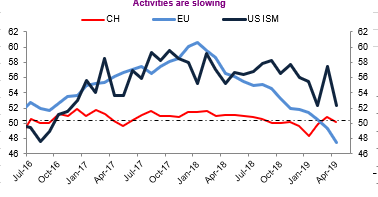

a) How data is collected (so this index & what the components are made of such as firms, sectors, ownership, etc

b) How data moves over time; & usually do the following to study it

a) Eyeball the data using line graph+scatter plot & then study the following stats: mean, median, max, min & standard deviation & outliers

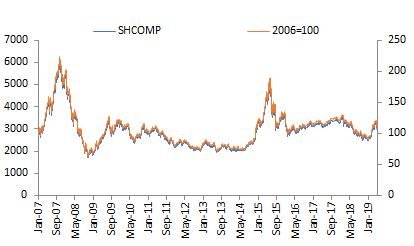

Large # is confusing so people like to rebase

But on 2 June 15, it was up 181 but down to 91 by 2 Jan 2019 😬.

That is called high volatility

a) If I gave u 100 dollars 10yrs ago, wut is it today?

b) What is the mean, max, min, median, standard deviation

c) What is the composition?

Sincerely,

@Trinhnomics