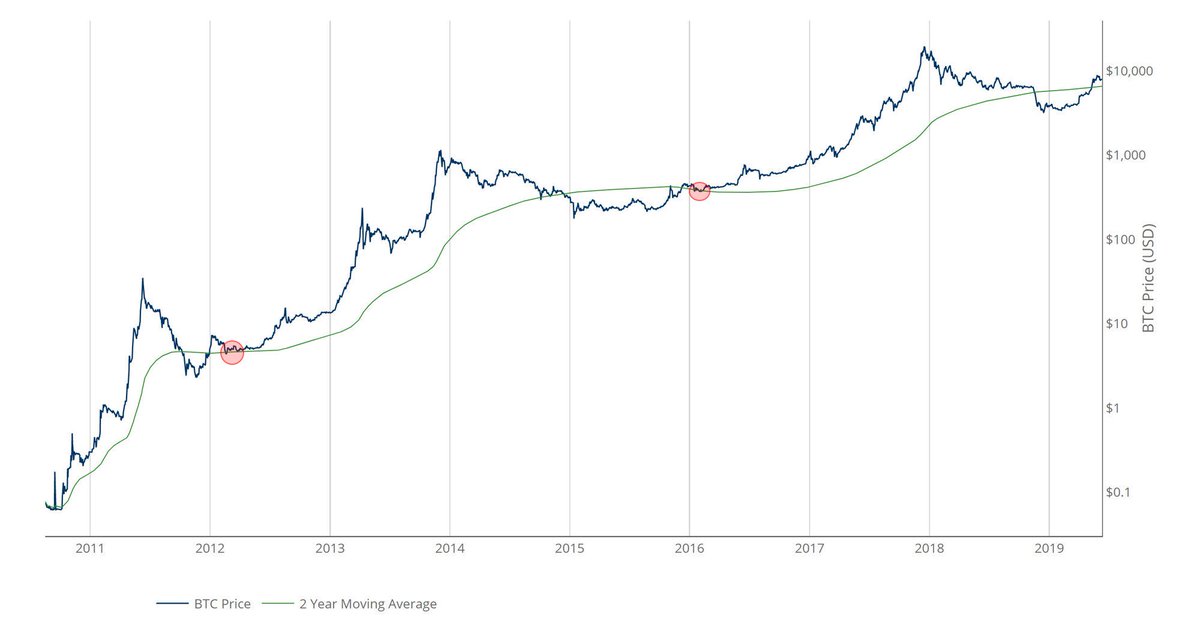

A new tool that helps us understand the cyclical patterns of Bitcoin adoption.

In doing so, it identifies intracycle AND full market cycle price tops, therefore providing a very useful risk management tool.

medium.com/@positivecrypt…

a) provides valuable take profit indication whenever price first hits one of the 350MA multiples.

b) shows the next market cycle top will be when price hits 350MA x3.

c) uncovers the mathematically organic nature of Bitcoins adoption curve market cycles.

philipswift.pythonanywhere.com

I hope you enjoy using it! 🙏