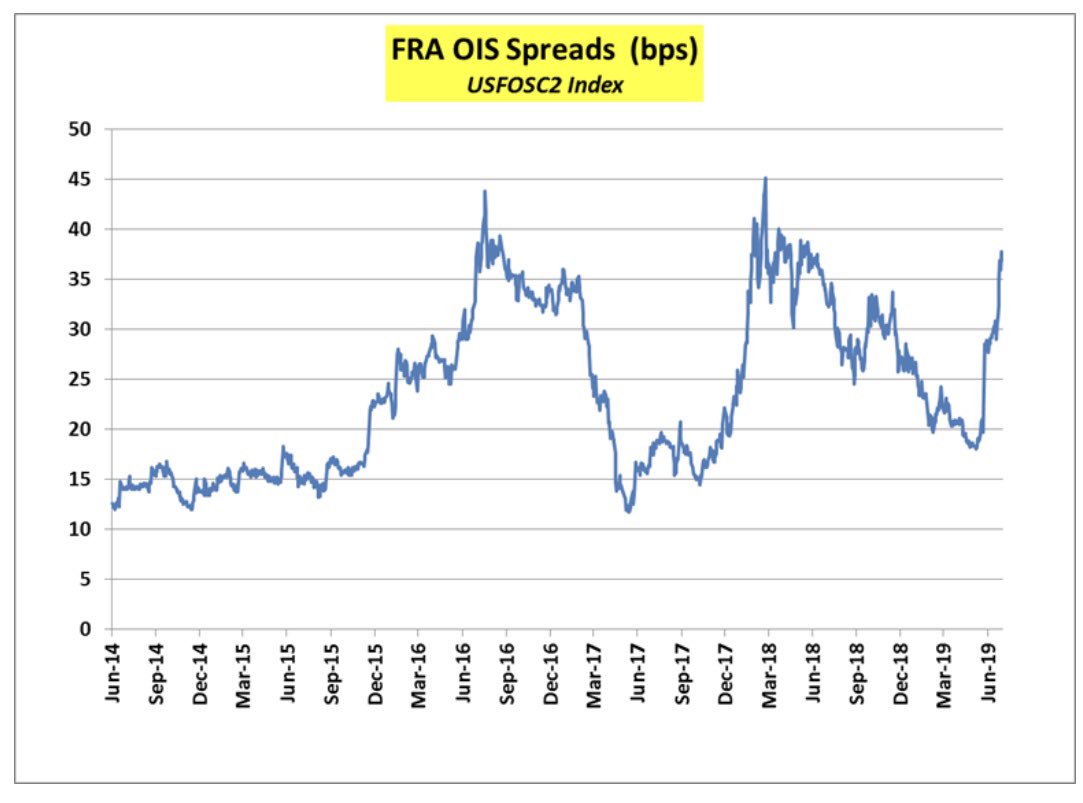

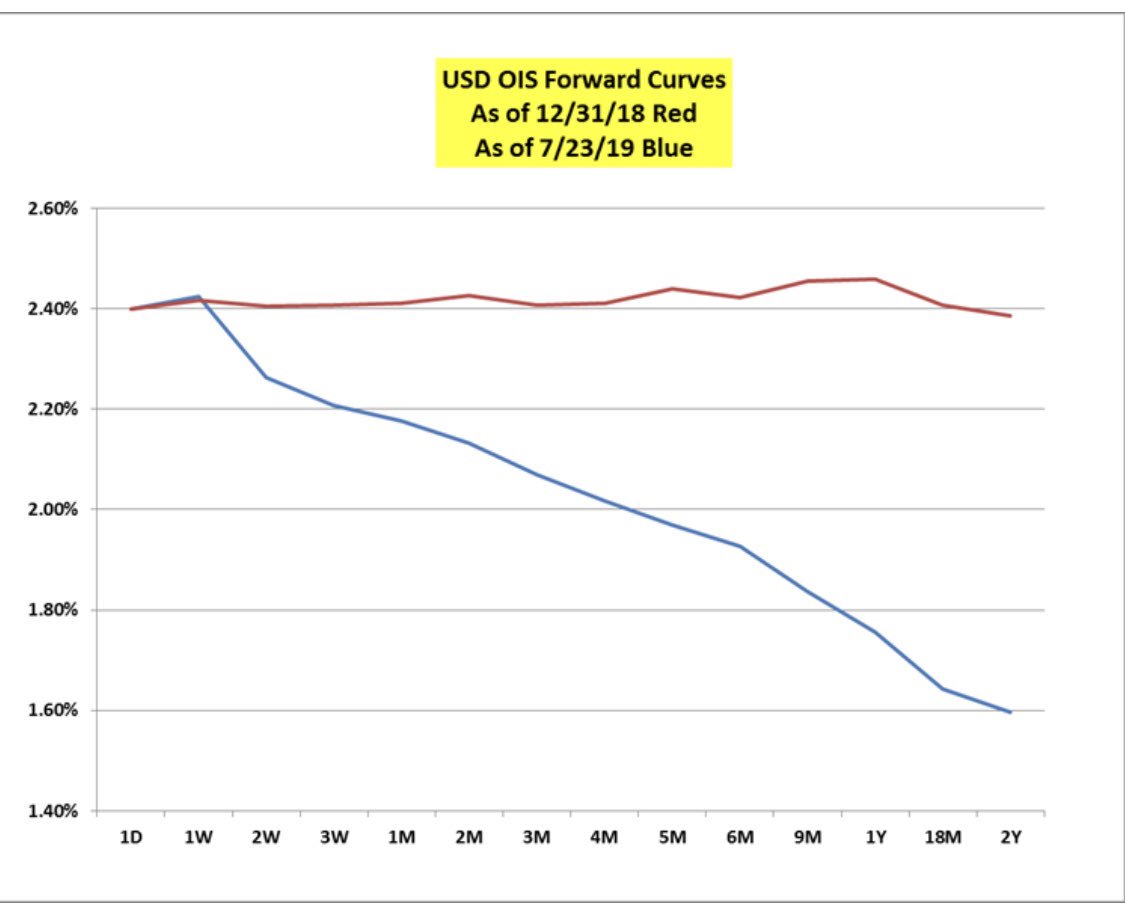

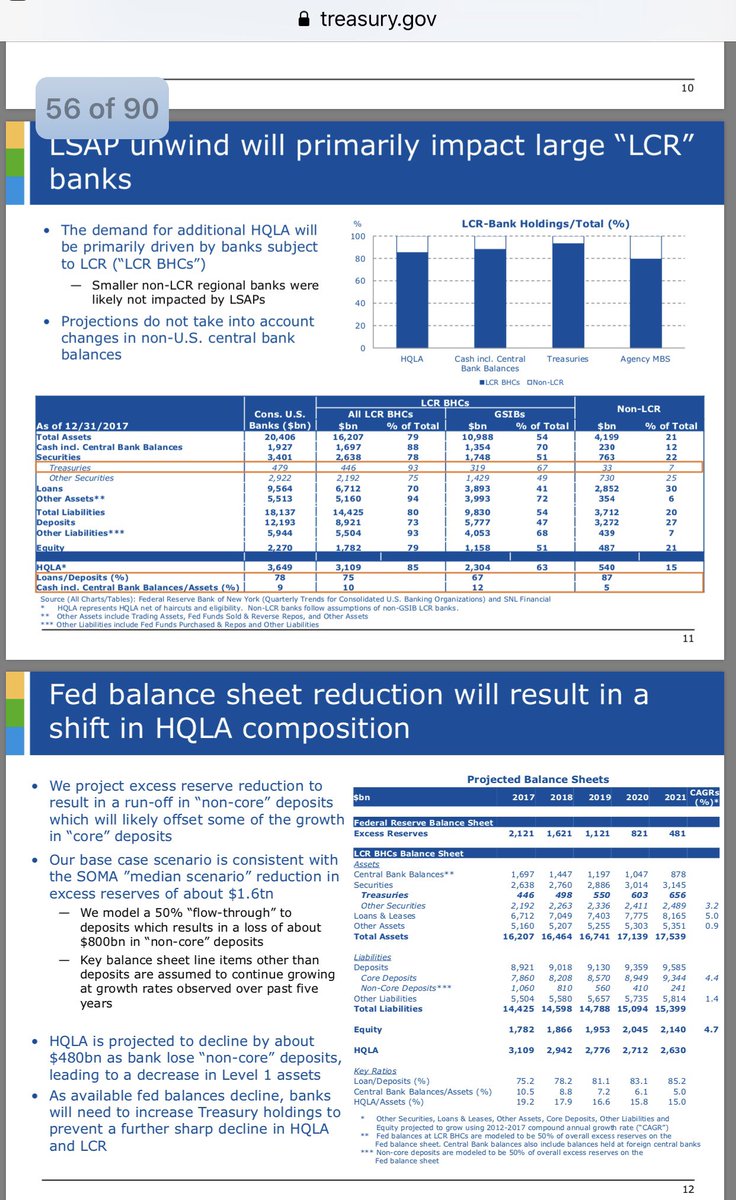

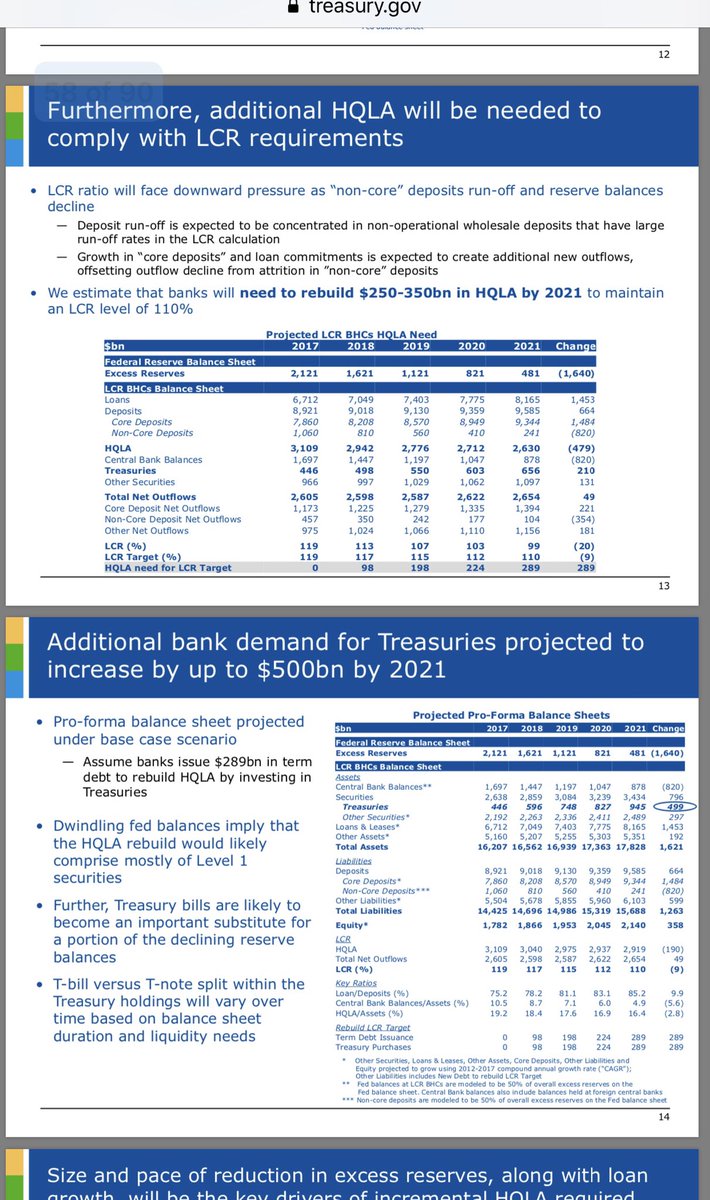

4Q19 TGA is unleashed with T Bills.. $DXY liquidity gets drained.. Curve inverts further & Banks pull Credit sharply & within context of decelerating consumer/biz confidence..spreads blow out.. as we r in 3Q of profit contraction YoY.. conditions tighten..

a) CCAR Stress Tests have a huge impact on banks tightening credit even further as Fed has to show tougher standards within a recession or close to..in order to be credible...exacerbates the credit cycle at a time jobs r lost.

CECL Accounting goes live on 1/1/20... Pulls forward a huge amount of Credit Provisions/Reserves for $XLF Banks increase +30-50% YoY in Credit Card book on Day 1 of adoption.. as jobs decelerate & Real losses continue..this slows Credit further..