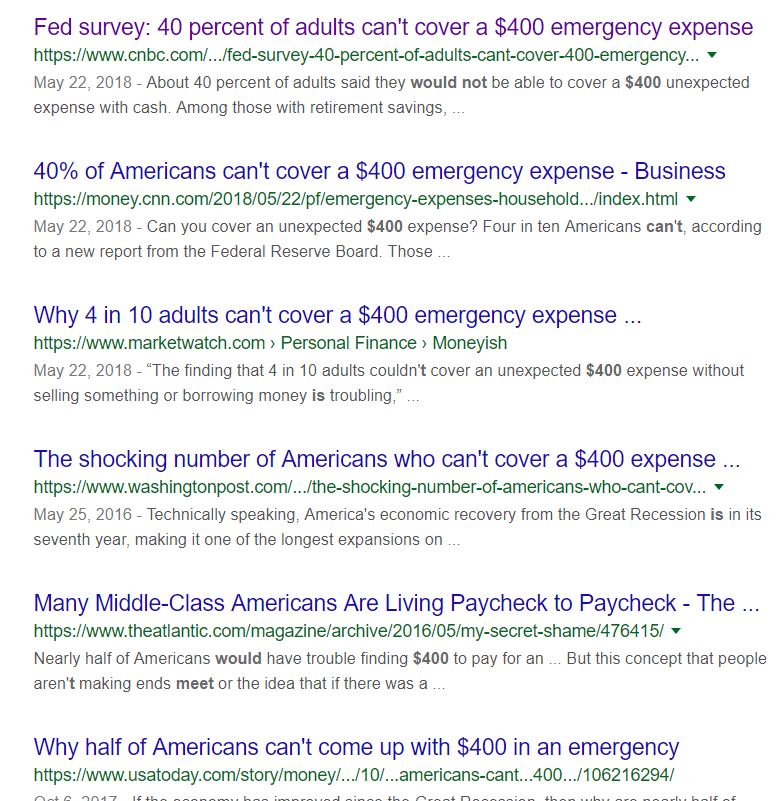

Inspired by @EconTalker to go deeper and question things I read, here is a perfect example of how people cherry pick data to fit their narrative.

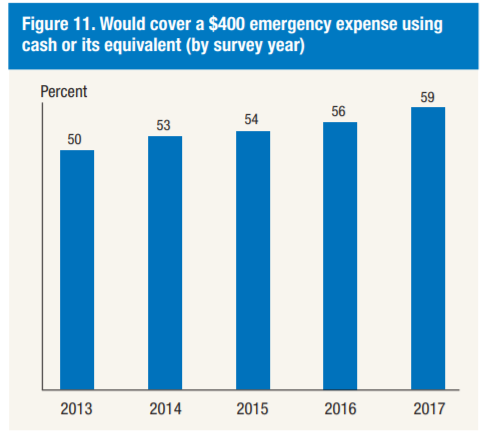

seen in 2013"

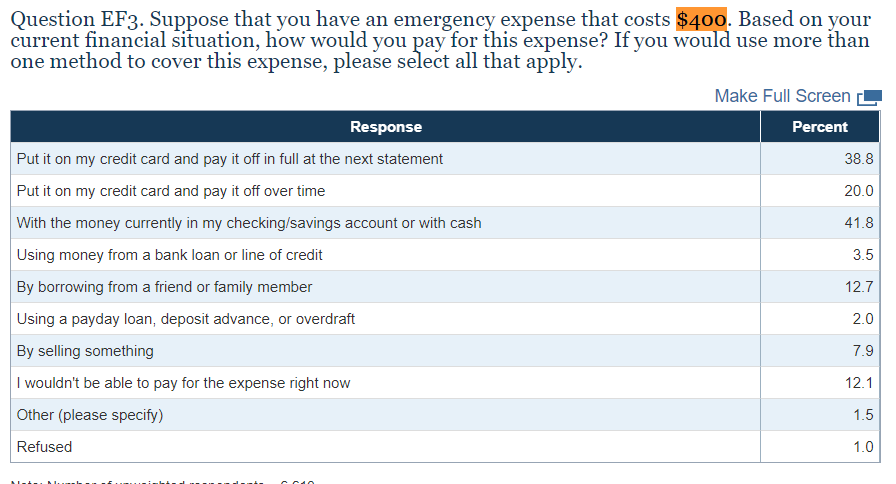

If I were a journalist that wanted to be credible, I'd use this response - 14% - I could see why they used 40% but it seems out of line with the rest of the reports takeaways.