(it's been a while my friends)

Listen in, fellow shorters, just make sure to remain on the good side of the event horizon of this Bag Hole™️

0/

...what could it be?

Website revamp?

Preventing shorties from tracking sales?

Fleet sale?

Elmer Terminal Bagspiracy Theory™️:

Perhaps Tesla is going through an ABL audit or other financial evaluation right now.

$tsla $tslaq

1/

As always, I look forward to input for those less baggy and smarter than myself.

2/

3/

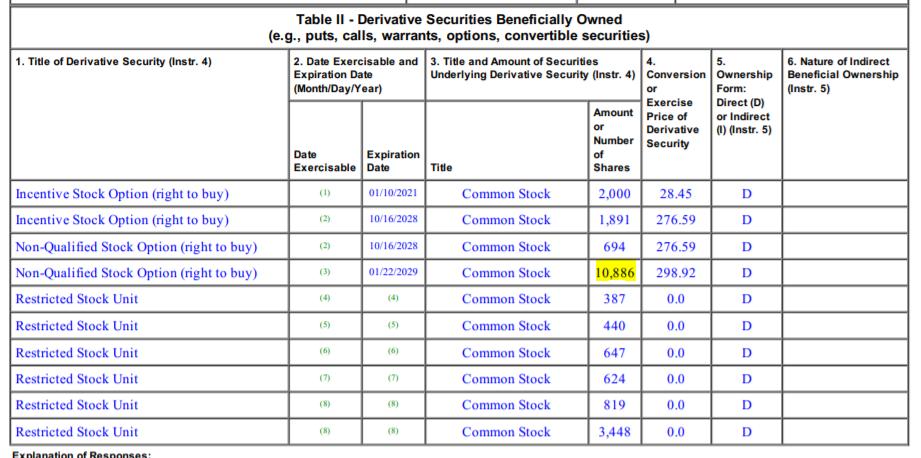

the 10k cars that ended up InTrans @Mar31

15-30k cars deliv. in late month (Elon said 30k deliv. as of Mar 21)

Plus norm. inv.

$tsla $tslaq

6

Tesla has 30, 40, 50, 60k cars in inventory!!!!

And that may have triggered the basis for this evaluation that I am going to purport could be occurring.

7/

$tsla $tslaq

9/

11/

and it is, as i've been tweeting about, the fact that essentially all Tesla inventory listings are no longer available on its website. See thread:

$tsla $tslaq

12/

when you do an inventory count, you cannot have *movement* in inventory, because that leads to inaccuracy. So you basically shut everything down while you count...

15/

16/

A) Tesla has (definitely) pulled customer-facing listings from its website, while (apparently) internal employees can still see the cars but they are marked not for sale

17/

C) They have many reasons why they may have requested one now;

D) Thus, the "locking" of inventory.

Again, this is an admittedly baggy theory, but figured I'd scream it into the void.

$tsla $tslaq

@mndothemath pointed out that this happened right after Q end, which was true. Website started getting washed April 1.

(getting baggy layer deeper) could be that lenders gave green light to sell sell sell thru Mar 31 (need cash), then hit the brakes.

$tslaq

This is definitely the kind of discounting I'd want to see if I'm a lender

teslamotorsclub.com/tmc/threads/en…

$tsla $tslaq

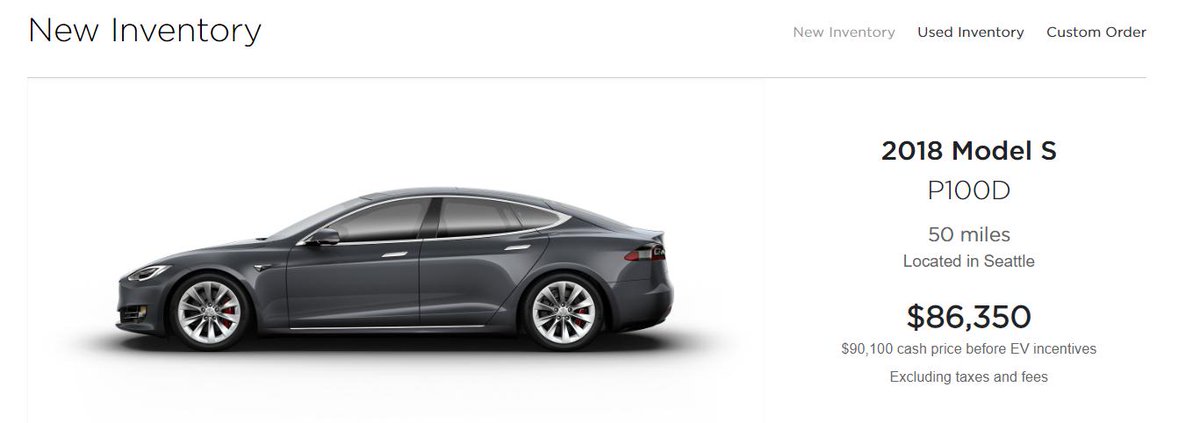

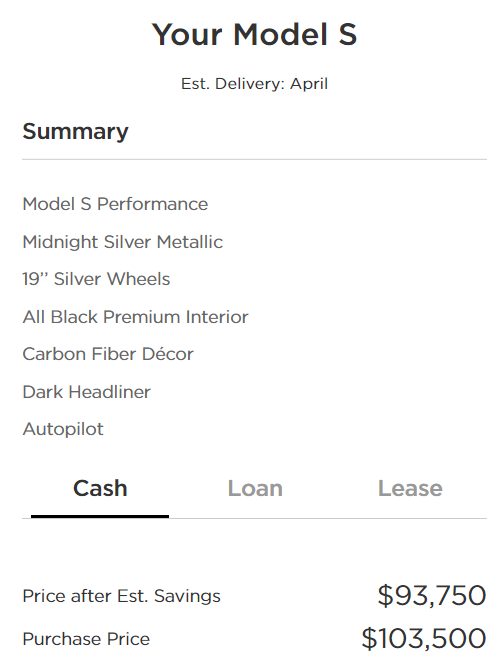

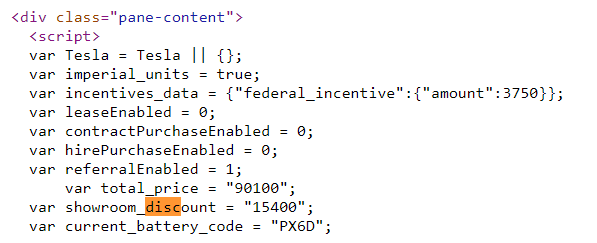

Brand new inventory Model S P100D for $90,100

vs. same build in configurator at $103,500

and a referenced discount of $15k (idk the calc)

$tsla $tslaq