Why? The mechanics of modern currency hedging.

cfr.org/blog/puzzle-ja…

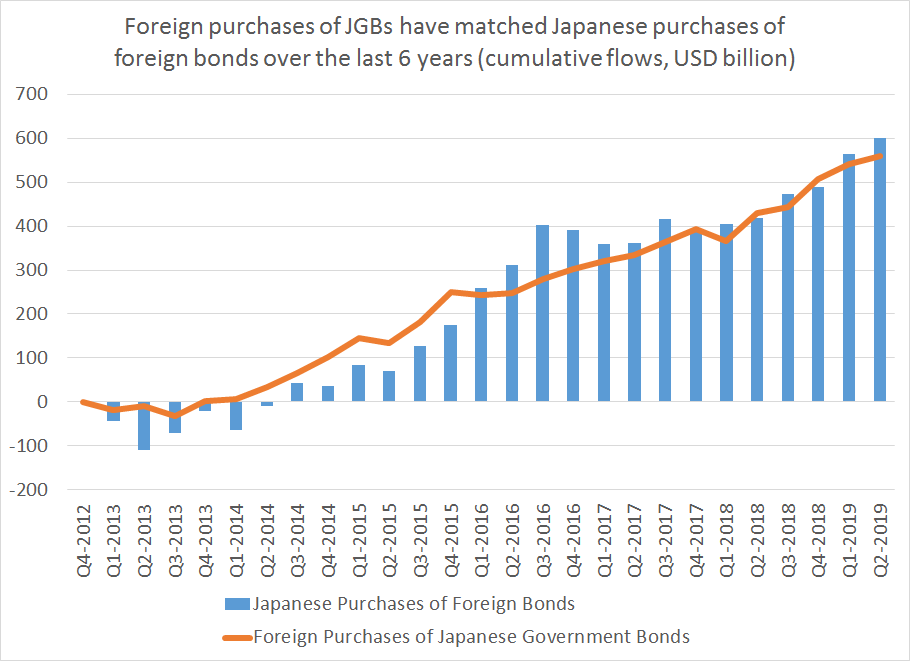

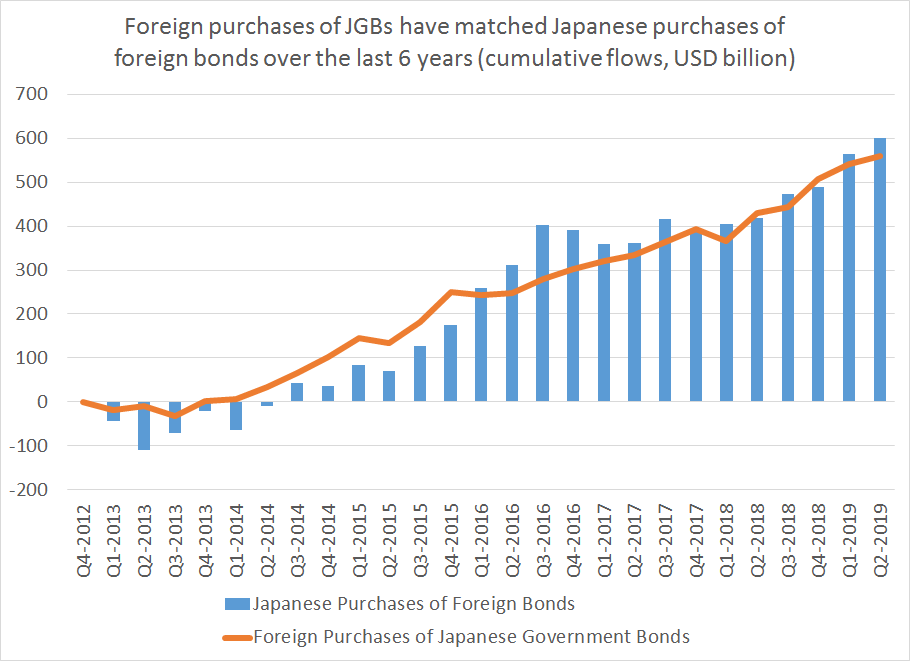

the counterparty to the swap gets yen, and typically buys short-term JGBS

3/x

4/x

Keep Current with Brad Setser

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!