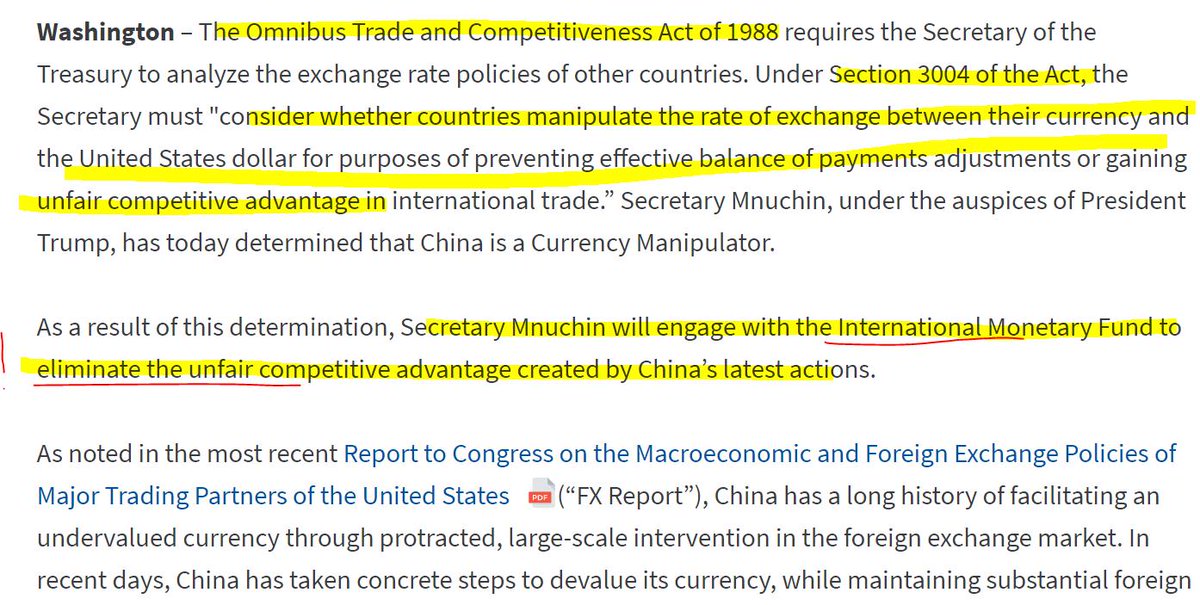

A: Mnuchin (boss of @USTreasury ) consults w/ the IMF on how to ELIMINATE the unfair competitive advantage of China's latest actions. So rhetorical BUT it means tensions are ESCALATED & opens door for retaliation/tariffs.

👇🏻👇🏻👇🏻

So that tells you what the fix will be right? It's walking this back a bit...

Told you, it's walking this back a bit😉

What's the downside from here? 🤷🏻♀️🦘🐨🇦🇺 On sale!!! RBA in 1.5 hrs btw - likely to hold at 1% until it cuts again!