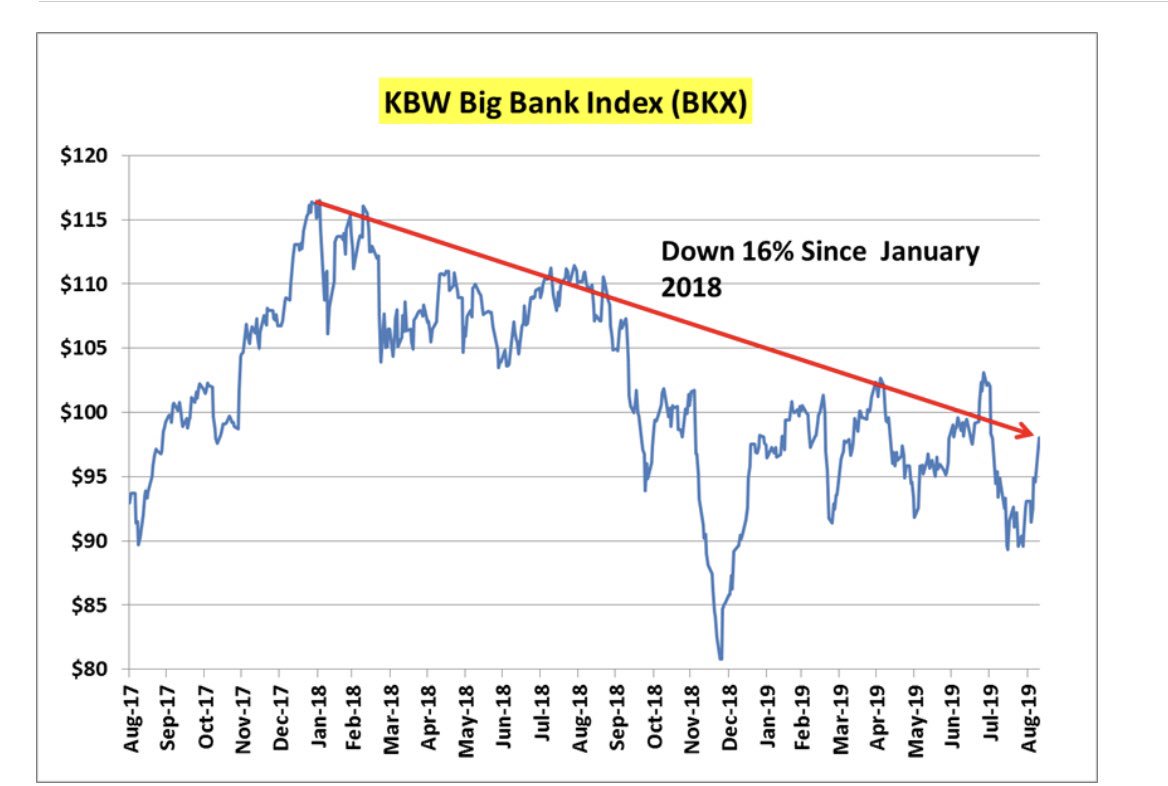

BKX Index approaching a #DeathCross

$TLT $KRE $IWM

@TeddyVallee $XLF

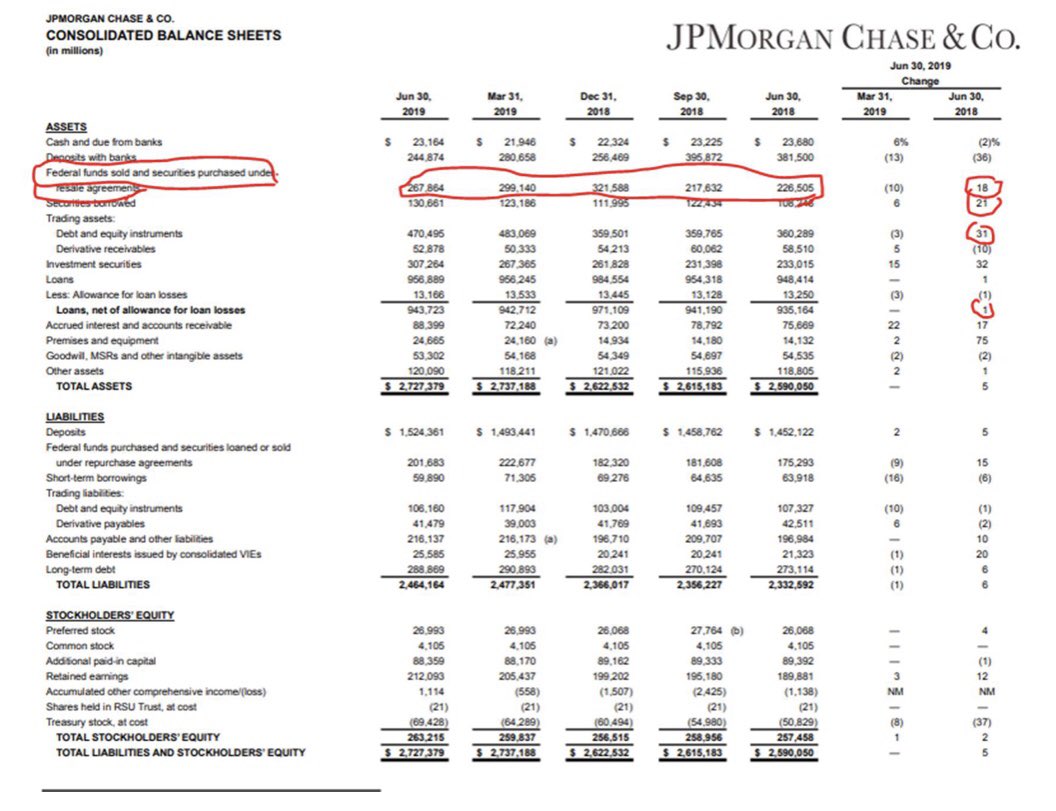

BN: “JP Morgan loan growth is no longer outpacing peers.”

“ $JPM is cautious on C&I & CRE Loans.”

“Risk in JPMs China expansion has increased.”

“I think some folks r very smart.. but it’s so political & so much is going on ... my own view is they (LCRs/GSIB Scores) aren’t going to be addressed...JUST PREPARE FOR IT”

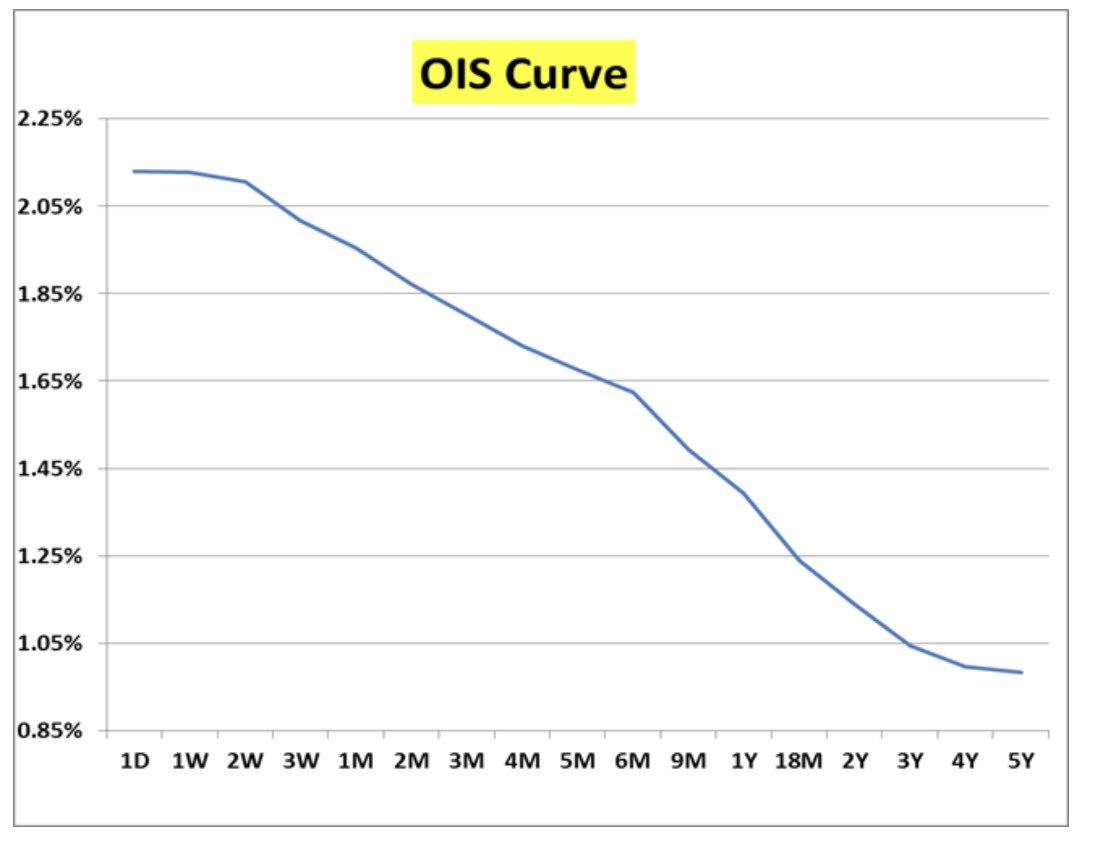

$DXY $TLT

He has now capitulated on SCB..

(Stressed Capital Buffer)

—> btw this is very bad for $MS & $GS b/s deployment that has very little room on this Buffer.. which is predicated on peak to trough decline in the DFAST Stress tests for CET1 ratios in Fed Severely Adverse Case.. but I digress...

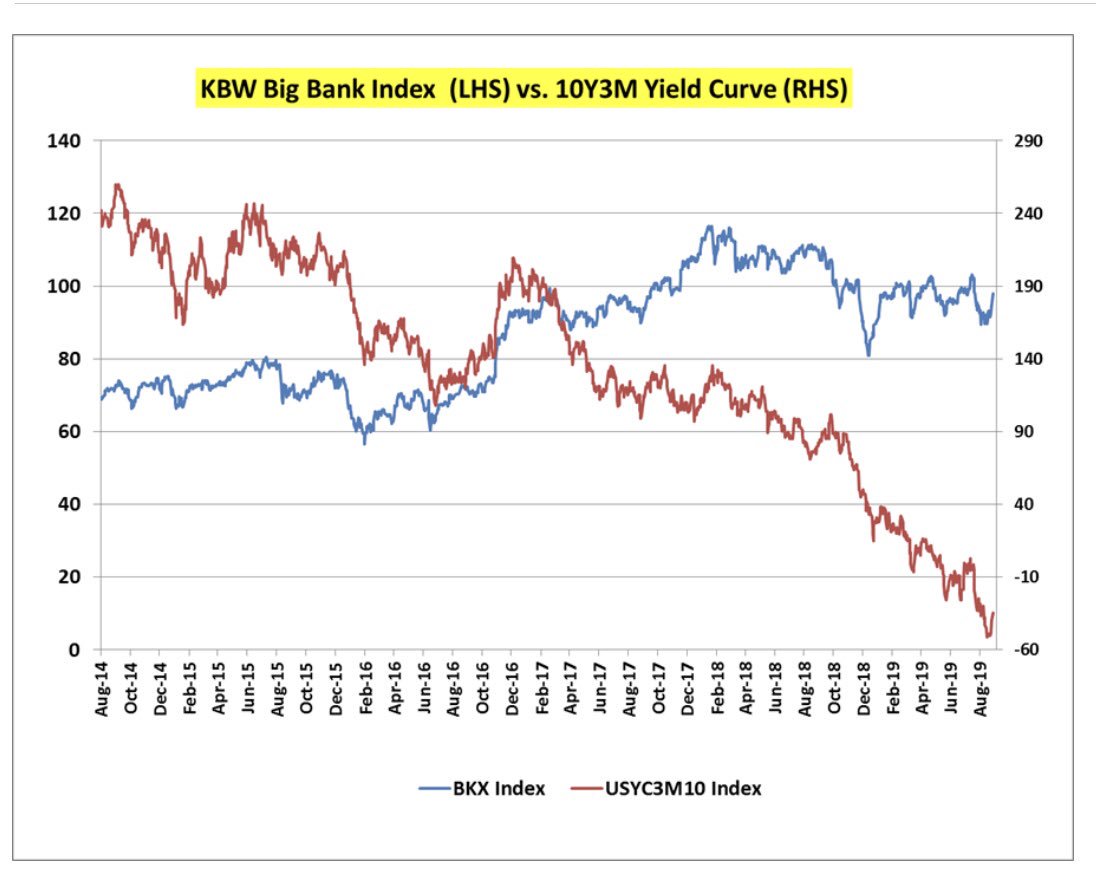

“U have spoken about tightness of GSIB Scores & LCR which is true 4 u & other Primary Dealers.. do u think Fed acknowledges tightness on front end w more T Supply coming.. r they worried about the fact u r capped on your balance sheet?

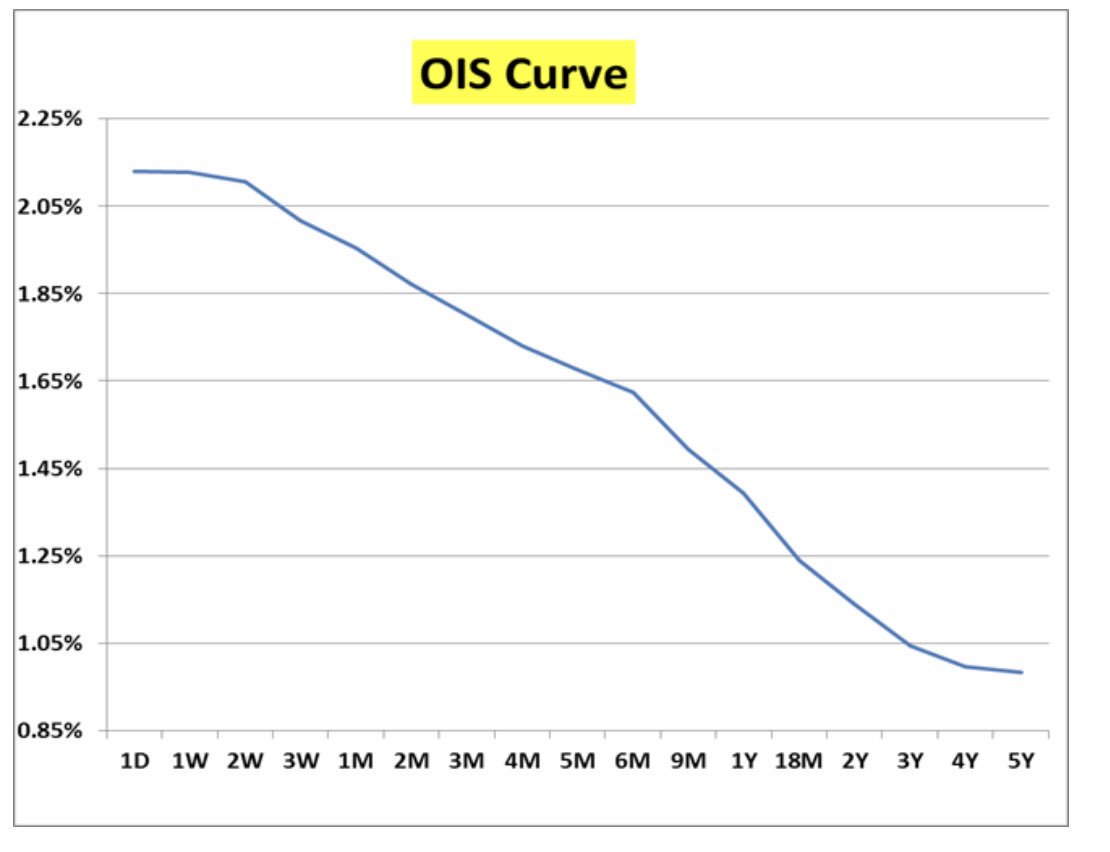

“One can cut costs.. but u can charge a/c fees.. but u can’t cut consumers < 0%.”

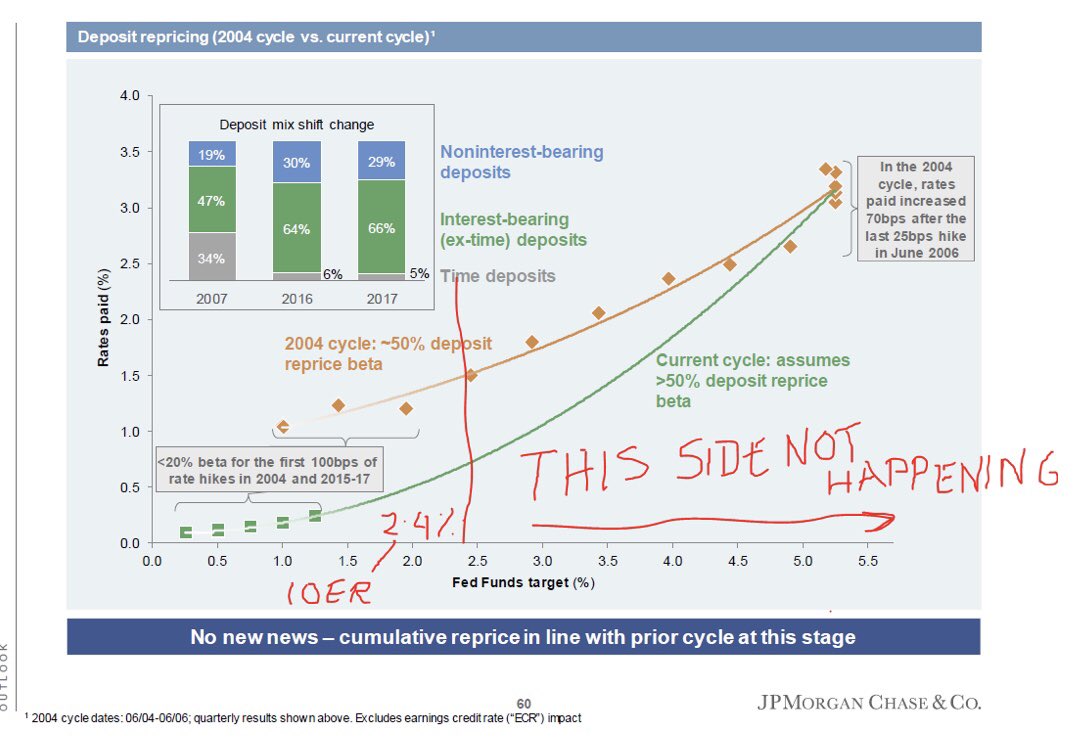

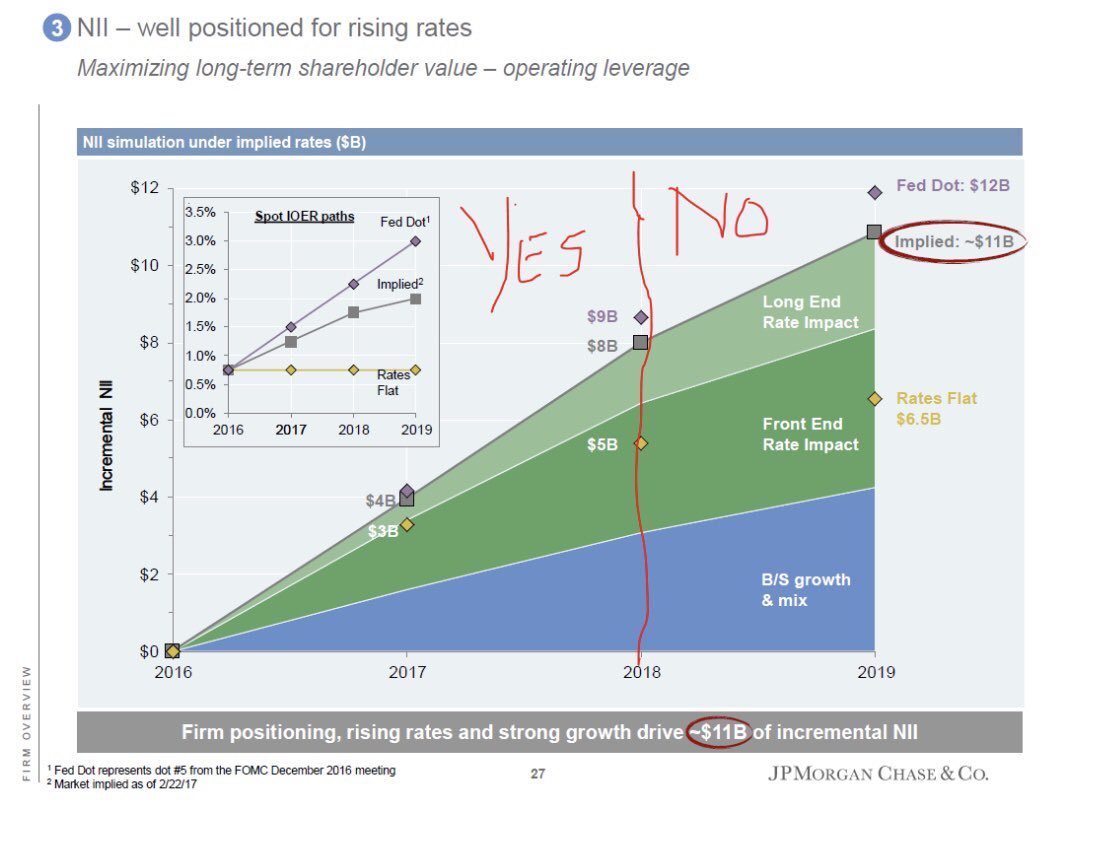

to our Qs u will see -$2.7B negative impact 4 a 100bps shift in the Curve.. keep that in back of mind for 2020.”