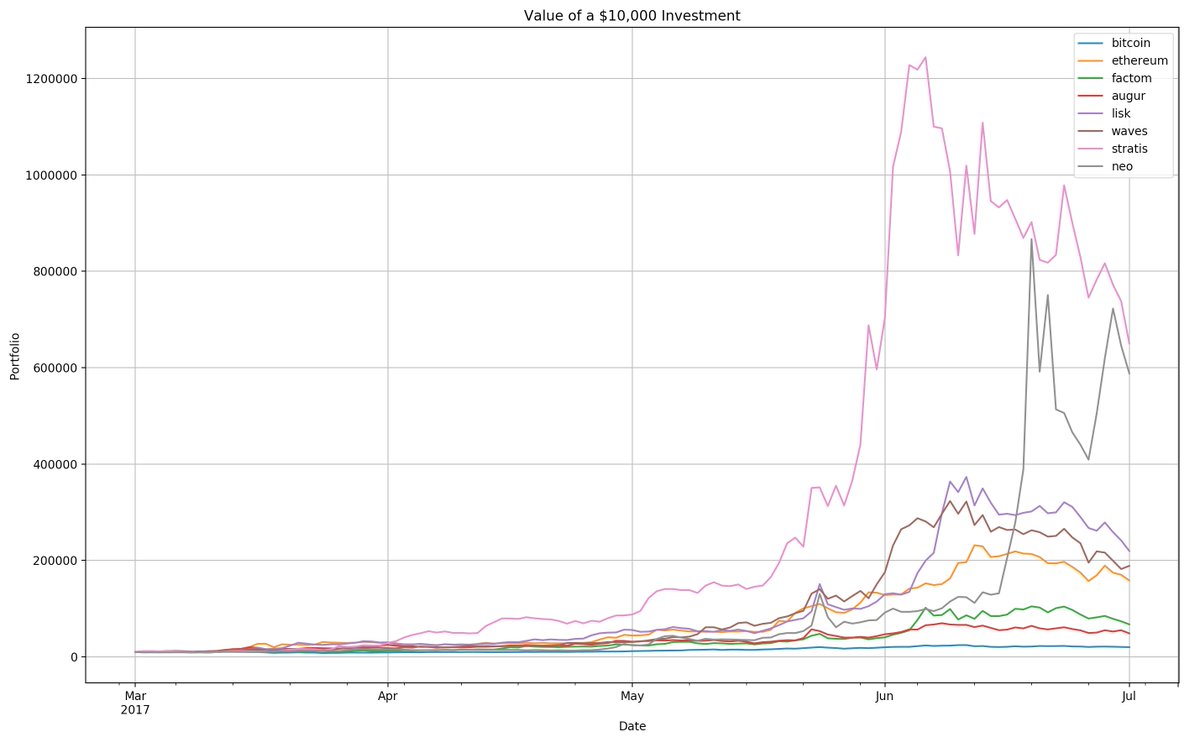

Retail investors searched for the gains of legacy ICOs like $LSK & $STRAT, and the market responded in kind.

The ICO boom was in full swing, as influencers gained overnight notoriety & broadcast the formula for a 10x ("token metrics").

During Stage 2, a back-of-the-napkin plan to build a "new blockchain" guaranteed at least $20M.

Double it if you mentioned "the unbanked".

It was a goldrush, with no time for skeptics.

Retail DD amounted to a quick skim of the website & influencer spreadsheets (or Spreadsheet Aggregators, as they would emerge).

The (relatively) small private sales of this period had a positive effect, as communities were larger & coin supplies were well distributed.

As $BTC came crashing down from its $20k ATH, public sales began to cool down.

However, retail FOMO was simply the beginning of the ICO: Institutional Money was now determined to get its slice.

At the same time, cryptographers & academics realized they could finally have their work funded after decades of esoteric research.

This created the perfect storm for Stage 3: the "Professor Coin Era".

What this meant in practice: academic cryptographers became the rockstars of crypto, raising unicorns out of the gate.

1) Contrasting Stage 2, almost all Professor Coin money was raised in multiple private sale rounds

2) Each round commanded higher valuations ("up rounds" from traditional VC)

4) Lockups increased in line with a long-term VC approach.

This time, it wasn't about influencer spreadsheets, but "who was in".

Scalable blockchains abound, the only way to differentiate your Professor Coin was to get the best brands to back you.

The rest would follow.

VC exuberance was at an ATH: even as $BTC tanked, crypto conferences remained exciting opportunities for deal flow.

Primary & secondary markets continued to lag.

Until they didn't.

And then, there was a rush to the door.

This time, it wasn't a race for gold, but a rush to offload SAFTs pre-TGE.

The party was over.

Once smart money realized this, it no longer mattered how many academic papers founder X had written - alpha was drying up.

Projects are struggling to raise & traders are flocking to liquidity.

Institutional investing has shifted towards equity deals in real infrastructure projects & listed "blue chip" cryptoassets.

While the skepticism faded into obscurity during Stage 1, 2 & 3, prominent figures voicing bearishness on alts increasingly dominate the narrative.

Those still left in the market are embracing a new thesis for crypto-investing - one centered around Bitcoin & few unique, value-add altcoins (e.g. $XMR, $DCR).

The market is still early in Stage 4:

1) Hundreds of millions in illiquid tokens are still marked-to-cost despite the collapse in primary demand, delaying inevitable blowups.

blog.bitmex.com/tracking-us-25…

medium.com/dfinity/dfinit…

While raising with a promise for near-term liquidity, they continue to cite concerns about market conditions.

These teams are delaying the inevitable at their project's peril.

It may seem wise in the short term, but it will damage these projects' long-term prospects.

Coins birthed in Stage 4 & Stage 0 who survive the winter & bear the brunt of extreme skepticism tend to significantly outperform in Stage 1.

Few survive, but those that do, flourish.

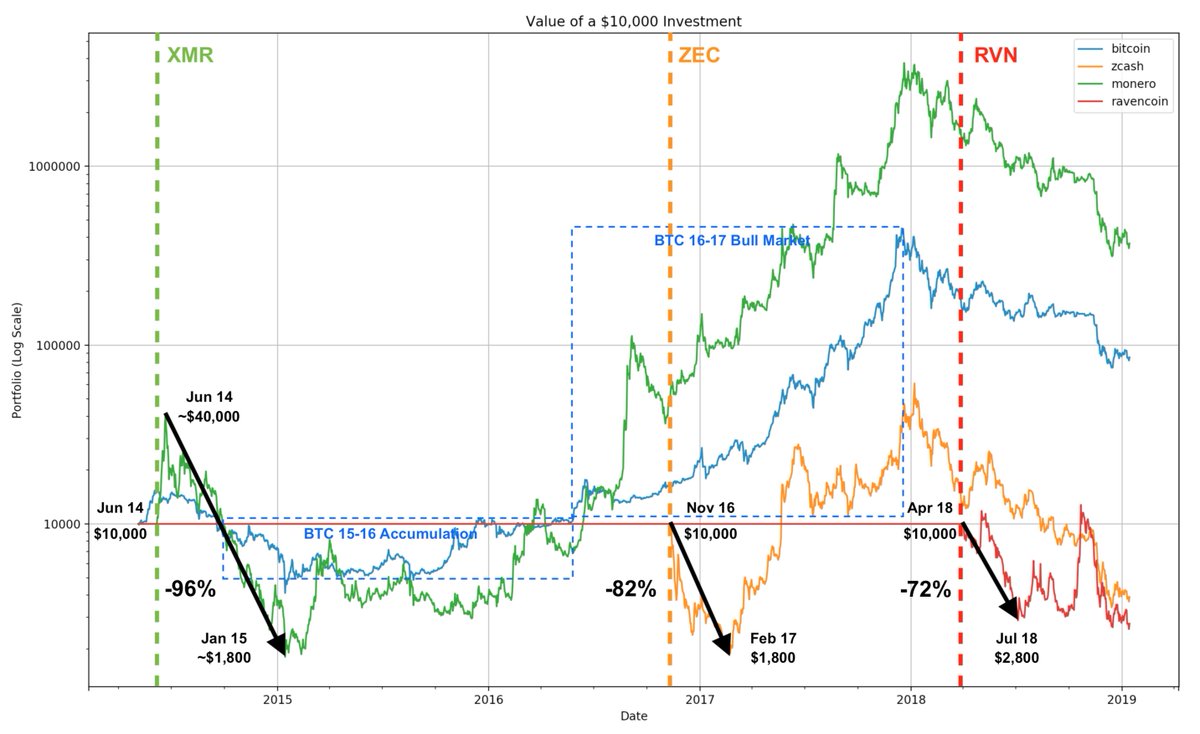

The most promising coins publicly trading in 2016 significantly outperformed $BTC during Stage 1.

The long ICO winter will continue until the 2020 Halvening, when Stage 0 will be in full swing, similar to the 2016 Halvening.

Those that delay MainNet launch & public trading the longest will be the least likely to survive long term.

Will ICOs make a comeback? This remains to be seen & will depend on regulatory developments.

Regardless, there is nothing as certain as individual greed.