Anyway back to data.

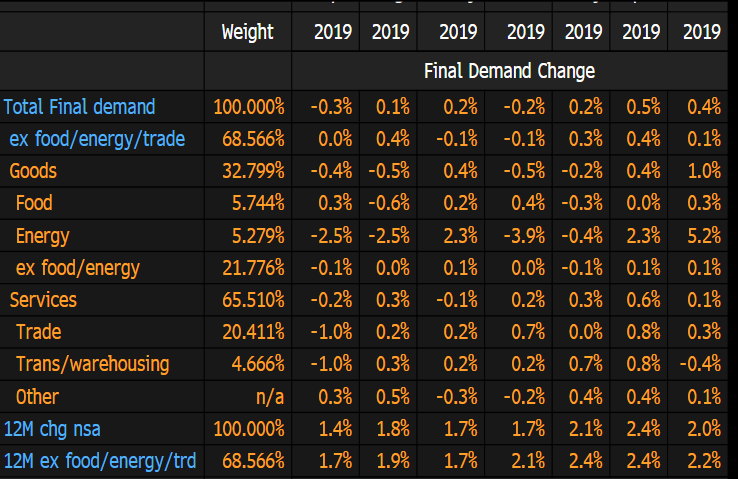

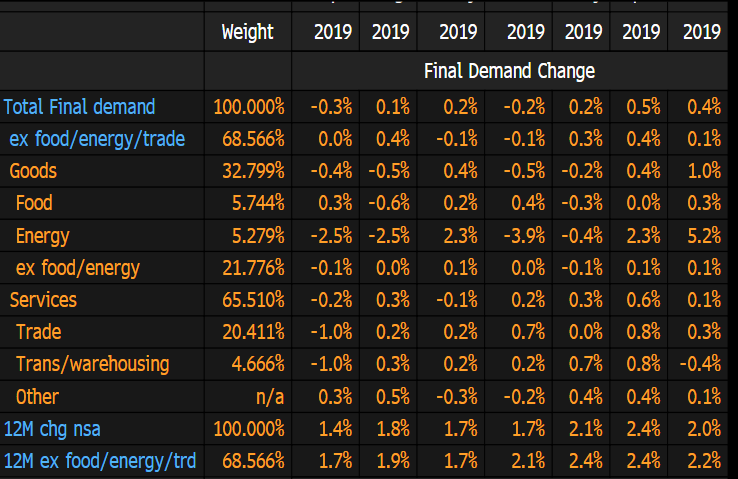

The @BLS_gov produces this. Largest weight = services. Food 5.7% out of 100 👇🏻

bls.gov/ppi/ppifaq.htm…

Can see that biggest drop is energy & also trade & trans/warehouse after increases earlier 👇🏻👇🏻

Pt is that prices for producers slow after a pick-up in August 👈🏻👈🏻