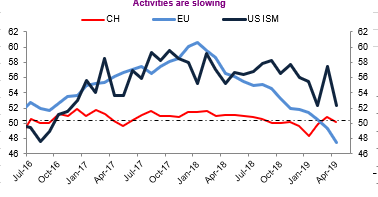

Will China cave? It has called Trump’s bluff before but this time Trump has the strong eco (& Fed holding) behind him🤔

Hanoi unlikely so why the threat?

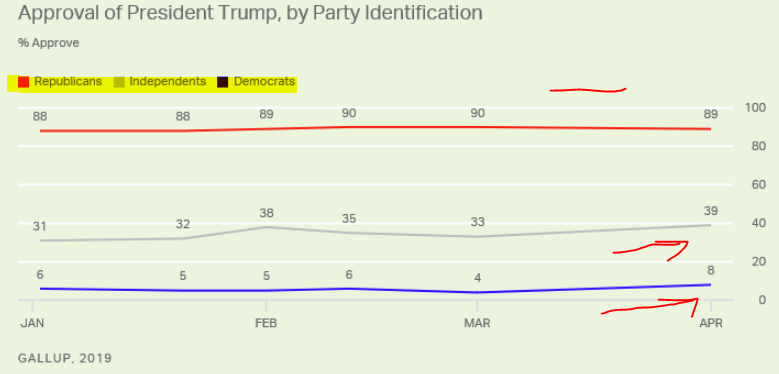

b) Since Trump has gone soft on China, he was criticised & so looking into 2020 want to come out strong on China

c) Meaning, he wants to come across trying his best.

So, what’s next

So w/ NFP strong & JPO holding & approvals up, Trump feels confident to raise the stakes.

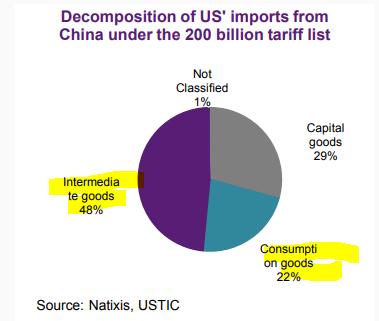

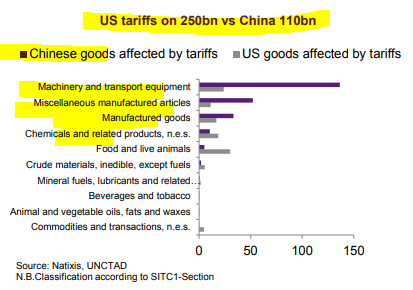

Is it credible?

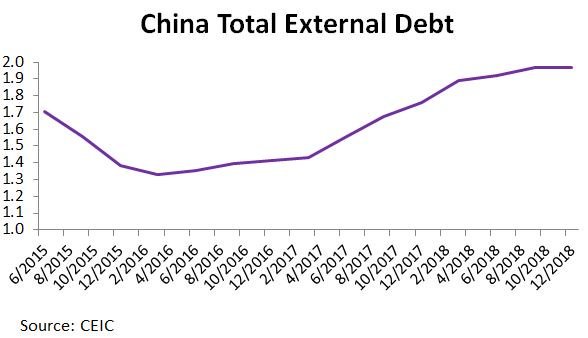

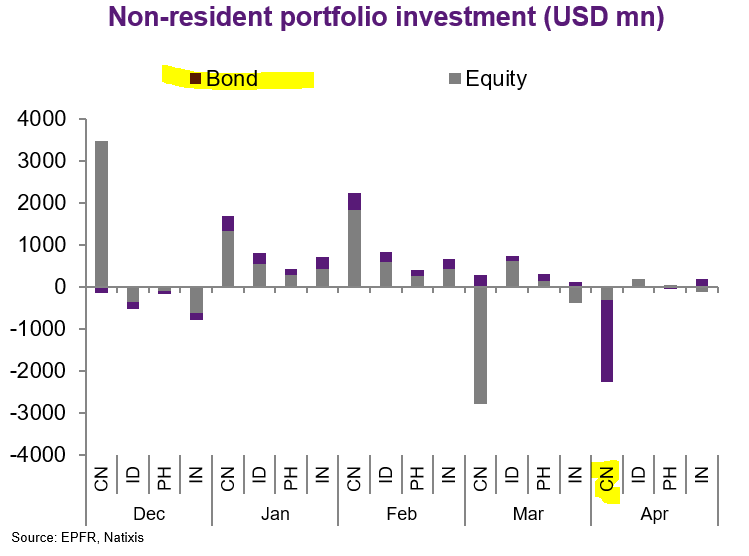

(Yes, if China actually walks away, the tool that it will have to use is the CNY & if that goes, u bet that firms that borrow in USD but earns in CNY will have a hard time😬

Both China & the US are upping the ante & if China walks, the firms that borrowed in USD'll feel the pain 😬

Asia red👇🏻(Japan closed

a) Trump is not serious about tariffs so kicking can

b) Trump is serious about tariffs & China isn't about walking away (so deal coming)

c) Trump is serious about tariffs & China is about to walk away.

Which do you think is most likely? 🧐🤔🤔

So it's China's CHOICE that matters for markets as Trump shows his cards 😬

I have a few ideas...

Yes, this is just an intra-day move 😬😬😬as markets fret option C.

It is among the most volatile equity indices in the world so plenty of up & down but mostly down... 😬

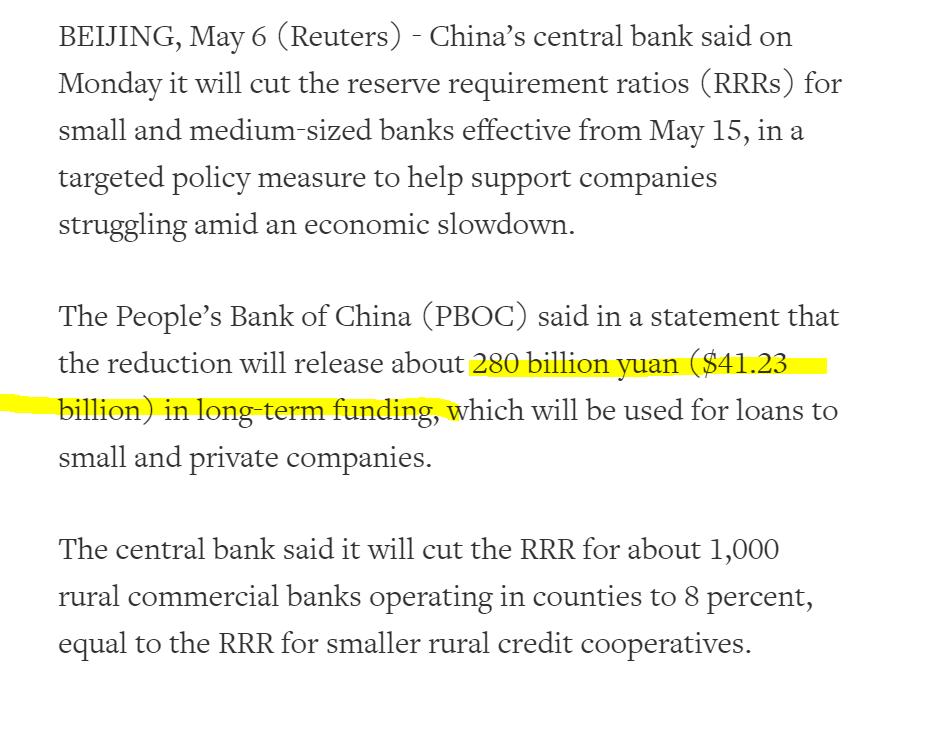

reuters.com/article/us-usa…

China position clear-cut, US knows it well;

China hopes to meet halfway w/ US, reach win-win deal

Declines comment on trade talks timing & Liu He going to the US

Chinese team preparing to travel to the US for talks

Opposes US actions in South China Sea & 5G