Systems securing new forms of money and apps.

When comparing blockchains, we should focus on relative security.

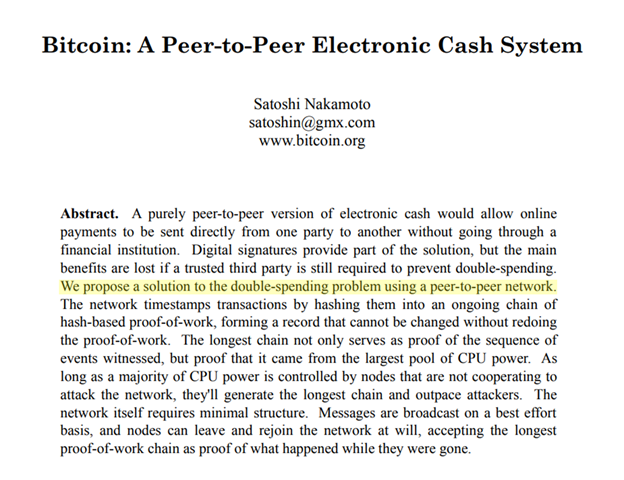

By ‘using PoW to make changes to the ledger difficult’, Satoshi eliminated trust and introduced an external cost for any would-be attacker.

(quote: hackernoon.com/peter-todd-on-…)

As the price of BTC increases, the value of the block reward increases.

As potential rev incs, more hash rate comes online chasing profit.

As the price falls, some mining biz models fall into the red, and more hash moves offline to save costs.

The higher the price, the more expensive to 51% attack the network (buying & staking enough tokens).

Low value chains should not be used w large amts of wealth or valuable apps.

Billions of $ should not be secured on a system that I can break w millions of $.

The value of any wealth stored should be compared to the attack cost.

For ‘low value use cases’, perhaps the security model is less important.

If I was going to bet > $1m tho, I would be extremely conscious of risk.

The chain’s security model, the dapps code, the miners, etc. are all threats to my wager.

I actually wish more small & insecure networks were attacked to accelerate this awareness.

The increased price will lead to increased security.

From there, eventually usage, liquidity, & network efforts will compound on each other.

Sidechains, layer 2 systems, etc. will make the ‘differentiating features’ of alternate chains less & less relevant.

1 most valuable & thus secure chain would accumulate ~ all wealth & valuable apps.

A less valuable chain secured by both PoW & PoS could be much more expensive to 51% attack than a more valuable chain secured by 1 or the other.

Or will we see several security models & at least somewhat valuable chains?

Will we have 1 leading hybrid PoW & PoS chain that dwarfs the security of either?

Perhaps this chain could host more ‘low value use cases’ where decentralization is not as important as something like speed or fees (for ex. a gambling dapp with a very low bet limit).