That suggests that finance has the same issues as other fields in finding a model that works both conceptually and empirically.

Using Piotroski's quality definition:

Using AQR's more robust definition:

*Long* thread below:

However, the combination of value and momentum (negatively correlated factors) seems hard to explain using risk-based arguments.

CAPM is also more broadly false: low-risk (low volatility, low beta) stocks have equal or higher returns.

Betting Against Beta

papers.ssrn.com/sol3/papers.cf…

(Long-dated options, which have lower risk, have better returns.)

papers.ssrn.com/sol3/papers.cf…

Capitalizing on the Greatest Anomaly in Finance with Mutual Funds

researchgate.net/publication/25…

Volatility Effect: Lower Risk Without Lower Return

papers.ssrn.com/sol3/papers.cf…

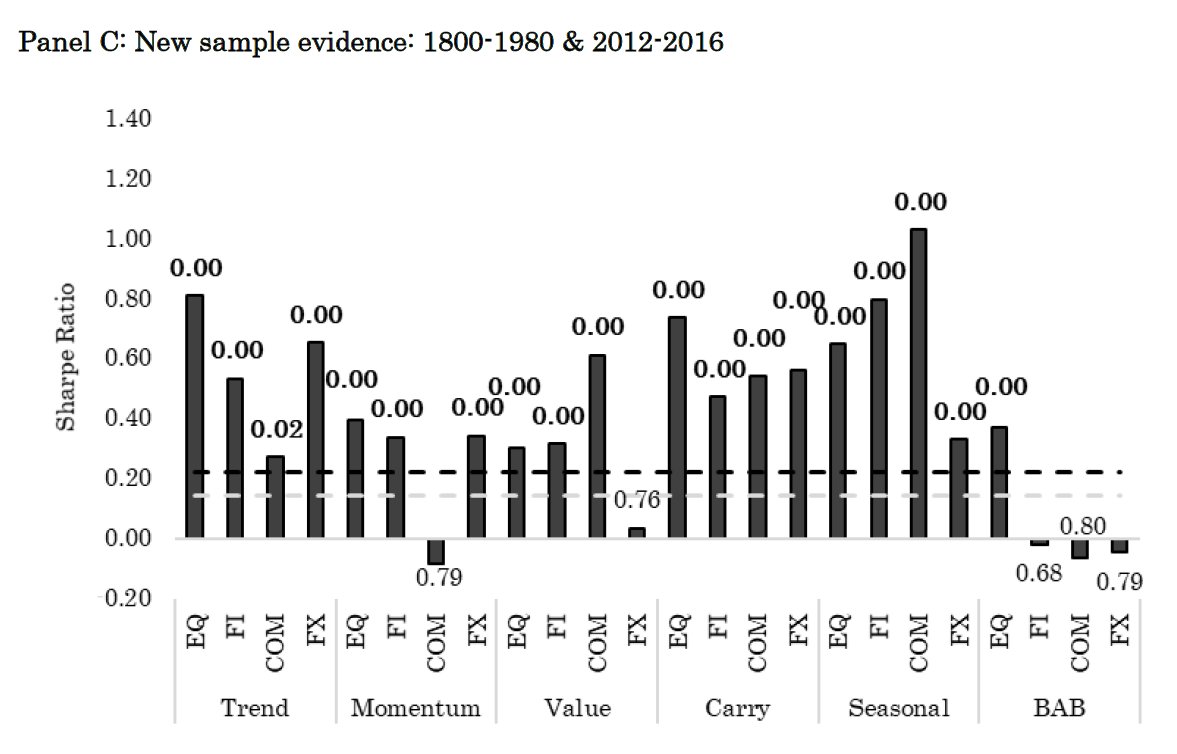

* some evidence of data mining

* no evidence factors have been arbed away

* no evidence that factors as a whole are compensation for macroeconomic risk

In other words, shorting stocks is expensive, hard to manage, less diversifying, and more prone to tail risk, but these risks are compensated by *negative*, not positive, returns.

Indeed, his alpha can be explained by the factors in this thread, but to the extent that factors are not compensation for risk, EMH is still problematic.

Global Factor Premiums

(This goes *really* far back to when trading costs were higher, so it addresses data mining but not "factors will disappear" objections)

(Here, only price data, not accounting data, is allowed for factor definitions.)

Dual Momentum – A Craftsman’s Perspective

(Stability across factor definitions)

(Trend following examined using new contracts, including VIX and VSTOXX futures)

Commodity Futures Risk Premium: 1871–2018

(New database, built from newspaper data, for commodity strategy tests)

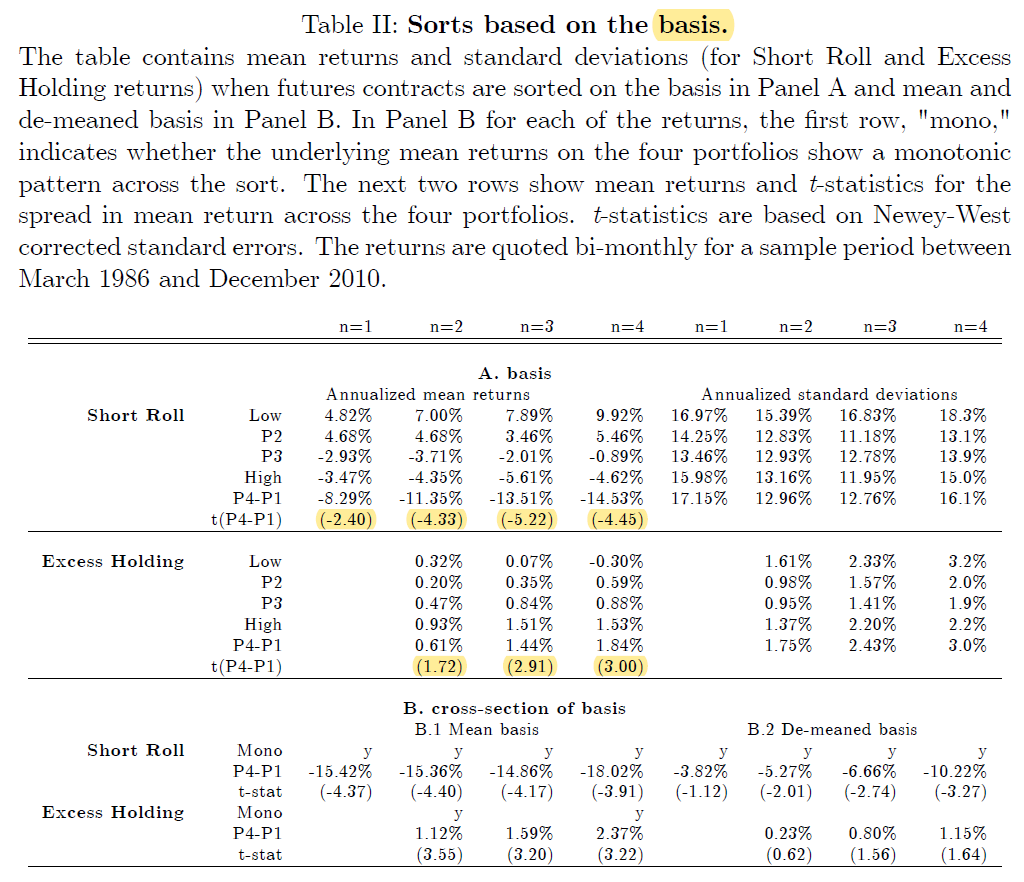

(A consistent definition for carry is tested across asset classes along with a logical variation that also works)