The global economic environment has changed, and the tables may have turned.

bloomberg.com/opinion/articl…

First, let's look at Germany. It's now probably in recession.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

And the internal combustion engine is on its way out.

bloomberg.com/opinion/articl…

South Korea is the semiconductor champion of the world, and the trade war and Chinese slowdown, as well as other factors, are taking their toll on that industry.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

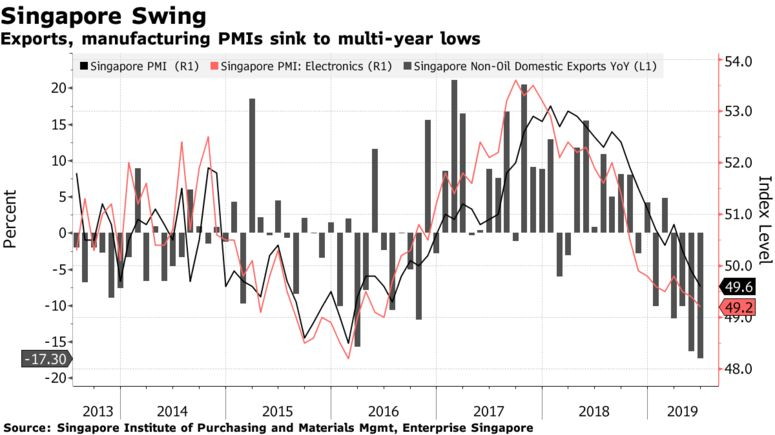

Again, manufacturing and exports are the big culprit in its second quarter slowdown.

bloomberg.com/news/articles/…

But ironically, Singapore is being bailed out by a flood of capital fleeing Hong Kong, so it may avoid recession.

bloomberg.com/news/articles/…

That "something" might be the end of the China-centric global growth model.

bloomberg.com/opinion/articl…

It's bringing supply chains inside the country.

And the U.S.-China trade war is forcing companies to pick between China and the rest of the world.

Or did they merely surf the China wave until it receded?

We're suddenly the best house in a bad neighborhood.

bloomberg.com/opinion/articl…

But the worm turns, times change, and today's stars may be tomorrow's laggards.

(end)

bloomberg.com/opinion/articl…