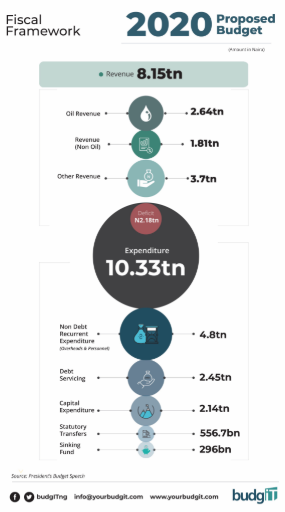

While we await the full details of the Finance Bill, I'll share some highlights.

THREAD

- An increase of the VAT rate from 5% to 7.5%.

- Expansion of the exempt items of the VAT Act

- Raising of the threshold for VAT registration to N25m in turnover p.a.

FIRS reported that it collected VAT of N1.1Trn in 2018. With this increase, we can estimate a VAT revenue target of N1.65Trn. Out of this amount, only N247.5Bn (15%) will go to the FG. The rest N1.4Trn (85%) will go to States and LGs.

The VAT Act already exempts pharmaceuticals, educational items & basic commodities. But the Finance Bill is expanding d exempt items to include:

a. Brown & white bread;

b. Cereals including maize, rice, wheat, millet, barley sorghum;

d. Flour & starch meals;

e. Fruits, nuts, pulses & vegetables of various kinds;

f. Roots such as yam, cocoyam, sweet & Irish potatoes;

g. Meat & poultry products including eggs;

h. Milk;

i. Salt & herbs of various kinds;

j. Natural water and table water.

The Finance Bill increases the threshold for VAT registration from Nil to N25m in turnover per annum, the objective of this is to support MSME's and make the tax authorities focus on bigger businesses.