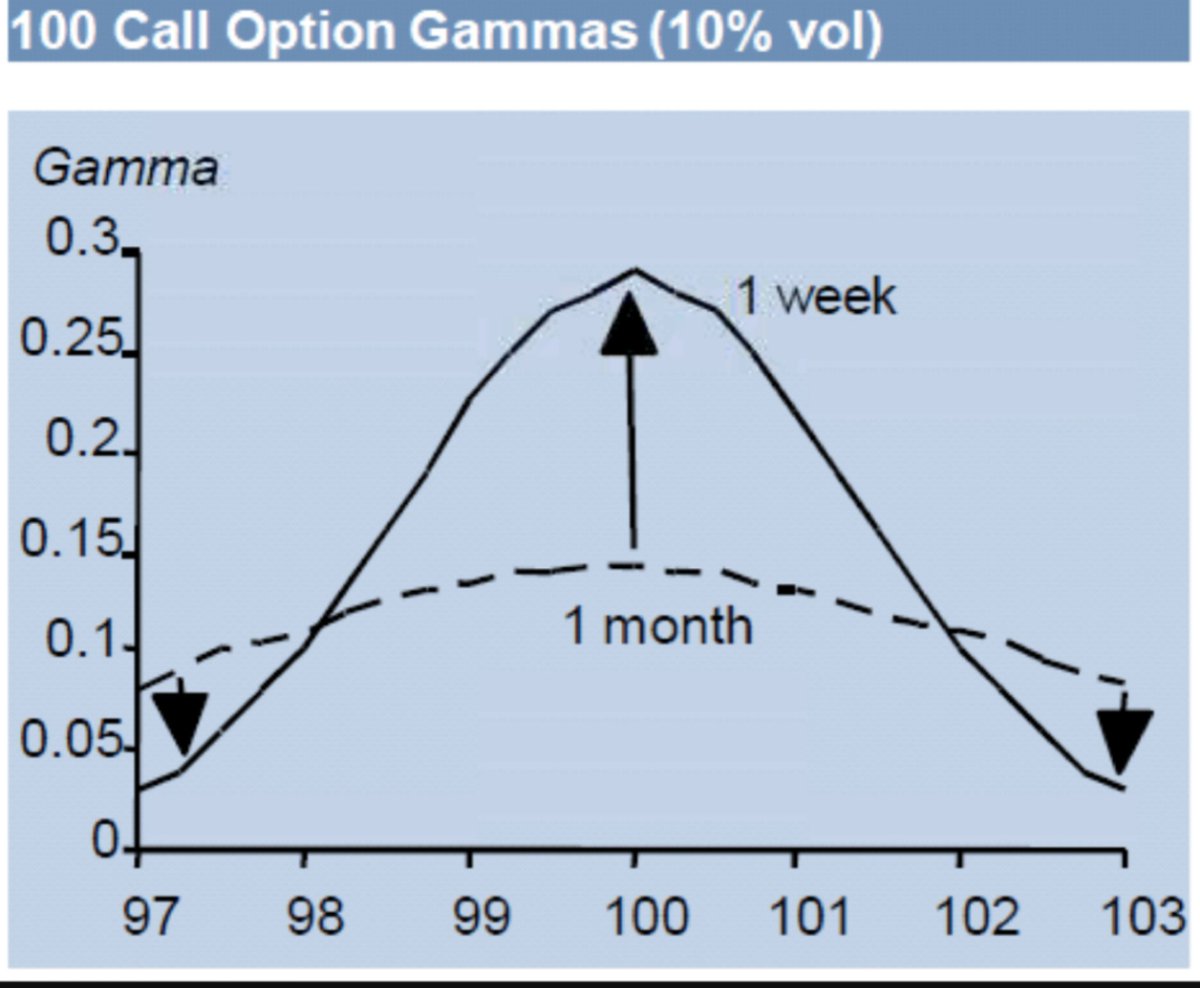

Now another leg, if u just sell option, u have Theta on your side but Gamma and Delta on your opposite. VEGA on your side partly if shorted at high IV, because IV falls down when news/event's gone.

So now spread comes in picture. To minimize option buying cost, Or to hedge Unlimited risk on option selling side. You combine both.

Views are welcome, On a lighter note, retweet for maximum reach are harmful to seminars on options :)