Good morning! 😁Deflationary phase is developing in economy. Stay tuned for my perspectives on coming developments in markets based on charts - technical and fundamental analysis #HZupdates thread coming up!

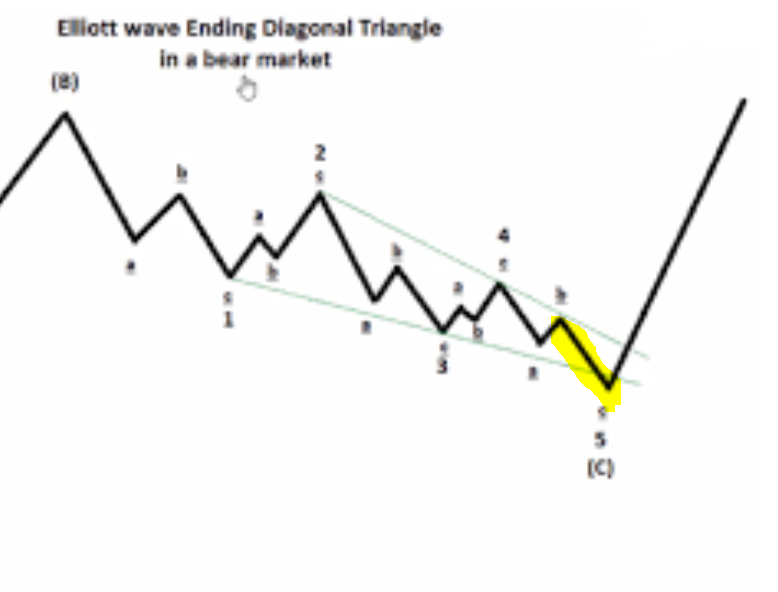

SP500 recovered some of the loses from early trading this week. Still, I think we have seen the top of the Expanding Diagonal, and we are currently in the Deflationary part of the crisis, where growth in economy is rolling over. Target ~2050 by Q1/Q2 2020 #HZupdates

#SP500 - will we see rally to 2950 for pot. top of wave 2 (black) before reversal and strong decline? That would close the gap in market from early Aug. #HZupdates

#Copper seems to be on the verge of embarking on the next leg down. Broke trendline - and has consolidated just below. A strong drop in Copper is deflationary and aligns with strong drop in #SP500 as real economy deteriorates. LT Target (A or B) is below 2008-bottom #HZupdates

Zooming in on the "Break" on #Copper chart, gives us a clear view of the consolidation below trendline. This is pot. very ominous for what is about to happen in real economy and in stock market - coming weeks, months and years! Deflation - before stagflation #HZupdates

#AUDUSD sends same message. Breaking below important area ~0.69-0.70 in LT-chart signals much lower levels to come. LT-target remains ~0.49. Again, this speaks of #deflationary environment for coming months, where #commodities and #equities will perform badly #HZupdates

Zooming in on #AUDUSD, we observe consolidation - below 0.69-0.70-area. This is NOT a bottoming pattern - but a short pause before pot. powerful break lower. #Deflation #HZupdates

#CRB sending same message. Consolidating below trendline of triangle before push lower in major Ending Diagonal. Deflationary! Much lower levels to come before final LT-bottom #HZupdates

#Oil sends same message. Consolidation in triangle before next thrust down. Deflationary! Target <20USD before LT-bottom #HZupdates

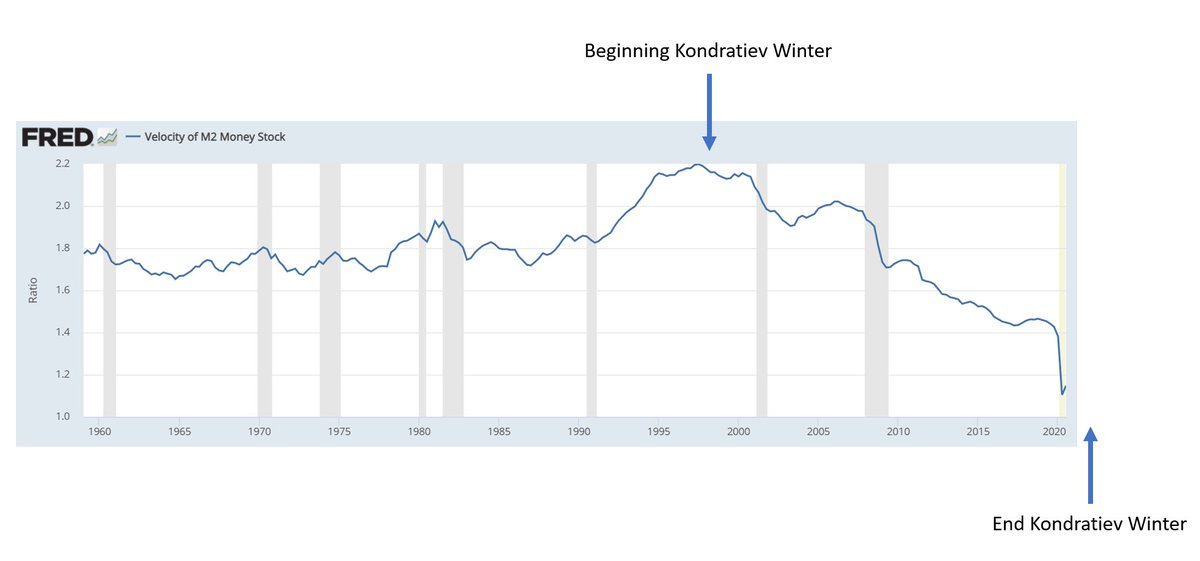

So economy enters deflationary bust, which will develop for months to come. Fed will finally engage at full force, which will put in SECULAR-bottom for commodities (Q1/Q2 2020). This will create bounce in economy and markets only to push economy into #stagflation #HZupdates

The #DEFLATIONARY part of the crisis will not be kind to #Gold as it delivers to its promise of providing LIQUIDITY. Top of B may be here or ~1600 but rally since 2015 is a correctional move. Wave C will take us to LT-bottom in 890-990-area before #STAGFLATION sets in #HZupdates

Crisis epi-center is likely to be #Europe which is a mess. #DAX looks terrible (notice decade-long divergence) and a major decline is likely to unfold. The target area speaks of major political, societal and economic crisis! The severity cannot be emphasized enough!! #HZupdates

#ECB will throw everything on the #Deflationary fire, which will crash #EURUSD. Notice LT-trendline (black) from 2008-bottom. This has just been broken. We may see ST-bounce - but EURUSD is heading towards min. 0.91 #HZupdates

As the #Deflationary part of the crisis unfolds, #DXY #USD will be only place to hide. DXY is likely to rally >111 before Fed is forced to step in and deliberately weaken strong #Greenback. This will mark the secular bottom in #commodities and send economy into #Stagflation

That is all for this week's #HZupdates. Please note consistency in the forecast on deflation to come from >1 yr ago. Only miss has been with #gold which is correcting in ZigZag-pattern and not in my earlier predicted Triangle😐Well, we all make mistakes! Stay safe! KR. from Cph😁

@threadreaderapp Please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh