Brussels-based #knowledgehub & #policy network for #legal, #regulatory & #compliance insights on #Fintech in Europe

How to get URL link on X (Twitter) App

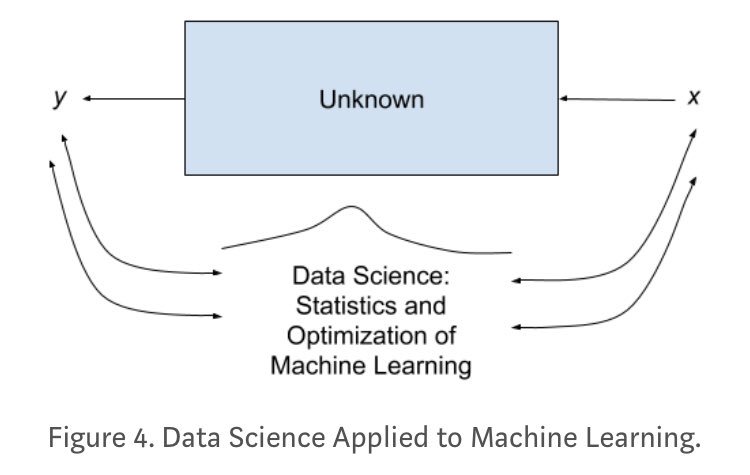

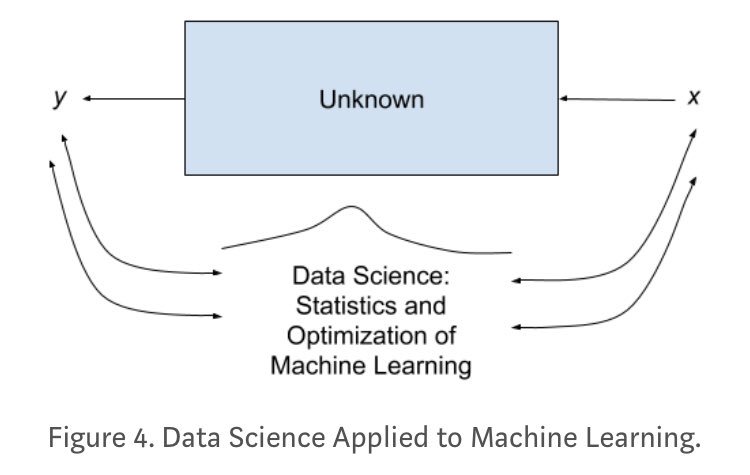

https://twitter.com/irenealdridge/status/11157789213148897281. ☝️🧐➿🔢 In traditional #statistics or #econometrics, researchers make assumptions about #data distributions ahead of the analysis

😇Jitesh Thakkar, the founder and president of Edge Financial Technologies, one of the leading firms for #software development for #algorithmic and #highfrequencytrading #hft, was acquitted on April 9th, 2019 of the count of #conspiracy to commit spoofing.

😇Jitesh Thakkar, the founder and president of Edge Financial Technologies, one of the leading firms for #software development for #algorithmic and #highfrequencytrading #hft, was acquitted on April 9th, 2019 of the count of #conspiracy to commit spoofing.

2018 #income #growth increase:

2018 #income #growth increase:

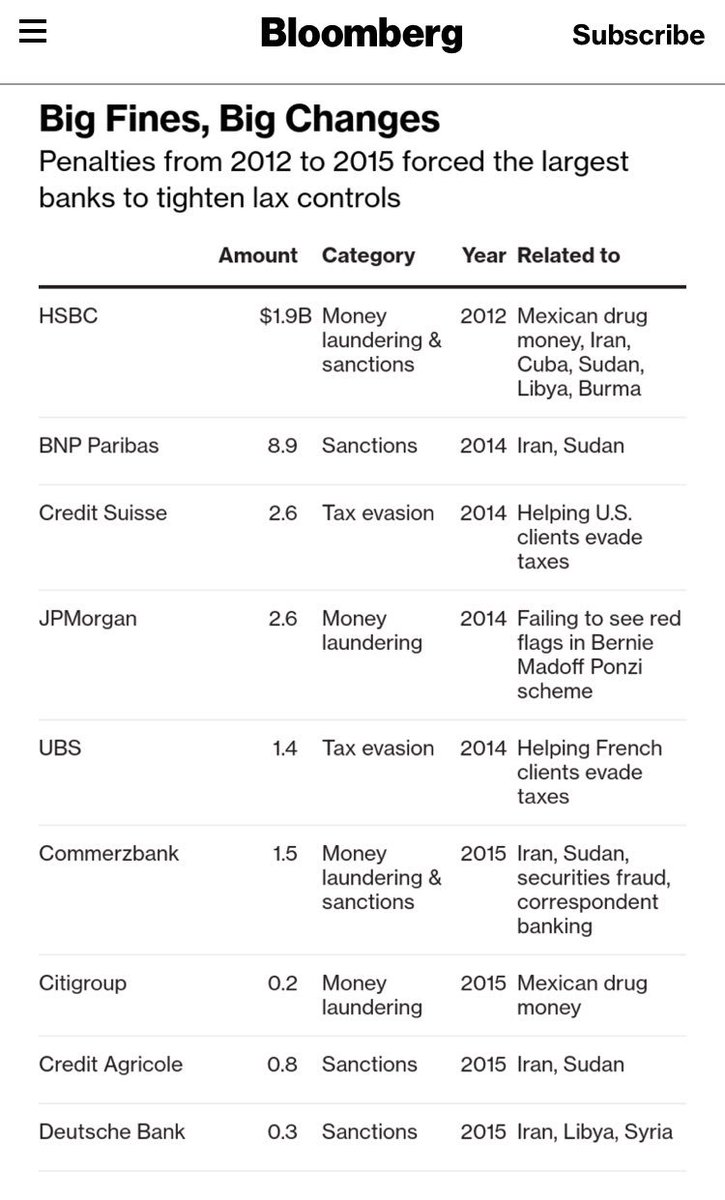

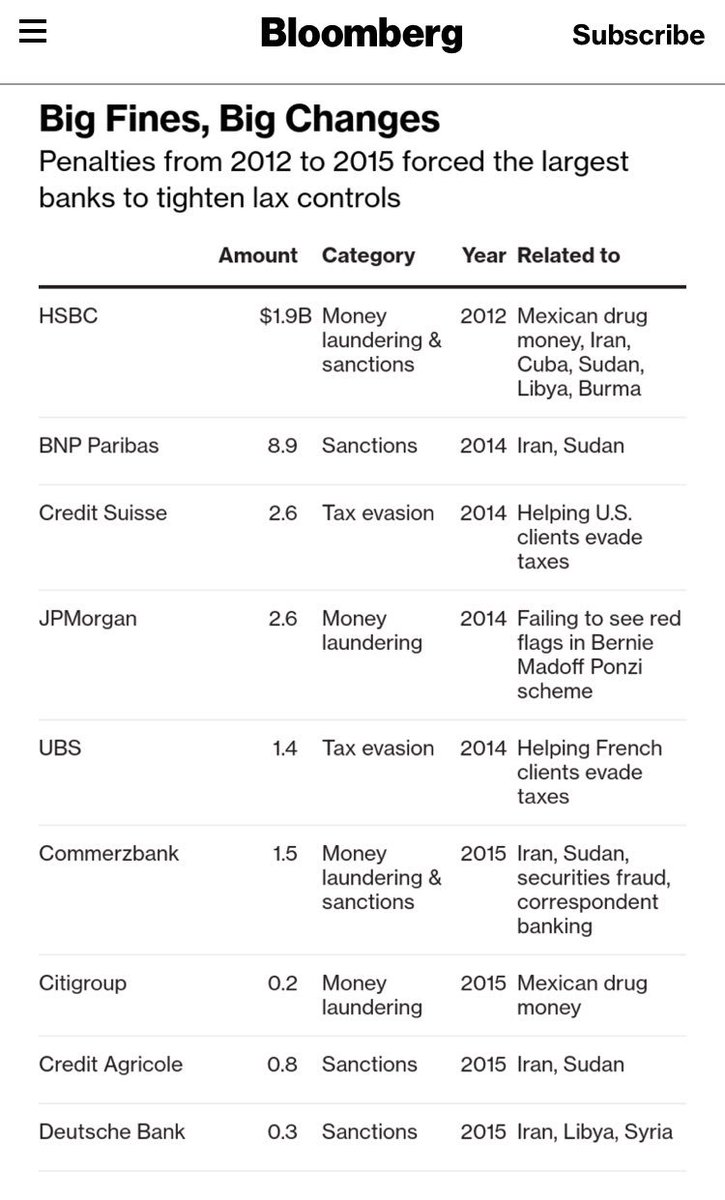

Measures by HSBC

Measures by HSBC