Part 1: What is economics?

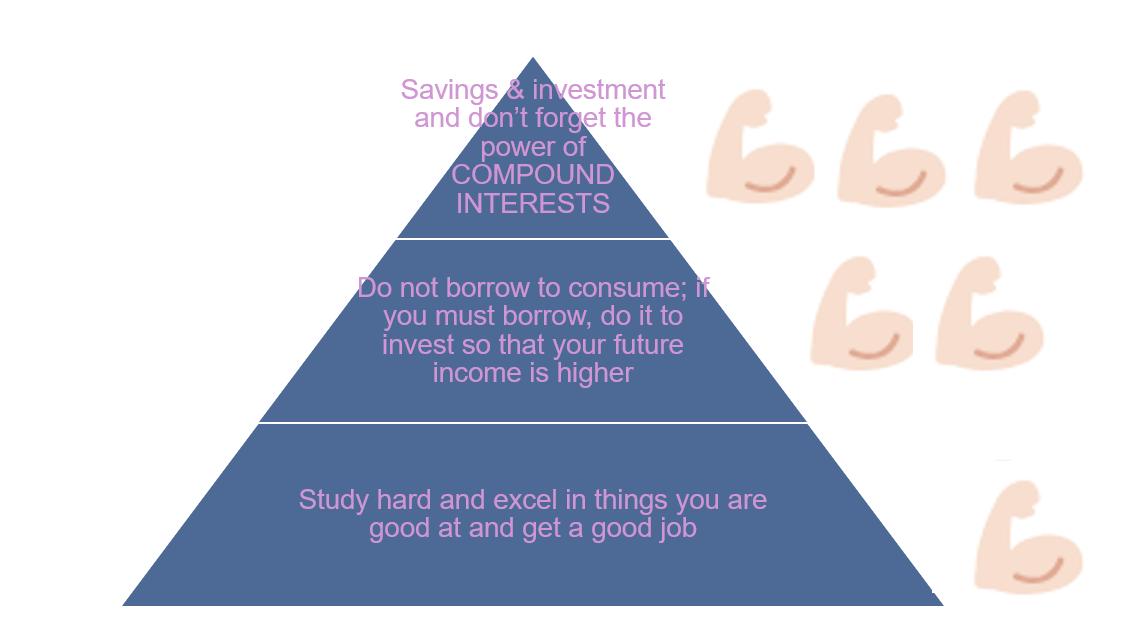

1) Wage matters so study to get a good job/wage & keep pushing for a raise 💪🏻;

2) DO NOT BORROW to consume & only to invest 💪🏻;

3) Save & invest & don't forget compound interests💪🏻

Sincerely,

@Trinhnomics

P.S. And marry well 😍