On the dawn of @grinMW's MainNet launch, we're witnessing the birth of truly fungible, trustless P2P cash.

Despite the long term promise of $GRIN, short term prospects of fair launch PoW coins are grim.

A case study of $XMR, $ZEC & $RVN.

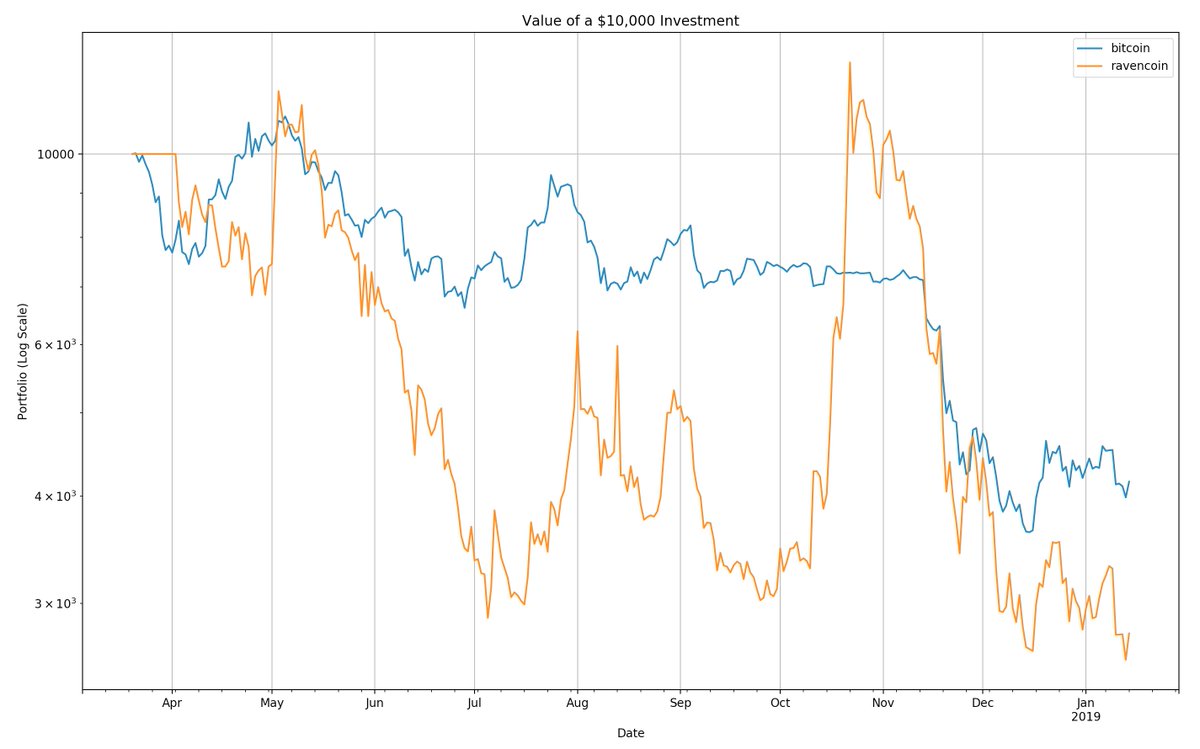

Fortunately for @Ravencoin, it reclaimed its throne on the back of a @binance listing, only to give it all back & make new lows as $BTC broke critical support @ $6,000.

What a shame.

1) Supply -> high tail emission; @grinMW inflation rate is 400% (!) 3 months post-MainNet launch

2) Demand -> function of the market cycle, which leads into the next point.

docs.google.com/spreadsheets/d…

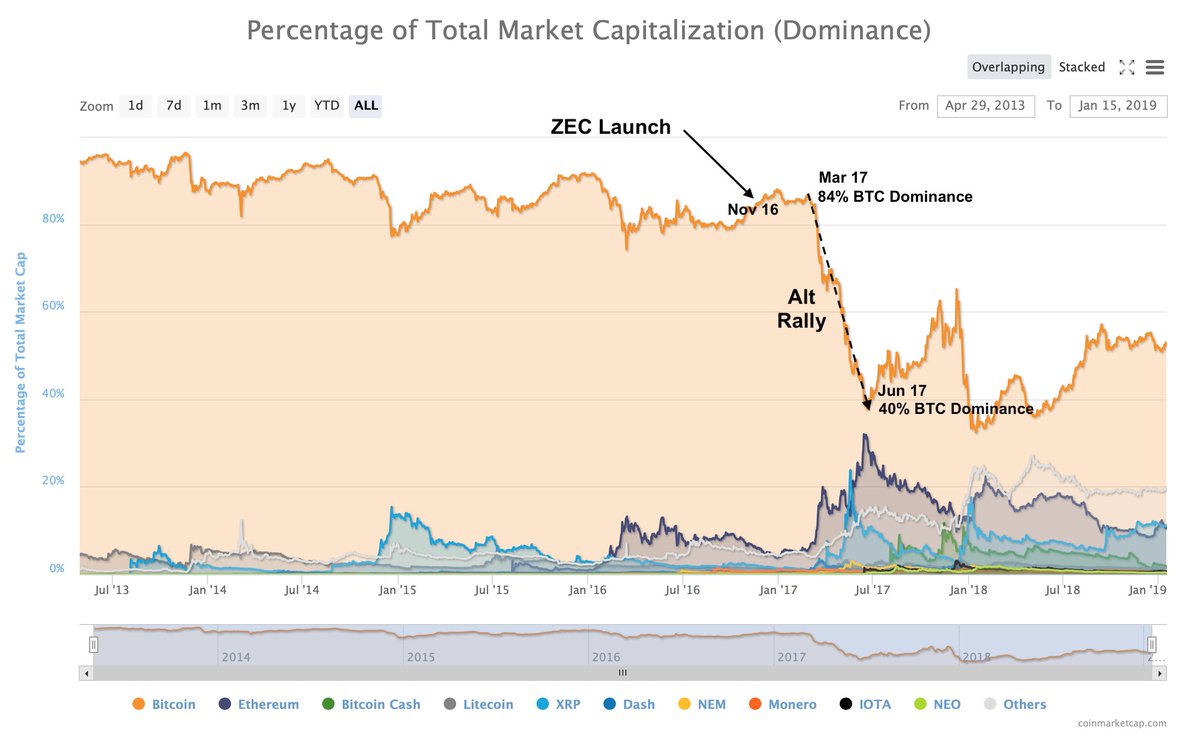

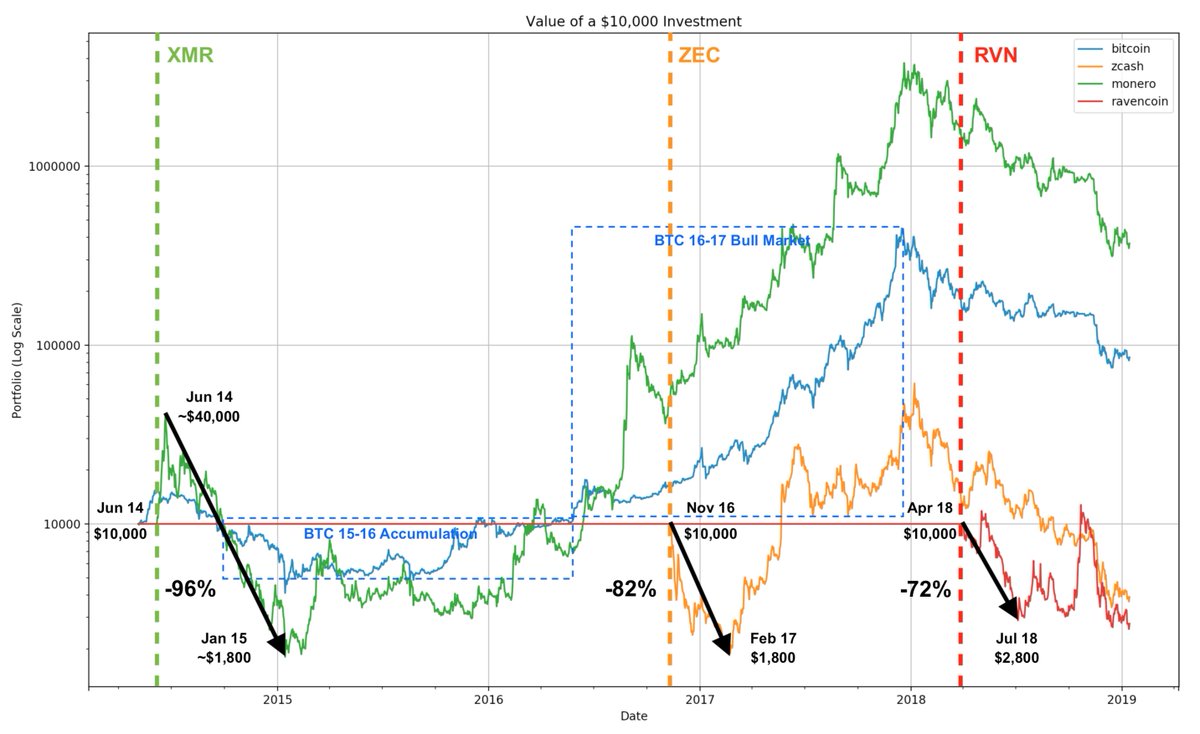

1) $XMR -> tail end of a Bear Market; approaching an Accumulation Range

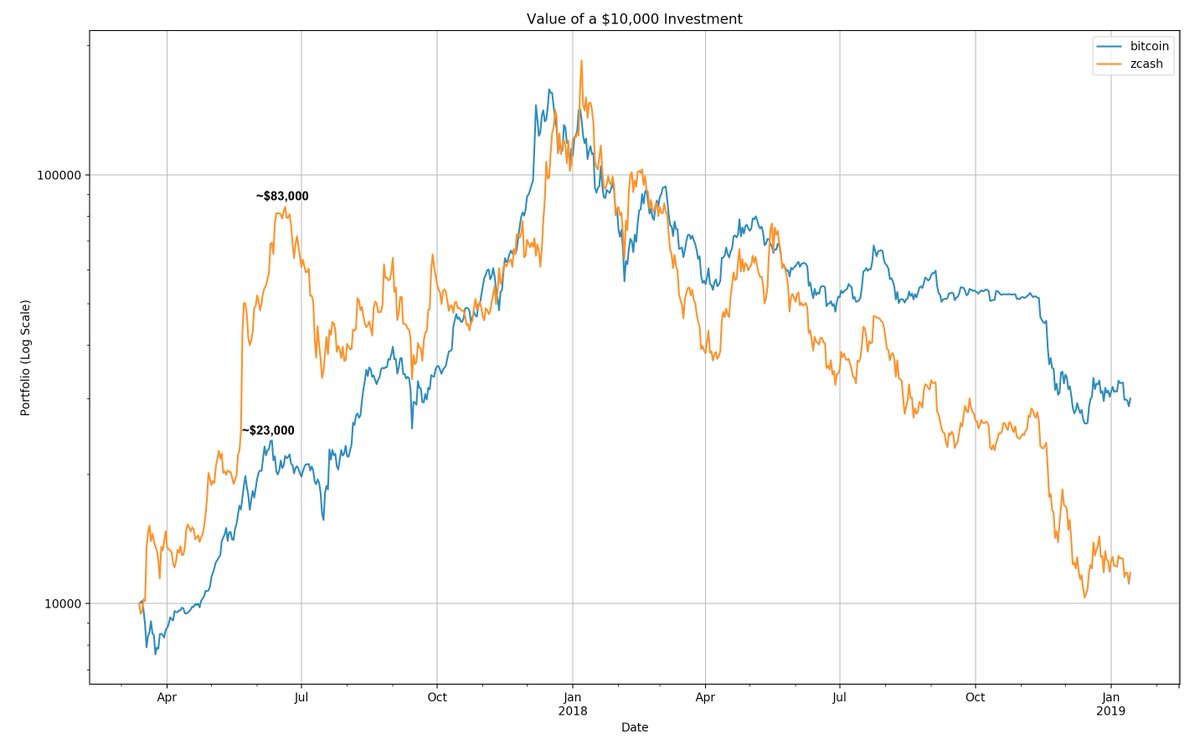

2) $ZEC -> early stages of a Bull Market

3) $RVN -> early stages of a Bear Market.

Regardless of the stage, supply & demand dynamics played out.

According to @MustStopMurad, BTC is currently pre-capitulation & on the brink of an extended Accumulation Range.

This is strikingly similar to market conditions during $XMR's launch back in 2014.

If @monero is anything to go by, $GRIN will - on balance of probabilities - experience a year of unimpressive performance, likely underperforming the $BTC benchmark.

In mid-2016, almost 2 years post-launch.

The $BTC Halvening.

Patience.

$GRIN is one of the most promising networks to launch in a long time, but don't let the hype cloud your judgement.

Given the overwhelming level of institutional interest, especially in SV, there is a non-zero chance of an accelerated bootstrapping phase.

1) Liquidity -> @coinbase comes to mind (backing coinmine.com) & the newly announced galleon.exchange (backed by @arrington)

2) Development -> activist investors like @Layer1Official expanding $GRIN's infrastructure.

Congratulations to the anonymous Ignotus Peverell, John Tromp, @yeastplume & the rest of the contributors on this spectacular achievement.