1) it accurately explained many or all of the things we observe in

2) it was largely based on how human natural emotions contributed to the markets operating in this way.

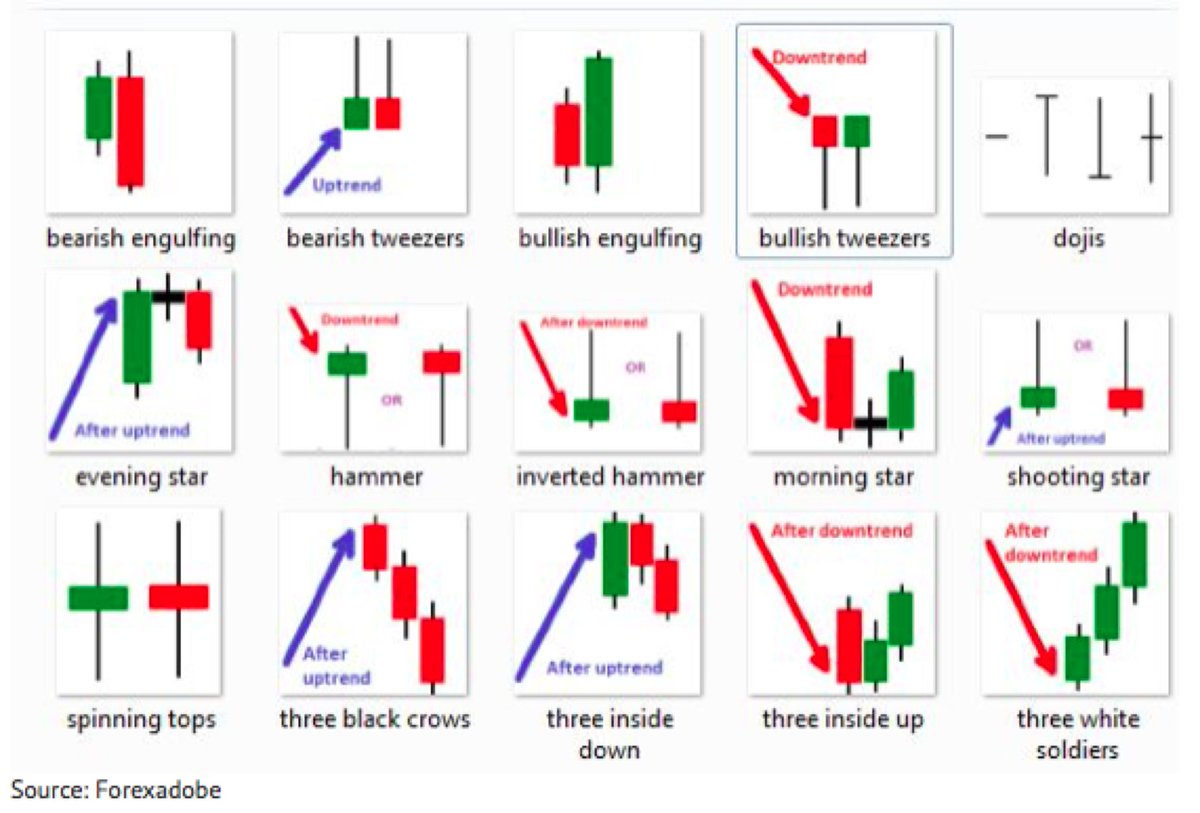

Ok, first of all, we will be talking about candlestick charts - a candlestick (or candle) is one way of representing price movements.

Now, when trading using these charts, many traders like to use patterns that they see in the types

That assessment can only be made once you understand the general position of that market at that time – does it show signs of strength, weakness, or neither?

If the volume is well above average,

For example, if this price level is one that was NOT supported the last time price came to this level, then this should make you hesitate buying at this price.

I realise I have just been explaining quite basic stuff, and have not started any analysis! I will end this thread now and may come back to it later if there is interest.

/THREAD