Thread to add a few of my thoughts to this awesome information:

It really is possible to separate liquidity from exit, something that very few founders consider.

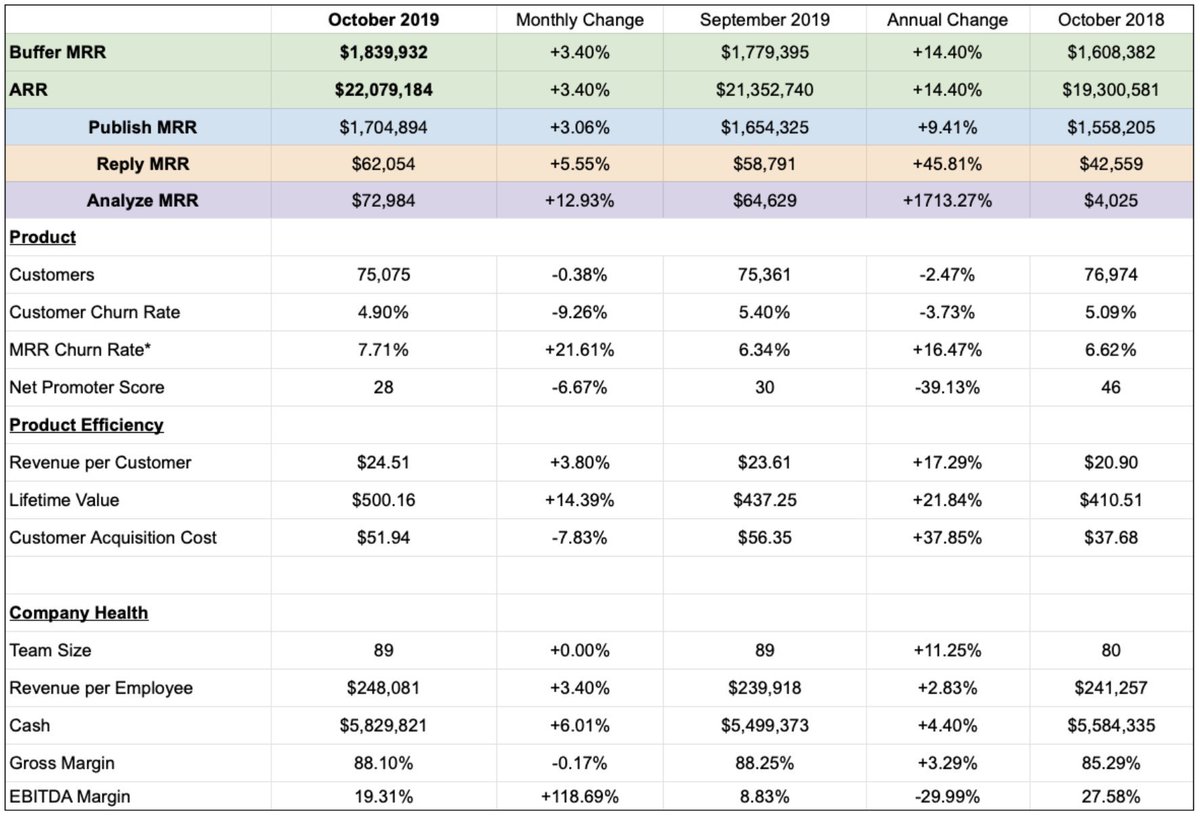

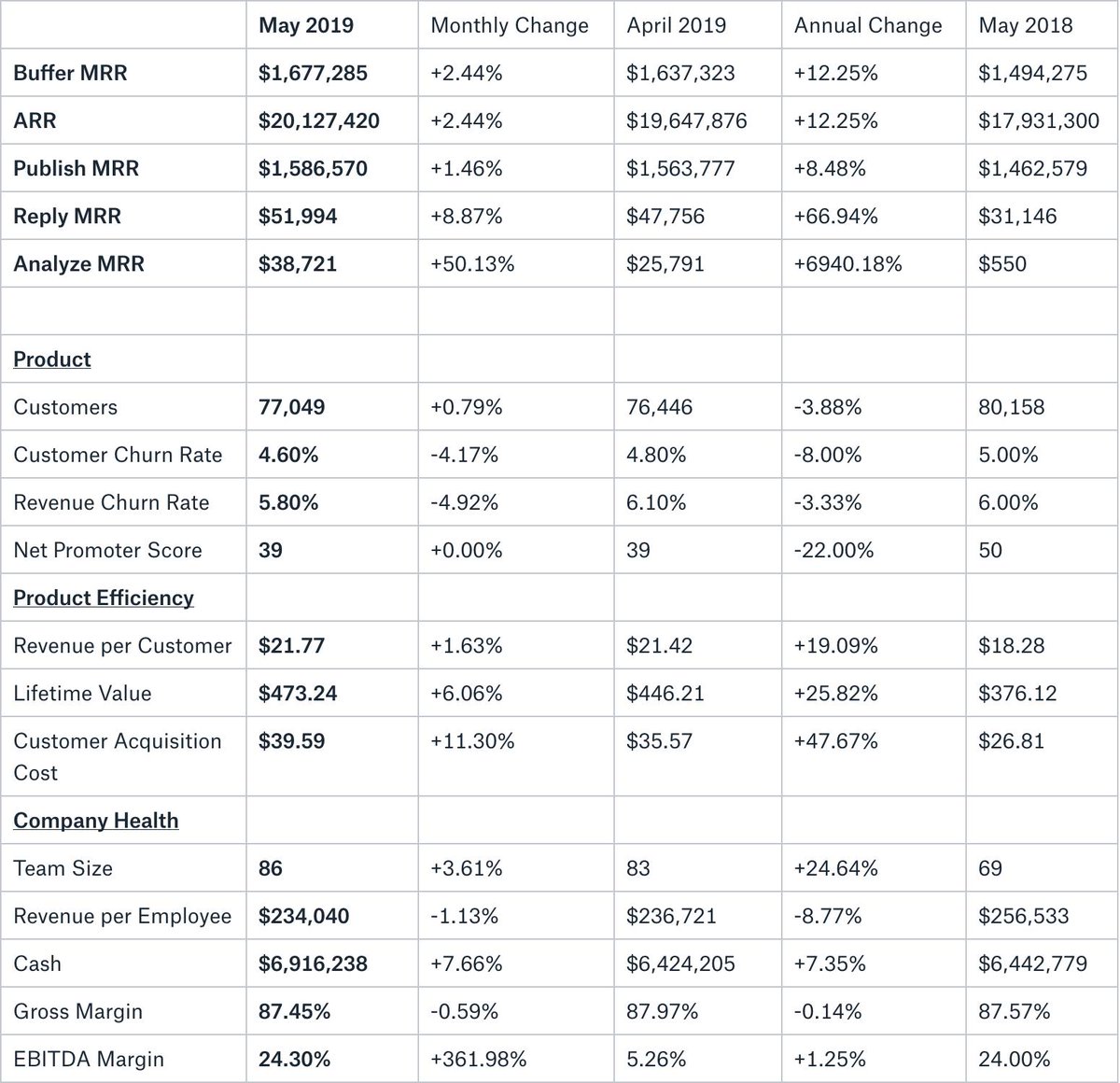

My answer is simple: control growth of expenses (salaries, tools, etc) in terms of desired profit margin. Only grow expenses if you can.

These days I think less about spending cash, more about spending margin.

When you have a 20% profit margin and want to keep it that way, I find it easier to pause hiring for a few months, grow margin to 22% and then spend that 2% of margin we earned.

If there are any specific questions, please reply and I'll either try to answer in the next couple of days, or use them as inspiration for the future.