Let us try to answer the great Qs that @LucidInvestment, @Sawcruhteez and I have received below, in a true Bitcoiner style... a tweet storm ⛈

But is bitcoin still in a Hyperwave?

The BTC Hyperwave is still in effect until a new all time high is reached.

Corollary: All short and intermediate term trends are NOT fundamentally based. We go after long term trends and look for situations where the technicals and fundamentals are in agreement

Consensio is used to identify major trend reversals. It is extremely efficient at this, however it consistently falls short when in the Fourth Phase of a Hyperwave.

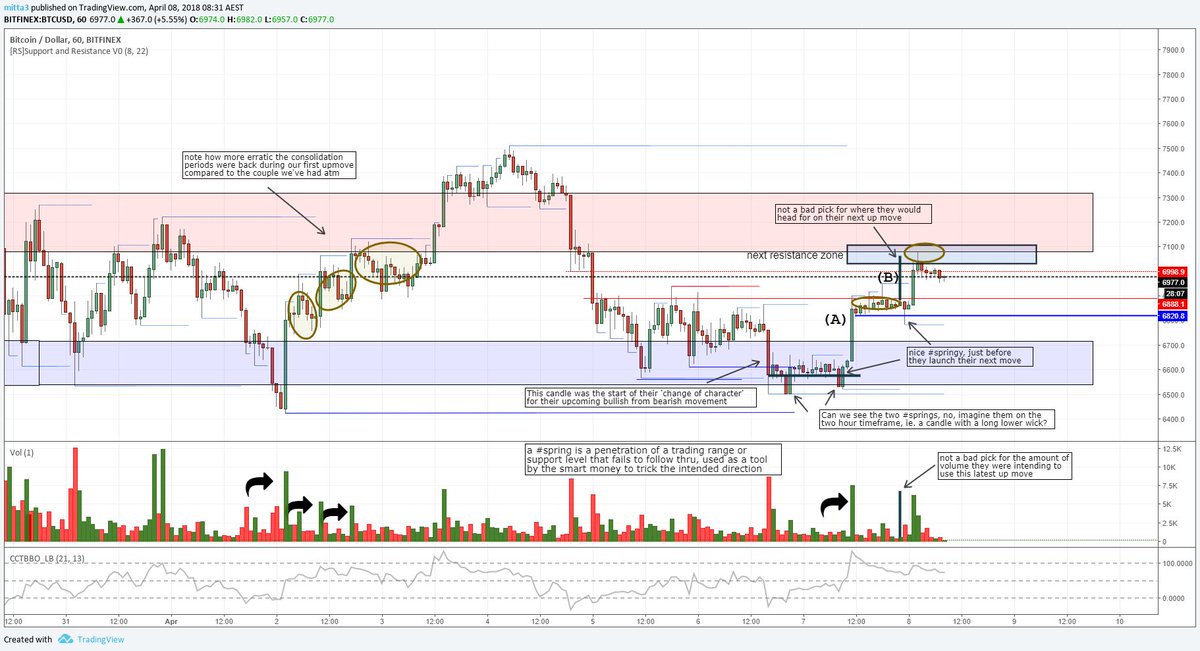

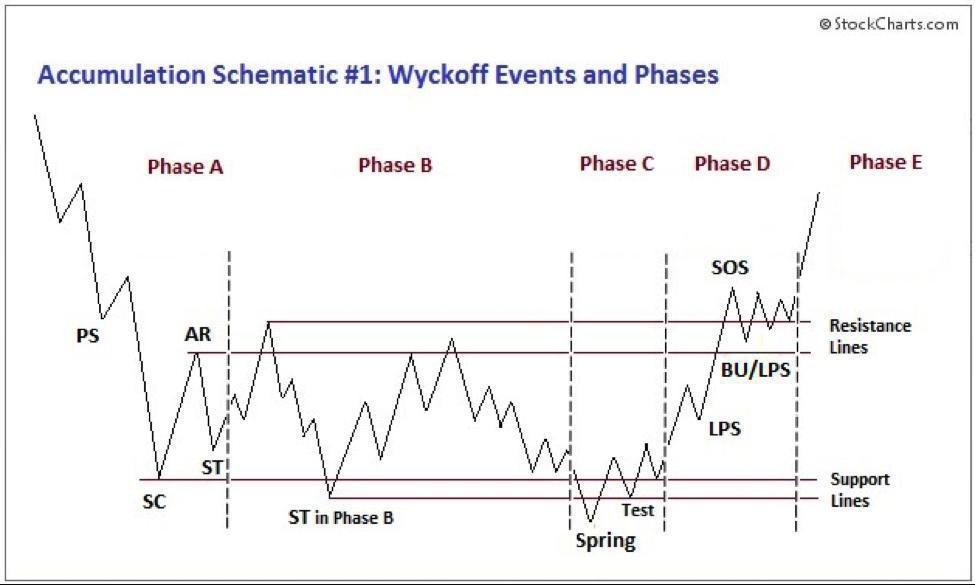

As the old adage, “the trend is your friend”, and it recently turned bullish. Therefore we are tentatively turning bullish and buying despite our confidence in the prior predictions. If the trend reverses then we will quickly get right back out