1)Commodity money

This is where something of intrinsic value was used as money. Salt in the Mediterranean region, Silk in China, and of course, gold and silver. In early Islam, gold and silver were used,

2)Representative Money

Is paper currency that can be exchanged

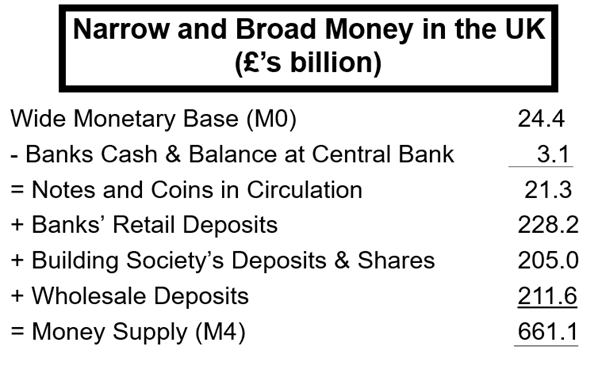

Physical money / total money = 21.3 / 661.1 = 3.2%

Ok, now let us look at the process of moving from commodity money (gold) to paper money occurred in the UK.

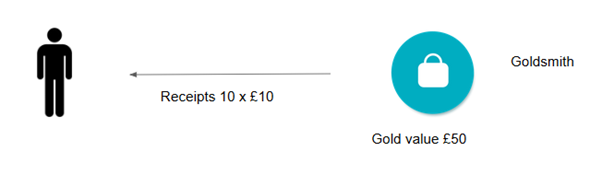

These were often goldsmiths who would already hold positions of trust in the community, and have secure methods of storage and protection of gold. Of course, the goldsmith would charge for these safekeeping services.

Now, in order to reflect ownership, the goldsmith would issue a receipt to the customer, when the gold

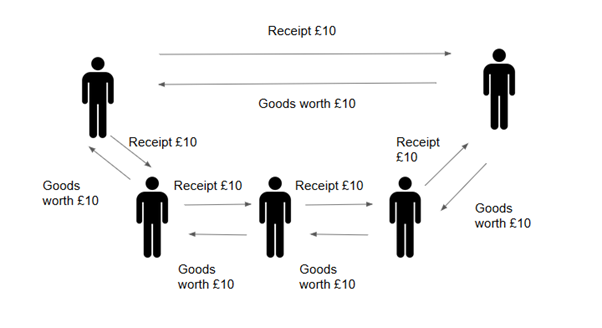

So, instead, the goldsmith tells his customer, that he can use the receipt to give it to someone else, and the goldsmith would honour the claim as long

Next step, as TRUST in the receipt grows in the community, people find that this receipt is actually easier and more convenient to use for payment, than actually redeeming it for gold.

So, the goldsmith discovered, that some of his

So, the goldsmith now thinks about how to make money from this creation of £50 of

We can see, as long as this process of creation of fiat money is in private

It is feasible for a government to create such money to actually pay for real services, and not aim to make money at interest. However, the

Firstly. We notice that fiat money has no underlying assets backing it.

Commodity money of course, is made from assets of value (gold, silver etc) and representative money represents ownership of such

But fiat money, has no assets backing it. Modern currency is fiat money, and electronic money.

And we can see that fiat money, when created by private enterprises, MUST charge interest on its creation, and its creation is via lending.

This is quite astonishing if you think about it.

So, when we have Islamic banks, we see they operate in EXACTLY the same model.

That is why 98-99% of everything they do is priced at interest / Riba.

So, this has quite an astonishing impact on the Islamic banking system.

Read my thread about asking “what is the answer?” and “how to fix Islamic banking?”.

Thank you for reading

/THREAD